1. Introduction

lectricity is a flexible form of energy and critical resource for modern life and a vital infrastructural input for economic development. In all economies, households and companies have extensive demand for electricity. This demand is driven by such important factors as industrialization, extensive urbanization, population growth, rising standard of living and even the modernization of the agricultural sector. There is widespread discussion and research over the topic of relationship between electricity consumption and income particularly since early seventies of the last decades. Obviously, the degree of interest intensified since the Kraft and Kraft (1978) findings. They found evidence of a uni-directional causal relationship running from GNP to energy consumption in the United States using data spanning from 1947 to 1974.

Electricity is a major source of energy in the industrial and agricultural sectors in Bangladesh. These two sectors collectively contribute to 50.3% of Bangladesh's GDP. The contribution of agricultural and industry sector to GDP in fiscal year 2010-11 was 19.9% and 30.4% respectively (Bangladesh Bank, 2012). The share of agriculture and industry sectors in electricity consumption is increasing gradually. According to the Bangladesh Power Development Board (BPDB) statistics about 45% (1995 to 2010) of total electricity was consume by agriculture and industrial sectors. These statistics indicate that industry and agriculture together contribute significantly to GDP and electricity consumption as well. From this we can infer, therefore that electricity consumption plays an important role in economic growth of Bangladesh. It is, therefore important to identify the relationship between electricity consumption and national output and also their direction of causality to get a better understanding of the issues involved and determine the policy strategies. That is why in this study the main purpose is made to examine the causal relationships between electricity consumption, economic growth and investment for Bangladesh using the time series data spanning from 1981 to 2011.

This paper is divided into six sections. The section one of this study is the introductory part. The rest of the study is organized into another five sections. The second section of the study will present contextual information of the study where we discussed regarding current and future situation of Bangladesh's power sector. Section three is the literature review section, where we present relevant literatures that will give us sound conception of the fact. The section four provides an avenue regarding research methodological approach and the relevant information on the time series data sets that are used for this study, while section five is discussed the empirical results. Finally, section six will provide the conclusion that will point out the possible policy recommendations of the study.

2. II.

3. Contextual Information Of The Study

The electricity infrastructure plays an important role in economic growth and employment generation for developing countries more than the developed ones (Chen et. al. 2007). In Bangladesh, expansion of economic activities is restrained by the underdeveloped electricity infrastructure. The energy sector is poorly managed (Mozumder and Marathe, 2007) and characterized by the limited coverage of supply, inefficiency, poor quality of services and huge government subsidies (Temple, 2002). The supply of electricity is inadequate to meet the growing demand. As a result frequent electrical power outages or loadshading are used to manage the gap between power generation and demand of electricity in Bangladesh (Buysse et. al. 2012). The production of electricity has increased over the years but failed to match the high demand of electricity leading to chronic shortage in power supply. Therefore, historically Bangladesh is electricity deficit country that has clear impact on economic activities. Though per capita electricity consumption increased from 75.88 Kilowatt hour (KWh) in 1995 to 180.08 KWh in 2011(BPDP, 2011) but remained one of the least per capita electricity consuming economies in the world (CPD, 2011).

At present 50% of the people in Bangladesh have access to electricity and the demand of electricity is increasing at a rate of 10% every year (FD, 2011). Considering the necessity of electricity and the achievement of 10 percent Gross Domestic Products (GDP) growth by 2021, Government has undertaken immediate, short, medium and long term programs for overall balanced development and revamps the electricity sector. Some of these development programs include i) installment of gas based power generation plants ii) establishment of nuclear power plants iii) generating environment friendly electricity from renewable energy sources iv) massive transmission and distribution programs to ensure uninterrupted power supply v) energy savings and energy efficiency programs for billing efficiency, optimum use of electricity and reduction of system loss vi) rehabilitation and enhancement of efficiency of old power plants and set up new power plants through public-private participation and regional co-operation to import electricity from neighboring countries (FD, 2011).

