1.

Rastin Partnership Accounting Part II: Mudarabah Financial Sharing (MFS)

Abstract-Purpose: This paper aims to explain a new system of accounting for partnership financing that applies in Rastin Profit and Loss Sharing Banking. In this system, the interest rate is not used in calculations and accounting, and instead, the "time value" of capital based on the amount and duration of the partnership is used. In this part, we will go to the details of Mudarabah accounting details.

Design: Rastin Partnership Accounting principles have been founded on off-balance-sheet items and on the basis of the institutions' obligations to the depositors and receivers of financial resources, and they are in compliance with the nature of the financial intermediary activity (a partnership of depositor in the yields of the fund receiver via the bank).

2. Introduction

n the first part of the paper, we discussed Profit and Loss Sharing (PLS) accounting experiences, and we introduced the Rastin Partnership Accounting principles and operations. We also showed that how this new accounting system can be used for the "Funds with Variable Capital". It was also addressed that how this accounting system deals with change in timing due to non-performance of the commitments.

In this part, the continuing topics of Rastin Partnership Accounting in Mudarabah Financial Sharing (MFS) accounting are discussed. Mudarabah Financial Sharing (MFS) provides the conditions for depositors to share in the commercial project of an entrepreneur. MFS is a financial subsystem 2 The rate of return determination in this kind of sharing -whether the bank is public or private-is the return rate of the real economy. Bank receives a commission for providing capital management services to the depositor as agent/attorney or and works as an intermediary of financial resources to allocate depositor's funds in Mudarabah business of entrepreneur. Bank enters a "Joalah contract" with depositor and a "Mudarabah contract" with Mudarib (entrepreneur) to join them in the sharing project according to their opinions. In this subsystem, the bank offers the deposited funds to those seeking financial resources for Mudarabah and the benefit of Mudarabah is divided between depositor and Mudarib according to instructions. Distribution of profit will be done among depositors and entrepreneur, and the bank receives a commission fee. In the case, that bank is interested in depositing in a project, of course, will receive profit of Rastin Profit and Loss sharing (PLS) banking system and works under general instructions, organisations, operating procedures, electronic software, contracts and related forms of Rastin PLS banking.

Findings: The distribution of profit among stakeholders (including workforce and capital owners) is accomplished according to the share of each beneficiary in the created value added. In this regard, Euler's theorem, as the best mathematical-economic innovation for distribution of income is applied.

Research limitations: This system is novel, and it is required to be more elaborated for further practical development and adjustment.

Practical implications: In this accounting system, the return of the partnership is distributed among sharers based on the amount and duration of their partnership. The penalty for delay in payment is calculated from the sum of the incurred loss due to negligence or blameworthy of the undertaker and not upon a penalty interest rate.

Social implications: Interest rate as an essential factor in conventional accounting is not usable in Islamic banking and other similar institutions that work based on partnership, such as mutual funds and saving and loan associations. The proposed system removes this shortage and is fairer than the conventional accounting.

Originality/value: Approach of this accounting system is fully different from the conventional accounting, because of intrinsic characteristics of the intermediary role of financial partnership institutions and Islamic banks.

share in proportion to its further fund depositing. The agent (entrepreneur/Mudarib) is a real person or legal entity who receives the money resources of depositor through the bank and according to the contract starts particular Mudarabah activity. The depositor will fund the Mudarib and Mudarib provides adequate guarantees to the bank for assuring to conduct his job properly. Trustee unit is a unit in Rastin PLS office of the bank that monitors the project implementation.

"Mudarabah Certificate" as well as "Periodic Mudarabah Certificate" are used as new financial innovations in MFS. Mudarabah Certificates are anonym certificates with a nominal price that are issued by Rastin bank for the specified period of the project. The owners of these certificates which are kinds of Rastin Certificates share the profits of Mudarabah business in proportion to the nominal price of the certificate and the period duration they had depositing. These certificates are issued digitally over the web to provide web-based digital transactions. The holders of this certificate can transact it on the web or over the counter of PLS bank branches. Therefore, these certificates can be negotiated internationally.

"Periodic Mudarabah Certificate" is a kind of "Mudarabah Certificate", but depositor receives her/his profit periodically and entrepreneur can do the business multiple times with the fund of the depositor.

