1. Introduction

irm's financial management policies compose of very important decisions including working capital management (WCM). Working Capital of a firm comprises on current assets. Current assets are cash and equivalents, accounts receivable, and inventory items of a firm. The decisions made in respect of current assets are called working capital management. Most of the researchers found a positive impact of working capital management decisions on profitability of organizations. It directly and positively affects the profitability of the firms. In this article, total 15 companies are selected at random from Textile, Chemical and Engineering sector i.e. 5 from each sector. The results showed positive impact of WCM on profitability and supported the hypothesis.

2. II.

3. Literature Review

Semra Karacaer, Mehmet Aygün and Ayhan Kapusuzo?lu (2009) observed that, in terms of their revenues, the firms in the first group were very sensitive to changes in earning level and less sensitive to unexpected changes (positive/negative) in the working capital accruals; those in the second group were very sensitive to changes in earning level and less sensitive to unexpected changes (positive/negative) in the working capital accruals as well as firm size; and finally, Author ?: M. Phil Scholar, Lahore Business School, The University of Lahore. E-mail : [email protected] Author ?: Assistant Professor, Lahore Business School, The University of Lahore. E-mail : [email protected] those in the third group were very sensitive to changes in earning level and less sensitive to earnings level and firm size.

Vedavinayagam Ganesan (2007), found that the working capital management efficiency is negatively associated to the profitability and liquidity. When the working capital management efficiency is improved by decreasing days of working capital, there is improvement in profitability of the firms in telecommunication firms in terms of profit margin.

Patrick Buchmann and Udo Jung (2009), observed that applying best practices of working capital management also means applying value-oriented management of tradeoffs between NWC and fixed assets, and between NWC and costs. The isolated treatment of individual levers has its boundaries and, therefore, all elements of tied-up capital across the balance sheet (fixed assets, inventories, receivables, payables, and cash) have to be considered as a whole.

Karamjeet Singh and Firew Chekol Asress (2010), concluded that firms which have adequate working capital in relation to their operational size are performed better than those firms which have less than the required working capital in relation to their operational size. If firms actual working capital is below the required working capital in relation to their operational size, firms are forced to produce below their optimal scale and this create problem to run day to day activities smoothly, so this lead firms to generate low return on their investment.

Corazon L. Magpayo (2011), highlighted the importance of working capital management and financial leverage on the firms' financial performance is emphasized in this study to bring attention of business leaders to the obvious but is often neglected. The next step is to look into the best practices of top performing companies. What working capital management strategies may be implemented to minimize investment in current assets, at the same time maximize use of financial leverage at the firm's acceptable financial risk appetite and concluded that aggressive working capital management policy reflected in low investments in current asset influences net income positively.

Afza, T. and MS Nasir (2007) found no significant relationship between working capital management policy and financial performance among the 208 public limited companies listed in the Karachi Stock Exchange. They measured aggressive working capital investment policy in terms of low level of investment in current assets as percentage of total assets. On the other side of the spectrum are companies with high investments in current assets vis-àvis total assets, which they classified as advocating conservative working capital management policy.

Wajahat Ali and Syed Hammad Ul Hassan (2010) study of 37 listed companies in the OMX Stockholm Stock Exchange showed no significant relationship between profitability and working capital management policy when grouped as aggressive, defensive or conservative based on cash conversion cycle. The ratio of current asset to total assets of the observations in this study was another possible proxy variable for working capital management, but the data failed the tests of normality. Because of this limitation, dummy variables were used instead to capture the effect of working capital management policy on profitability.

Garcia-Teruel and Marinez-Solano (2007) affirmed in their study the importance of working capital management to corporate profitability especially among small and medium enterprises by providing empirical evidence on the effects of working capital management on the profitability of 8,872 small and medium-sized Spanish firms. They demonstrated in their study how managers can improve profitability by shortening the cash conversion cycle through inventory reduction and reduction in the outstanding number of days receivables.

Kesseven Padachi (2006) the different analyses have identified critical management practices and are expected to assist managers in identifying areas where they might improve the financial performance of their operation. The results have provided owner-managers with information regarding the basic financial management practices used by their peers and their peers attitudes toward these practices. The working capital needs of an organization change over time as does its internal cash generation rate. As such, the small firms should ensure a good synchronization of its assets and liabilities.