According to the Bangladesh Power Development Board (BPDB) estimation, peak demand of the electricity will be increased faster rate. The peak demand of electricity will be 10,283 Megawatt (MW) by 2015. In Bangladesh a huge amount of natural gas is used to generate electricity, as most of the existing power plants are gas-based. About 83% of total electricity was produced from gas-based power plants and rest of the electricity produced from fuel in 2011(FD, 2011). To achieve the target to generate 10,283 MW by required. In this regard Government has taken necessary steps to increase the foreign and domestic investment. Government has also increased the budget allocation in power sector over time. The development budget allocation gradually increased over the year. The allocation of total development budget in 2009-10 fiscal year was about TK. 20 billion and for fiscal year 2011-12 it is TK. 71.53 billion, which is about 26% of total development budget and 7.5 percent of national budget (FD, 2011).

4. III.

5. Review Of Related Study

The study of the characteristics of economic dynamics and electricity sector has been an area of interest of researchers for long time. However, the pioneering work is investigating causal relationship between economic growth and energy consumption was done by Kraft and Kraft (1987). The existing literature focuses on developed and some developing economies. Different results have been found for different countries and different time periods. Those studies used different proxy variables for energy usage. This study will concentrate on the existing literature that is similar to our study. a) Literature Review: Bangladesh Reviewing the existing literature on economic growth and electricity consumption, we find only a few studies regarding Bangladesh. Most of those studies fall into the omitted variable(s) trap as they only examined the energy-growth nexus in a bi-variate framework. But our study include important variable like investment. Ahmad and Islam (2011) conducted a research on Bangladesh scenario. They found short-run unidirectional causality running from per capita electricity consumption to per capita GDP without feedback applying co-integration and VECM based Grangercausality test for the period spanning from 1971 to 2008. They also found long-run bidirectional causality running from per capita electricity consumption to per capita consumption and economic growth but no causal relationship exists in short run. Applying Granger causality tests on the nexus between economic growth 2015 huge amount of public and private investment GDP. Asaduzzaman and Billah (2008) found positive relationship between energy consumption and economic growth for Bangladesh using data spanning from 1994-2004 and reported that higher level of energy use led to higher level of growth. Buysse et. al. (2012) investigated the possible existence of dynamic causality among electricity consumption, energy consumption, carbon emissions and economic growth in Bangladesh. The results indicate that uni-directional causality exists from energy consumption to economic growth both in short and long run, While bi-directional long run causality exists between electricity and electricity generation, Alam and Sarker (2010) claims that there exists short run causal relationship running from electricity generation to economic growth without feedback. On the other hand Mozumder and Marathe (2007) found reverse relationship that is unidirectional causality from GDP to electricity consumption for Bangladesh over the period 1971 to 1999 by employing Co-integration and Vector Error Correction Model (VECM).

6. b) Literature Review: South Asia

There are some notable studies conducted in the South Asian region. Ghosh (2002) conducted a study using annual data covering the period of 1950-51 to 1996-97 in India and found that unidirectional Granger causality existed running from economic growth to electricity consumption. But, the same author in 2009 claimed that there was unidirectional causality running from economic growth to electricity c) Literature Review: Developed and Developing Countries Asafu-Adjaye (2000) investigated the existence of causal relationship between energy consumption and output in four Asian countries using the co-integration and error-correction mechanism and pointed out that unidirectional causality ran from energy consumption to output in India and Indonesia. However, bi-directional causality was found in case of Thailand and the Philippines. Akinlo (2009) conducted a study in Nigeria to investigate relationship between economic growth and electricity consumption during the period 1980 to 2006. The result exhibits that there is unidirectional Granger causality running from electricity consumption to real GDP and suggested use of electricity could stimulate the Nigerian economy.