By applying to the web information portal of Rastin Certificate Market, or a Rastin PLS bank branch, depositor acquaints with depositing and dispensing through consulting with bank expert and selects the project she desires. By depositing and after signing and registering the contract, the web-based system automatically issues the certificate. At the end of the project, the accounting/auditing unit will calculate and pay the profit to the certificate holder.

By applying to a bank branch, Mudarib also offers his Mudarabah project proposal to the bank. Then, while informing the Mudarib (entrepreneur) about the conditions and regulations concerning participation through web information portal of Rastin Certificate Market (RCM) or information counter of Rastin PLS bank branch, the registration fee (according to instruction) with the written project proposal, and economic, technical and financial justification of the project will be received from the Mudarib.

The assessment unit of the PLS bank will assess the credibility of the agent on the basis of the available historical background of the Mudarib and according to the compiled instructions if the Mudarib possesses required technical and other capabilities, will report to project assessment unit. If the assessment report is positive, the necessary guarantees and collaterals will be determined according to instructions. After signing a contract with the Mudarib, bank delivers the requested fund to the Mudarib according to a Mudarabah contract. All the Mudarabah documents according to the agreement including the details of Mudarabah merchandise, budgeting, timetable, needed resources, and the method of consumption of resources and implementing the project, phasing, quality control and reporting and finishing the project will be given to the trustee unit of the PLS office of the bank. The monitoring reports of trustee unit will be delivered to accounting/auditing unit at pre-determined intervals. The trustee report will be the basis for final Mudarabah settlements. At the end of the project or at the specific periods, accounting/auditing unit of the PLS office of the bank will compute profit or loss and bank commission fee according to the compiled instructions. The share of depositor and Mudarib will be carried to their accounts. If there were a stoppage report provided by the trustee, the resulted losses would be calculated according to the compiled instructions.

3. II.

4. Mudarabah Contract

In Islamic Fiqh (jurisprudence) it is a transaction contract between two persons according to which a person conducts economic activity by the money of the another person, and the derived profit is divided according to pre-agreed ratios. On the other words, Mudarabah is a contract between depositor (capital owner) and Mudarib (entrepreneur/agent) for conducting economic activity by the depositor's capital and dividing the profit by an agreed percentage among them. If the business ends to benefit, it will be split between the two, but if it ends with a loss, only the entrepreneur's loss is his unfruitful efforts. Except in the case that it is proved that agent's fault caused the loss. In Mudarabah there is the condition that the depositor should accept the probable loss; otherwise, the contract will not be a Mudarabah deal, but it is a loan. If it is agreed to transfer all the profit to the owner of capital, again the contract will not be a Mudarabah one, but an Ibza 3 . Defining the shares of profit of each party is of essential conditions of a Mudarabah contract. Mudarabah contract has two sides and it needs that the both side approve the contract and its conditions 4 Some jurists believe that the capital of Mudarabah should be in cash .

5. 5

, and conducting Mudarabah with commodities is not valid 6 3 -In Ibza the agent works for the owner of capital and earns wage. 4 -Tabatbaee Yazdi, Saied Muhammad Kazem; Orvatol-Vosgha, Qom, Islamic Publication Institute, 1420 Lunar Hijri. Khomeini, Seyyed Rouhul-Allah Musavi; Tahrir-ul-Vasileh, Qom, Islamic Publication Institute, 1420 Lunar Hijri, Vol. 1, pp. 558-567. Al-Husaini Shirazi, Seyyed Muhammad; Al-Feqh (Vol. Mudarabah), Qom, Seyyed-u-Shohada Publication, Pp 5-8. 5 -Civil Act, article No. 547. 6 -Allameh Helli, Al Jame-u-sharaye, ed. by Murvarid, Ali Asghar, Birea: Al Shiah Feqh Institute, 1410 Lunar Hijri. hand, by restricting the definition of Mudarabah, some jurists believe that Mudarabah should only be used in commercial activities 7 . Of course, these beliefs do not reject original rules and conditions of the contract; and types of the Mudarabah contract can be made by goods as capital, or be made on the other non-commercial activities 8 . On the other words, there is no reason to limit all contracts to contracts in fiqh books and as narrated contracts; therefore, even if the capital is non-cash, and it is not considered as a Mudarabah contract, though the contract is yet legal and valid. The narration-based reasoning for Mudarabah is based on epithet (laqab) 9 concept, which is the weakest logic in fiqh and is not a proof. On the other side, there are some narrations that goods can be regarded as the capital of Mudarabah 10 Some of the Sunni jurists admit goods Mudarabah by evaluating the price of goods and considering the price as the Mudarabah capital, or if a debt were created by transacting measurable/weighable property, it would be quite similar to cash money, and the Mudarib (agent) receives what he is rightful and accordingly, there will be no guarantee-less profit (Rebhe-la'yozman) .