Deloof (2003) have found a strong significant relationship between the measures of Working Capital Management and corporate profitability. Their findings suggest that managers can increase profitability by reducing the number of day's accounts receivable and inventories. This is particularly important for small growing firms who need to finance increasing amounts of debtors.

Raheman A., Afza T, Qayyum A, Bodla M.A (2010) the Cash Conversion Cycle and Net Trade Cycle offer easy and useful way to check working capital management efficiency. For value creation of shareholders, firms must try to keep these numbers of days to minimum level. Afza and Nazir (2007) investigated the relationship between aggressive and conservative working capital policies for a large sample of 205 firms in 17 sectors listed on Karachi Stock Exchange during 1998-2005. They found a negative relationship between the profitability measures of firms and degree of aggressiveness of working capital investment and financing policies. Lazaridis and Tryfonidis (2006) investigated the relationship of corporate profitability and working capital management for firms listed at Athens Stock Exchange. They reported that there is statistically significant relationship between profitability measured by gross operating profit and the Cash Conversion Cycle. Furthermore, Managers can create profit by correctly handling the individual components of working capital to an optimal level. Amarjit Gill, Nahum Biger, Neil Mathur (2010) the finding indicates that slow collection of accounts receivables is correlated with low profitability. Managers can improve profitability by reducing the credit period granted to their customers. Regarding the average days of accounts payable previous studies reported negative correlation of this variable and the profitability of the firm. They found no statistically significant relationship between these variables.

B.A Ranjith Appuhami (2008) On the basis of the findings of the research, it can be concluded that the listed companies in Thailand change their working capital management policies based on many factors, such as capital expenditure, operating cash flow, sales growth, etc. Thus, I can recommend that firms operating in other countries consider the pattern of capital expenditure in managing working capital. Especially, the findings suggest that companies manage working capital efficiently when companies have growth opportunities so that they can meet required capital expenditure to expand their business.

4. III.

5. Research Objectives

The objectives of this research article are:

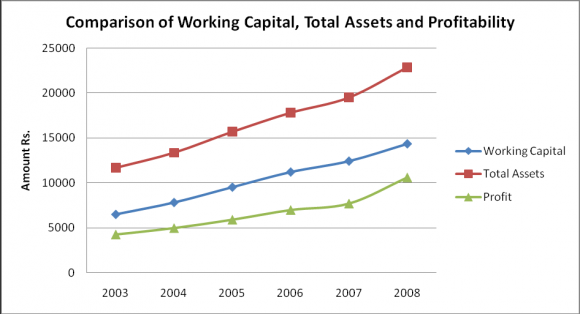

? To find the affect of working capital on profitability of firms. ? To find the affect of total assets on profitability of firms. ? To find the affect of working capital on total assets of firms.

IV.

6. Hypothesis Development

The following hypotheses are developed: H1 = There is positive impact of working capital management on profitability of firm. H2 = There is positive impact of total assets on profitability of firm. Results mentioned in model 2 above showing positive impact of total assets on profitability of the firms. Total asset shows the strong financial position of the firms. Firms having much total assets also have choices for making better financial decisions which increase the profitability of the firms. Results mentioned in model 3 above showing positive impact of working capital on total assets of the firms. Firms with sufficient amount of working capital have enough total assets. The firms having better working capital have enough total assets which affects the increase in ratio of profitability of firms.

VII.

7. Conclusion

The study showed a positive impact of working capital management on profitability, working capital on total assets and impact of total assets on profitability of 15 companies of 3 different sectors of Pakistan. Considering the results it is evident that efficient management of working capital can lead a firm towards profitability. The firms should improve their receivables and other currents assets components for sufficient working capital. Efficient management of inventories enhances the profitability of firms. It is concluded that firms with higher working capital have higher ratio of profitability and firms with higher total assets also have higher ratio of profitability. The firms having sufficient working capital also have enough total assets. So it is observed that firms having sufficient proportion of working capital have positive effect on total assets and profitability of the firms.

8. Bibliography