China, the largest developing country uses huge amount of energy. Recently, more attention has been given in China to determine the short run and long run causal relationship between electricity consumption and economic growth. However, conflicting result have been revealed by different researchers. Using yearly data covering the period 1978 to 2004 and applying cointegration and Granger causality approaches Yuan et. al. (2007) indicated that electricity consumption and real GDP for China were co-integrated and there was unidirectional Granger causality from electricity consumption to real GDP. Shiu and Lam (2004) claimed that causality existed running from electricity consumption to economic growth for the period 1971 to 2000. On the other hand, Lin (2003) covered the 1978-2001 period and found that economic growth causes electricity consumption. Chontanawat et. al. (2008) investigated the existence of causal relationship between energy economic growth nexus in 30 OECD developed economies and 78 non-OECD developing economies. They pointed out that causality running from energy consumption to GDP. However, the result was more prevalent in the developed OECD economies compare to the developing non-OECD economies. Employing cointegration and VECM, Belloumi (2009) pointed out Tunisian per capita energy consumption in the short-run caused to per capita GDP and there were bidirectional long-run causal relationship between the series for the period of 1971 to 2004. Ouedraogo (2010) found that there was a long run bi-directional causal relationship between electricity consumption and GDP for Burkina Faso for the period spanning from 1968 to 2003 and claimed electricity was a significant factor in economic development. Chandran et. al. (2010) considered the relationship between electricity consumption and real GDP growth in case of Malaysia. Employing autoregressive distributed lag (ARDL), the result indicated that there was positive relationship between electricity consumption and real GDP. The causality test confirms the uni-directional causal flow from electricity consumption to real GDP and the findings conclude that Malaysia is an energy-dependent country.

7. IV. Data Description And Research Methodology a) Data Description

The empirical analysis of the study is conducted by using time series data of total Electricity consumption, total real Gross Domestic Product (GDP) and total investment for the period spanning from 1981 to 2011 (Fiscal Year, July to June). The choice of the starting period was constrained by the availability of time series data on electricity consumption. The data of total electricity consumption is expressed in terms of Gigawatt hours (GWh) and obtained from annual report, published by Bangladesh Power Development Board's consumption in the short run. Lean and Shahbaz (2012) claim that electricity consumption has positive impact on economic growth and bi-directional Granger causality has been identified between electricity consumption and economic growth in Pakistan. However, Ahmad and Jamil (2010) using annual data for the period of 1960-2008, found the presence of unidirectional causality from economic activity to electricity consumption. Morimoto and Hope (2004) pointed out that current as well as past changes in electricity supply have a significant impact on a change in real GDP in Sri Lanka. Saeki and Hossain (2011) found existence of unidirectional causality from economic growth to electricity consumption in India, Nepal and Pakistan, and from electricity consumption to economic growth in Bangladesh.

Therefore the above literature reveals that due to the application of different econometric methodologies and different sample sizes, the empirical results are very mixed and even vary for the same country and are not conclusive.

(BPDB). On the other hand, real GDP (which is a proxy to economic growth) and total investment series is in constant price (base year 1995-96) of BDT (Billion) and obtained from Bangladesh Bureau of Statistics (BBS).

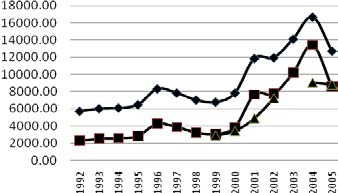

The following figure-1 describes the historical movements of total electricity consumption, real GDP and total investment over the time period 1981 to 2011. All the series shows upward trend.