6. 11

. In addition, it is possible for Mudarib to give back the original capital (commodity) at the end of Mudarabah 12 Mudarabah is a definite and revocable contract . 13 . The Civil Act of Iran prescribes: "Mudarabah is an agreement according to which one party of the contract provides the capital and the other party should do business with it and divide the profit between them 14 . The share of each side in the profit should be clarified from the joined ownership such as a quarter, a third or 10 -See: Tafreshi, Muhammed Isa, and Jalil Ghanavati Khalafabadi, Foundation of Mudarabah contract in Islamic jurisprudence and Iran Civil Act. http://www.ghavanin.ir/PaperDetail.asp?id=839 11 -This is a kind of profit for which the person has no guarantee about it. 12 -Al Fatehul Ghozat, Zakaria Muhammad, Al-Salam val-Mudarabah, Amman, Darul Fekr Lelnashr va Tozie, 1984. 13 -Article 550, Civil Act of Iran. 14 -Article 546, Civil Act of Iran.

else 15 . These shares should be determined before unless it were generally known, and if it is not defined by the parties, it is considered as a common general case 16 . It is also mentioned in the Iran's Civil Act that the subject of Mudarabah might be any general unconditional business activity -if any particular event is not referred to in the contract 17 . Mudarib (agent) will work as an amin (trustee) and therefore s/he is not a guarantor of the owner's capital, except he has wasted or oppressed it 18 . As another condition of Mudarabah, the capital is to be specified. If someone provides the money and conditions that all the profit should be returned to him, the other side only receives a commission; unless it is proved that, the Mudarib has carried out the task freely 19 . If it is conditioned in the contract that the agent is responsible and guarantor for the Mudarabah capital; then the contract will be nullified unless it has been said that the Mudarib compensates the losses freely from his own wealth 20

7. III. Mudarabah Financial Sharing (MFS)

. Civil Act defines the legal basis of Mudarabah Financial Sharing (MFS). In addition, other regulations and measures have been ruled on the detailed application. Accordingly in Mudarabah Financial Sharing (MFS), one party provides the money, and the other one trades with that money, and the profit is shared. The necessary activities to be carried out by the agent (Mudarib) should be defined in the contract. The agent can be a real person or legal entity as well. The MFS activity should be carried out under the general instructions of Rastin PLS Banking Base System unless the deviation from it is mentioned.

In MFS, bank obtains the Mudarabah project proposal from Mudarib. After careful assessing of the project proposal and agent capability and reliability according to compiled instructions, the project proposal is introduced to depositors; and by issuing Mudarabah Certificates bank will provide the necessary fund for Mudarabah activity. Bank allocates the resource to entrepreneur and Mudarabah starts under the supervision of bank's trustee unit, and after the end of Mudarabah activity, the bank pays the principal capital and profit shares back to depositor and agent, and the bank receives its commission. If the business fails to obtain profit, the bank will receive no commission fee. The issuance and transaction of Mudarabah Certificate are according to Rastin PLS banking instructions.

Mudarabah subject is a commerce (trade) to be carried out in following fields: a. Transaction of merchandise inside the country (domestic trade) b. Exporting merchandise for selling abroad (export) c. Importing merchandise to sell in the country (import) d. Importing merchandise to re-export (transit) e. Interchanging foreign trade merchandises (swap).

The Mudarabah capital is defined by acceptable costs (including the price of buying goods for Mudarabah, insurance, transportation, warehousing, packaging, order registration, customs, commercial and banking fees) for the buying and selling period. Depositing a percent of import value, as the guarantee for opening the letter of credit (LC) at the central bank, is not considered as a cost because it will be paid back to the Mudarib when customhouse releases the imported commodity. This payment should be carried out by the agent himself.

Other related and different unexpected costs are acceptable if the Rastin bank's trustee unit confirms their necessities; otherwise, they should be paid by the agent. The cash capital of Mudarabah is given to the Mudarib (entrepreneur) all in once or in different prespecified stages.

If the trustee unit of the Rastin Bank accepts the entrepreneur's quest for further funds, because of increase in some of the above-mentioned agreed costs or price increase, this will be financed through complimentary contract according to the compiled instruction. If it is necessary, the bank will decide about additional collaterals. Financing new fund will be through issuing new Mudarabah Certificates for the new depositors to apply for the same project.

Duration of the contract is proportional to a full period of buying and selling of the Mudarabah merchandise. Export Mudarabah contract length is determined by considering the maturity of the letter of credit (LC) and its length should be more than the former. Mudarabah duration can only be extended by providing documents to the trustee unit of the Rastin Bank about the occurred delay according to the instructions of Rastin PLS Banking and trustee unit approval. However, this period should not be set longer than 6 and 9 months for internal and external trade contracts respectively.

All bank supervisions will be carried out by trustee unit. All the sell receipts will be transferred to a particular account of the bank immediately. The agent should promptly inform the trustee regarding his purchase, and the trustee will supervise his warehousing and sale. The trustee is obliged to monitor the flow of the purchased merchandise from the supplier to storehouse and details of sell and outgoing from the store. Mudarib is bound to inform the trustee unit of the PLS office about all physical movement of the merchandises from the place of sale to storehouse, loading and delivery of merchandise and move it by trustee unit permission. If there is a delay, fault, violation, or other similar troubles, the trustee unit of the PLS office will reconsider the competency of the agent to preserve the rights of the depositor.

The Mudarabah capital will be in ownership of bank to preserve the depositor's rights. After receiving information about the stoppage of Mudarabah activity, or bankruptcy of agent, the bank will promptly provide a list of merchandise and confiscates it into the hands of the bank. Then, by selling goods under the supervision of the trustee, the bank will settle the claims of the depositor. The Mudarib allows the bank with an irrevocable attorneyship power for after his death to permit the bank to refer to his firm, storehouse or other places related to the subject of Mudarabah, and confiscates the related merchandise, and draw depositor claim from his accounts in any bank to perform his obligations and settle the contract if necessary.

The organisational structure applied in MFS banking, its processing procedures, regulations and instructions and requirements designed for the bank, depositor, Mudarib and necessary regulatory structure work under Rastin PLS banking regulations. Rastin PLS banking organization is defined in chart framework of "Rastin PLS Banking Leading Committee", "Reviewing Group for Rastin PLS Banking Regulations" and "PLS Office" 21 , together with "Legal Unit" 22 and "Assessment Unit" and "Trustee Unit" and "Auditing and Calculation Unit" 23 and "Financial Engineering Unit" 24

8. a) Apportionment of Benefit between Depositor and Mudarib

and "PLS Branch" with "Cashier Section" and "Information and Consulting Section". The same organisation will be used for MFS.

Dividing profit between Mudarib and depositor is one of the significant Mudarabah problems. Traditionally, this splitting is made by mutual agreement, but it is not possible to leave the decision to bank branches, and it is necessary to compile special regulation for it. Before discussing this subject, we should consider that Mudarabah activity is a process, which creates value added in economic concept and in the framework of national accounting is considered as the production of goods and services.

21 PLS Office: It is a bank department that along with subordinate units manages participation processes in Rastin Banking. 22 Legal unit is a unit in PLS office in of Rastin Banking and includes awared insurance and law experts in Rastin Profit and Loss Sharing Banking. 23 Auditing and Calculation Unit is a unit in PLS office of Rastin PLS bank and includes accountants and auditing experts. 24 Financial engeineering unit is a unit in PLS office of Rastin PLS bank for supervision on Rastin Certificat Market and information disclouser of the entrepreneur.

Different schools of thoughts have differences of opinion about the value of work along the history, and different people believed different sources for the creation of value 25 Physiocrats were the pioneers who discussed the source of "value added" and extended it from transaction to production . Their points of view in different schools of thoughts are so different that some of them think that labour is not a source of value creation, and others believe that labour is the sole source of value creation.