8. Fig.1 : Historical trends of total electricity consumption (GWh), total real GDP and total investment

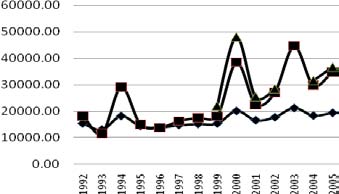

To provide an overall understanding of the chosen variables we include summary statistics for full sample in the following Table1 : Summary Statistics of real GDP, Investment and Electricity Consumption It should be mentioned here that electricity consumption and economic growth shows almost constant correlation in Bangladesh. The other two pairs also presence high time varying correlation. Considering the GDP and electricity consumption, the plotted time varying correlations range in a corridor with the lowest value of 0.91 in 1989 and almost near 1.00 rest of the years, while correlations between electricity consumption and investment to be found lowest 0.61 in 1990(Figure -2). We also note that the correlation between GDP and investment maintains high correlations except very little deviations (6%) in 2007. Generally we see that time series data is nonstationary but the model can only be built once the given time series are stationary. According to the Engle and Granger (1987) if independent series are stationary then the series are said to be co-integrated. To investigate, whether the given time series are stationary, there are several procedure found in the econometric literature. It is evident that each test has its own merits and demerits. In our study, we use two test in this regard such as Augmented Dickey Fuller (1979) and Phillips Peron (1988) test to avoid the criticisms of individual test. Appropriate lag lengths are selected according to the Akaike Information Criterion (AIC) method.

We performed the ADF tests based on the following model Where ? = first difference operator, n= optimal number lags, = disturbance term consider as a white noise error, y= time series that is GDP, investment and electricity consumption. The PP test are based on the following model Where ? = first difference operator, ? = constant, ? t = error and y= time series that is GDP, investment and electricity consumption.

ii. b2 Johansen Co-integration and VECM For co-integration test it is required that the chosen time series that is GDP, investment and electricity consumption to be integrated of the first order I (1), when this condition satisfy then we can move into examine the existence of long run co-integration relationship of the chosen time series. In this regards, we will be employed Johansen co-integration test. Johansen method indicates the maximum likelihood procedure to identification of existence of co-integrating vectors for chosen non-stationary time series data. The Johansen methods allow us to determining the number of co-integrating vector. These tests directly investigate the integration in Vector Auto-regression (VAR) model. Appropriate lag lengths are selected according to the Akaike Information Criterion (AIC) method. We can write the VAR of order p in the following way.

Where represents n×1 vector that integrated I (1) and is n×1-vector innovations.

? = -T ? ? ? k r j 1 ln(1-? ?j ) ...... (iv) max ? = -T ln(1- 1 ?? r ? ) .......... (v) j ? trace ? ( )Eigen value test tests the null of r cointegrating vectors against the alternative hypothesis of r+1 cointegrating vectors. max ? ) ( If two or more series co-integrated then it implies that causality exists among the series but it does not indicate the direction of the causal relationship. Thus the dynamic Granger causality can be captured based on Vector Error Correction Model (VECM) will be employed to determine the causality direction between economic growth, electricity consumption and investment. To ascertain the causality direction, we estimate the following VECM:

Where refers to the error correction term derived from the long-run co-integrating relationship. This is also measures the magnitude of the past disequilibrium and the coefficients of represents the deviation of the dependent variables from the long run equilibrium.

iii. b3 Short-run and long-run elasticity Saeki and Hossain (2011) applied following model to obtain short-run (Model -vii) and long-run (Model-viii) elasticity. We will be employed the same.

Where the random error term, and are the parameters to be estimated This equation is augmented with lead and lagged differences of the dependent and explanatory variables to control for serial correlation and endogenous feedback effects.