9. 26

. They considered value in a frame of material tangible goods with the meaning of "use value", not trade value. Thus, the concept of value added was just in the form of the value of production against the value of goods used to produce the commodity, which is called "net production", and only exists in the agriculture and farming sector. According to Physiocrats' belief, that only shape of materials changes in manufactory and no added value is created in industry, and the only farmer creates added value 27 In Marxian literature, "The theory of value" is described as the amount of used human labour that is equal to the value of goods, and labour should produce relative added value in addition to the goods' absolute added value in the competitive scene. In order to create relative added value, his personal value of produced goods should be less than his current social value of that product. In creating absolute added value, the labour should use capital. Producing absolute added value is a material manifestation of capital by labour . 28 25 These topics are discussed in history of economic thoughts. 26 Physiocarts did not believe to social concept of value and "surplus value" in Marxian literature. 27 Physiocarts believed that this is because of the power of growth in plants, which is seen only in agriculture and not in industry. In their view, the added value is not because of labour, but it is created by the cooperation of land and nature and it is the creativity or fertility power of the land which changes the amount of planted seeds to larger amounts of seeds. Accordingly, the dividend of proprietor or additional value in agriculture is a natural endowment that is because of relationship of human being and land, and not because of his social relations. 28 Marx, Karl, Capital, vol. 1, Penguin, England, pp. 1019-1026.

. If we regard total production process from a production viewpoint, production means are the tools by which production takes place according to Karl Marx and his descendants; and it is only the labour, which is creative. As far as work is an individual process, a worker carries out all the work until the product is made and a human being has not hegemony on nature by his own solely, and force the nature to create crops as Physiocrats asserted. Therefore, the direct production of a single worker will change into a joint production of labours. According to the Marxist viewpoint, the concept of capitalistic production is not just the production of goods, but it is derived from a surplus value. The labour is not producing for himself alone, but for the capital owner and increase of his wealth, and he is not just producing, but he is also producing surplus value.

In Ricardo viewpoint, surplus value is an inherent and inseparable part of the capitalistic production. Ricardo is not searching for the very reason of the existence of surplus value but he is looking for the cause that defines the amount of this value. Mercantilists believed that the surplus price of goods over its production cost is because of the transaction and selling it at a price above its original value. John Stewart Mill believed that the origin of profit is the excess production of labour more than his own sustenance needs and the reason for the creation of profit from capital is because of the durability of raw materials and production means more than the time required for producing them. Hence, according to this economic school of thought, profit is not created by the transaction, but it is because of productivity power of labour.

These theories have not the applicational merit for distribution of the outcome of Mudarabah, but the neoclassical microeconomic firm theory has an extensive and profound analytical base 29 The above function is defined without fixed factor of production, and the amount of production is defined by variable factors of production L, and K. The production function is defined for an exclusive period in which the fixed cost does not enter into calculations. That is investment does not change. The applied technology, technical information of the entrepreneur that can be used for this problem. In simple words, according to the neoclassic opinion, "firm" is a place, which produces goods by using factors of production of labour and capital. The production function of the firm is a mathematical presentation of the relation between labour, capital and product. Consider a Mudarabah procedure in which Mudarib uses two variable factors of production: capital of the depositor (K) and labour work of Mudarib (L) together with his own fixed production factor to produce value added (from a business). The Mudarabah value added (Q) as a mathematical function of variable factors of production as capital (K) and labour (L) will be as follows: about using capital, is included in the mathematical form of the production function. Usually, the production function is assumed to be a continuous non-negative, single-valued, increasing function in the domain and regular strictly quasi-concave. The scope of entrepreneur and his activity and capital of depositor are defined for a specific period. The period in which the amount of L and K and thereof the Mudarabah function are defined has three constraints: Firstly, this time must be so short, in which entrepreneur cannot change the fixed factor of production. Moreover, it should be so short that the production function might not be modified because of improvement of Mudarabah technology.

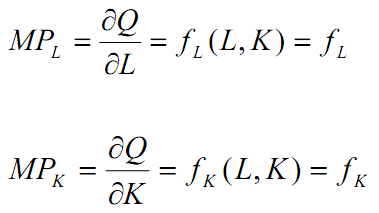

Q = ? (L, K)(1Thirdly, it should be so long enough to cover all the process of Mudarabah. The marginal efficiency of factors of production or the labour of Mudarib (entrepreneur) and the capital of depositor are defined as MP L and MP K respectively:

(2)

The "decreasing marginal productivity of factors of production" rule explains that increasing the amount of a variable production factor will increase its marginal productivity for first, and then after diminishing point of return decreases the marginal productivity of that factor. That is the more use of that variable production factor, after reaching a point of production; the lower will be the amount of extra production 30 Increasing the depositor capital factor of . This rule has particular effects on the Mudarabah profit distribution, which can be confined from the forthcoming profit distribution relation.

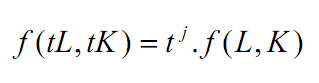

The term "Economies of scale" explicates the method of proportional increase in all factors of production. If Mudarabah is increased commensurate with labour and capital increments, the economies of scale in the specified range of their combination is fixed. The Increasing return to scale can be seen when the increased use of production factors leads to more production increment, and it is decreasing when it leads to a lower increase in production. "Return to scale" is defined by the concept of homogeneity. A homogeneous production function has a degree of "j" if:

(3) 30 -This point is the intersection point of average and marginal productivity curves. production and Mudarib labour factor of production by t times for amounts of j>1, j=1, 0<j<1, the return to scale will be increasing, constant and decreasing respectively. Moreover, a linear production function can be obtained from a collection of linear simultaneous activities 31 According to this theorem, we can understand that the total value of Mudarabah is equal to the sum of multiplication of marginal production of the labour of Mudarib (f L ) by his labour (L) and marginal production of the capital of depositor (f K ) by the amount of her/his capital (K). On the other words, if we want to distribute the yield of Mudarabah according to the marginal .

Linear production functions are homogeneous of degree one and hence, have constant returns to scale. The concept of homogeneity of production function means that if an increase (or decrease) in all factors of production occurs proportionally, production will increase (or decrease) proportionally as well. If production increase was proportional to the increase of production factors, the production function is homogeneous of degree one. When production increase was less than the increase of production factors, the homogeneity is less than one. Otherwise will be greater than one. In these cases of homogeneity of degree one, less than one and greater than one, the return to scale will be constant, decreasing and increasing respectively. This condition in the production function is mathematically confined by equation (3).

The assumption of homogeneity of degree one in the Mudarabah function is entirely rational and meaningful and by this assumption we can obtain a way for distribution of the yields of Mudarabah by Euler theorem. In other words, in the case of homogeneity of degree one, if all production factors increase/decrease proportionally, the production amount will also increase/decrease proportionally. In this case, because of the stability of average productivity of production factors, total productivity will not change. Euler's theorem explicates that the following equation is established in homogeneous production function of Substitution of (1) into (4) and assuming j=1 (homogeneity of degree one), the following relation is reached: productivity of labour and capital, the total outcome exhausts. Euler's theorem has a basic role in marginal production theory, and each production factor will receive its marginal production and Mudarabah yield is distributed accordingly. It should be mentioned that the homogeneity of degree one causes the Mudarabah function to be homogeneous as well. In other words, let ? be the profit of Mudarabah, we have: (6) This means that if the amount of entrepreneur's labour work and depositor's capital increase at the same ratio, the Mudarabah profit will increase proportionately.

By means of this analysis, we can compute the share of depositor and Mudarib according to the ratio of marginal capital and labour productivities by using the following formulas. In the following relation, the capital value is the Mudarabah sharing capital; and the marginal productivity of labour is Mudarabah profit, and the value added is the profit of the sale, and the value of the sold merchandise is the amount of Mudarabah commodity sold. In other words, we have: (7) That is the total of value added (V) plus cost (C) is equal to Mudarabah value (Q) and is equal to the values of labour (L) and capital (K). This is because:

? = V (8)This means that the value added equals to Mudarabah profit, and the value of the sold merchandise is equal to the sum of value added and cost: (9) Therefore, the value of the Mudarib labour will be equal to the value of the sale value of merchandise minus the capital of depositor: (10) Therefore, the profit share of depositor from the created value added (R K ) is equal to the ratio of the depositor's capital to the value of the sold merchandise and the profit share of the entrepreneur from the created value added (R L ) is equal to the ratio of the value added to the value of the sold merchandise. In other words: (11) (12) The profit share of the depositor( ) and the entrepreneur (? L ) are obtained by multiplication of their profit shares into their corresponding values added. That is:

(13) (14) Accordingly, each part of the Mudarabah (depositor and entrepreneur) share proportionately to their productivity ratios in producing value added. On the other words, if we sum up the above-mentioned relations, we will get the following relationship in which, the value added is equal to the total productivity (output) of labour and capital:

(15) That is the amount of payment to the depositor at the end of Mudarabah is equal to the sum value of his original capital plus his profit. The amount paid to Mudarib will be equal to his profit share: (17) The sum of the above two relations shows that after the end of Mudarabah and reimburse of principal capital and distribution of Mudarabah profit, the sum of the payment to the entrepreneur and payment to the depositor is equal to the total value of depositor's capital and profits of depositor and entrepreneur:

On the other hand, the total amount paid to depositor and Mudarib is equal to the total value of depositor capital and Mudarabah profit:

10. b) Mudarabah Financial Sharing (MFS) Accounting

In order to provide the financial facilities and allocate the resources, needed for commercial projects, the bank can employ the subsystem, of Mudarabah Financial Sharing (MFS). On behalf of the depositor, the bank will sign a mudarabah contract with the entrepreneur and as an intermediary, and will give the deposit of the depositor to the entrepreneur (i.e., the mudarib) in order to perform the mudarabah; moreover, the bank will monitor the entrepreneur's operation and on the other side, will surrender the Mudarabah Certificate or the Periodic Mudarabah Certificate to the depositor. After accomplishing the mudarabah financial process, the bank will share the gained profit or loss between the depositor and the mudarib after deduction of the bank's commission (if any profit realised). The

+ = = + Q + = Q = ? Q ? k = × = × + =(16)= + = + = + +(18)11. + = +

which is compatible with Euler's theorem of distribution of value added between labour and capital according to the marginal productivity of labour (Mudarib) and capital owner (depositor). Therefore, the amount received by the depositor for the principal and profit of the activity will be: main subject of mudarabah in Mudarabah Financial Sharing (MFS) is to use the depositor's capital by the entrepreneur (mudarib) for the purpose of selling and buying (business), which can be carried out via domestic commerce, export, import), re-export, transit, and swap.

The ratio of the profit share of each party (the entrepreneur and the depositor), of the value added of the mudarabah operation, will be determined according to the return ratio of capital and labour, via the following formulas; in the following relations, the capital value means the depositor's partnership capital, the return rate of the mudarib's labour means the profit obtained from mudarabah, the value added means the benefit yielded from sales, and the value of sold goods means the total sales of goods.

The depositors' profit share of the value added will be equal to the ratio of the depositors' capital value divided by the value of sold goods. Also, the entrepreneur's profit share of the value added will equal to the ratio of the value added divided by the amount of sold goods; thus:

The depositors' and the entrepreneur's profit will be obtained by multiplying their profit shares by the created value added; hence: Accordingly, each party (the depositors and the entrepreneur) will take a share of the value added, based on its return ratio. After calculation of each party's profit, the settlement process with the depositors and the entrepreneur will be proceeded as below:

After performing the calculations and the sharing process, the bank's commission will be deducted in favour of the bank from the value-added resulting from the mudarabah, based on the depositor's and the entrepreneur's profit shares and the full resources financed, and will be remitted to the bank's account. The bank's commission will be receivable, only if any value added has been realised in the partnership operation. If the bank PLS office and the entrepreneur agree upon the equal sharing of the mudarabah profit between the depositor and the entrepreneur, the entrepreneur will be obliged, at the time of contract signing, to buy the Mudarabah Certificate of his/her own project, equal to half of the nominal value of the deposit, minus the predicted value added in the project proposal.

The original deposit and the value added of each depositor (in accordance with the mudarabah subject and terms and conditions), will be calculated, distributed, and paid to depositors, based on the "term share" (resulted from the nominal amount and the partnership duration) of the Mudarabah Certificates (issued for each project according to the provisions of Rastin Banking regulations (Rastin Partnership Accounting)). Hence: If for a project, all Mudarabah Certificates are issued once and on the same date, the above-mentioned formula will be simplified as below:

The selling price of goods in the project proposal will be predicted based on the predicted price and market conditions. The entrepreneur will be obliged to confirm the real price of the day of selling goods with the trustee unit. The trustee unit will investigate the mentioned price and adjust it with the market price quote and then, will issue the permission for selling goods at a price declared by the entrepreneur. *** To be continued in Part III 32