9. V. Empirical Results

The order of integration of the time series is investigated by applying both Augmented Dickey Fuller (1979) and Philips Perron(1988) tests. We include trend and constant term in the both tests. The following table -2 exhibits the results of unit root tests on natural logarithms of the levels and the first differences of real GDP, electricity consumption and investment, where evidence was found in favour of the null hypothesis that all series contain unit roots at level. However, we reject the null hypothesis for the first differences of all series. Therefore, it is concluded that all the series are integrated of the order 1 i.e. I (1). Thus co-integration tests can be applied for all variables. 0.05 -Our next aim is to investigate whether or not real GDP, electricity consumption and investment share common long run relationships. To achieve this, as explained earlier we consider both the trace statistic and Maximum Eigen Value Statistic test to investigate the long run relationship among the variables. The primary step in the Johansen co-integration test is to determine the optimal lag length for each VAR model. This study identified the optimal number of Lag by using Akaike Information Criteria (AIC) and considered the minimized Notes: *indicates significant at 1% level, ** indicates significant at 5% level criterion value. The results of Johansen co-integration test shown in table-3, where we find that the null hypothesis of no co-integration can be rejected using Table 3 : Result of the Johansen Co-integration Test We have found that the chosen time series are co-integrated and there exist long run relationship that indicates there must be Granger causality in at least one direction, but it does not indicate the direction of temporal causality among the variables. The direction of causality can be divided into short and long run causation. We then, therefore explore the dynamic Granger causality in the (Vector Error Correction Model) VECM specification to obtain both short-run and longrun direction. The short-run causal effects can be obtained by the F-test of the lagged explanatory variables, while the t-statistics on the coefficient of the lagged error correction term in model (vi) indicates significance of the long-run causal effect.

Beginning with the long-run causality, the coefficient of is having a negative sign in all equations except when GDP acts as the dependent variables. In investment equation we can see that the coefficient of is -0.35 (table -4) and is significant at 05% level that confirms the unidirectional long run relation from GDP and electricity consumption to investment with no feedback. The significant negative coefficient of error correction term implies that the variable is not overshooting and thus the long run relationship is attainable in investment equation. That is if the system is exposed to a shock, it will be converge to the long run equilibrium at 35% per year. The coefficient of is negative in electricity consumption equation but insignificant. The coefficient of is positive in GDP equation which means that any exogenous shock in one of the variables may be lead to divergence from equilibrium. Therefore in case of shock in the GDP, there may be 3% divergence from equilibrium per year.

In the short-run there is unidirectional causality running from electricity consumption to GDP, Electricity consumption to Investment and Investment to GDP but not the reverse. This implies that electricity consumption acts as a stimulus to investment and economic growth as well and high levels of economic growth demands a high level of electricity consumption. The result also show that in the short run investment causes GDP, which simply suggests that a high level of investment leads to high level of economic growth. These finding indicates that in Bangladesh electricity generation polices should aimed at improving the power infrastructure and increasing the power supply are the appropriate options to boost the economic growth.

The finding of our study is on the line with earlier findings of Ahamad and Islam (2011); as they revealed the causality from energy consumption to GDP for Bangladesh. Our result is also consistent with the finding of Asaduzzaman and Billah (2008) as they claims higher level of energy use led to higher level of growth in Bangladesh. Our result also consistence with the finding of Alam and Sarker (2010), as they revealed that short run causal relationship running from electricity generation to economic growth without feedback. The findings of our study also partly consistent with the findings of Buysse et. al. (2012) as their results indicate that uni-directional causality exists from energy consumption to economic growth both in short and long run while bi-directional long run causality exists between electricity consumption and economic growth but no causal relationship exists in short run. However, our result is totally conflicting with the finding of Mozumder and Marathe (2007) because they reveal that there is unidirectional causality from GDP electricity consumption for Bangladesh over the period 1971 to 1999. This contradiction can be argued upon with a plausible view that the time series are different. We estimate the short and long run elasticity based on model (vii) and viii). The estimated results are given below in table-5. The findings indicate that the short-run and long-run electricity consumption and investment have significant positive impact on economic growth for Bangladesh. The long-run elasticity of economic growth.

with respect to electricity consumption is (0.12) higher than short-run elasticity (0.09) and also the longrun elasticity of economic growth with respect to investment is (0.78) higher than short-run elasticity (0.50), indicate that over time higher electricity consumption and higher investment in Bangladesh give rise to more economic growth.

10. VI. Conclusion And Policy Implications

The main goal of this paper was the examination of causal interdependences between economic growth, electricity consumption and investment in Bangladesh. For this purpose, the study focused on total electricity consumption, total real GDP and total investment for the period spanning from 1981 to 2011. This paper applies the ECM model to examine the causal relationship among the chosen variables. Prior to testing for causality, the ADP/PP test and Johansen co-integration test were used to examine for stationarity and long-run co-integration. Results from the Johansen co-integration test show the existence of long run equilibrium among the variables, while the causality results confirm unidirectional causal relationship running from electricity consumption to economic growth in the short run. The causality results also exhibit that electricity consumption causes investment and investment causes economic growth but not the vice versa. The source of causation in the long run is also found to be the error correction terms from electricity consumption and economic growth to investment. The long run elasticity of economic growth with respect to electricity consumption and investment are higher than their short run elasticity. This implies that over time higher electricity consumption and higher investment in Bangladesh give rise to more economic growth. Our overall findings indicate that Bangladesh is an energy (electricity) dependent country. This implies that an increase in electricity consumption raises economic growth. We also find that an increase in electricity consumption raises investment and obviously an increase in investment raises economic growth. Therefore, emphasis should be given on electricity generation and more investment. There is no other alternative for economic growth than to generation more power for Bangladesh, needed especially for transforming into a middle income country by 2021. However, a question may be raise as to whether electricity consumption could boost the economic growth alone; the answer is simply no. Because, electricity consumption is one of the influencing factors not all. Along with generation of more power, government should ensure a business friendly environment to encourage local and overseas investors to invest more. Only in that case more electricity will lead to increased economic activities otherwise it would be costly. In this regard, government may take policy action to increase power generation as well as attract local and foreign investors to invest in energy and other sectors. As we mentioned earlier, the findings of our study emphasizes the consumption of electricity as a prerequisite of achieving higher economic growth for Bangladesh so high priority should be placed not only on power generation but also on the issues of appropriate electricity distribution and management system in the short-run and medium term policies of the government to take the country to middle status by 2021.

Bangladesh use huge amount of gas and fuel to generate electricity (Finance Division, 2011). So, Ministry of power, energy and mineral resources may continue to investigate and exploit the possibilities of renewable energy and more use of coal for electricity generation as it can reduce reliance on imported fuels. Renewable energy source and alternative source of electricity generation may change the power structure of Bangladesh. The Ministry of Power and energy resources may extract coal from the Dinajpur coal field and generate electricity. Renewable energy technology has an enormous potential to solve electricity problem in Bangladesh. The energy provided by the sun (solar energy) is many times greater than the current electricity demand. The wind, waves and tides have a large potential as well. It is to be understood that renewable energy may be the one of the vital source of future electricity supply and the said traditional energy source like gas and fuel are coming to an end.

As investment positively affects GDP growth and electricity consumption affects investment, Bangladesh Bank (Central Bank of Bangladesh) may under take appropriate monetary policy to provide loan at cheaper rate in banking sectors. The enhancement of capitalization towards small investors at cheaper cost helps in expanding existing business and generates new business activities as well that means crates more employment opportunity, increase purchasing power. So, investment considered as a leading indicator of economic activity, prosperity and hence economic growth.

| 11,015.35 GWh, TK. 1914.21 billion and TK. 436.20 | ||||

| billion respectively. The high standard deviations | ||||

| 1. The table shows that | indicate | that | electricity consumption, GDP and | |

| during the period average electric consumption, | investment are increased in the recent past in | |||

| average real GDP and average investment | was | Bangladesh. | ||

| both the trace statistic ( | ) and Max Eigen Value ) at 5% level. trace Statistics ( ? max ? | ||||

| Null | Trace Statistic | 05% Critical | Max Eigen Value | 05% Critical | |

| hypothesis | ( trace ? ) | Value | Statistic( max ? ) | Value | |

| Total GDP, | r=o | 110.24 | 29.68 | 102.19 | 20.97 |

| Electricity | r ? 1 | 8.04 | 15.4 | 6.59 | 14.07 |

| Consumption | r ? 2 | 1.44 | 3.76 | 1.44 | 3.76 |

| and Investment | |||||