1. Introduction

ntil the mid-1980s, the prevailing thought in the cost accounting was that production volume is the only main way for cost allocation. Therefore, based on this idea, all manufacturing costs, whether direct or indirect, must be allocated to the final corporate products. Companies continued in the allocation of their manufacturing costs under this idea until both Kaplan & Cooper (1987) introduced a new system for allocation of corporate overhead costs known as Activity Based Costing (ABC).

Although, the 1990s was considered as the decade of the digital industrial revolution that increased efficiency and productivity in many industrial sectors (Drucker 1993). Hilton (1999) argued that there are many economic consequences brought about by this industrial revolution. One of these consequences of the industrial revolution during that decade was a study by Brierley et al. (2001) which widely considered an important study to ABC system. Brierley et al. (2001) argued that there was an instability for using both direct and indirect industrial costs in many manufacturing activities, which has made some manufacturing costs more difficult to be. Hence many decisions within the company like pricing decisions would be uncertain and risky for decision-makers (Al-Bashtawi, 2007). Therefore, it clear that many organizations tend to use new systems that help in calculating the cost of the product more accurately to enhance the costs control and to exclude some activities that do not add value to the product (Shaban & Shabana, 2014;Kumar & Mahto, 2013).

Nowadays, modern corporate business environments have been surrounded by strong competition from different local and foreign businesses. This strong competition is imposing businesses to meet the diverse requirements of markets through new management accounting systems like ABC system (Drury, 2005). In this regard, Quinn et al. (2017) argued that these new market requirements forced companies to analyze the costs of their products and make successful pricing decisions to deal with fierce competition. Thus, most corporate businesses are now paying more attention to adopting many costing techniques such as ABC. Based on this, this study seeks to identify the level of the application of ABC in Jordanian industrial companies and its impact on pricing decisions.

2. II.

3. Literature Review

Towards the end of the 1980s, the academic literature related to cost and management accounting witnessed the emergence of the so-called ABC. The beginning was in the 1990s when some researchers argued that ABC is an appropriate system to trace and assign the costs of overhead activities to its final products (see, Weygandt et al. 2017;Namazi, 2009;and Drury 2005).

Towards this end, several empirical studies have conducted in an attempt to understand the ABC system and its benefits from various perspectives (Fei & Isa 2010). Most ABC studies enriched the existing literature through empirical investigations that added a reasonable justification for adoption and implementation of the ABC system in the business environment around the world.

Other studies look at the benefit of ABC system as a strategic approach by examining at what competitive advantages are gained of it. In this regard, Fito et al. (2018) argued, in a thirty years longitudinal study, that this importance has drawn the attention of several researchers to focus on understanding ABC from other different aspects that can affect or are affected by this system (Fei and Isa, 2010).

Indeed, it was documented that, evaluation, adoption, implementation, benefits and the factors impacting ABC success are the main aspects that have covered in the business literature. These studies include, e.g. Other studies have used ABC system as an independent variable in determining its effect on various corporate strategic decisions (Maelah and Ibrahim, 2007). For example, studies of Bromwich and Hong (1999); Brierley et al. (2001); Cardinaels et al. (2004); and Tobi et al. (2015), have investigated the effect of ABC system on corporate pricing decisions during the period of the 1980s-2000s. These studies have found the ABC system has a significant role in assigning the cost of their products or services. It is therefore considered an appropriate manner that makes the costing process more accurate and thus facilitating the price decisions-making.

The above-mentioned studies have attempted to clarifying the relationship between ABC system and pricing decision in different countries with different ways. For example Bromwich and Hong (1999), in their study, focused on analyzing the main requirements for ABC success that may help business in accurate measurement of its production costs, and then to make correct pricing decisions. They found that the cost estimation method without using of ABC system may provide management with false data for decision makers, especially in pricing decisions. Bromwich and Hong (1999) have also found that the failure in satisfying the requirements of ABC system may lead to distorting production costs and thus weakening the competitive position.

Similarly, Brierley et al. (2001) analysed much products costing practices and their effects on pricing decisions making for manufacturing sectors in the European context. Their results indicated that there is significant progress in describing costing behaviour in Europe over the last decade. It was also found that one of the most significant considerations for European companies to make a good pricing decisions for their products is ABC information.

In Belgium, Cardinaels et al. ( 2004) provided some experimental evidence on the advantages of costsystem development in 120 healthcare organizations. One of these advantages was by examining the role of the ABC system on price decisions. The study found that cost-system development can play a significant role in the strategic decision-making process. It was also found that the ABC system provides more accurate costing information, and therefore the decision-makers will have a better understanding of the correct pricing decisions, thus protecting their performance.

In the Indian context, Sharma and Gupta (2010) argued that the old traditional-cost method has become unacceptable and very costly in many organizations. This old method was likely due to the high volume of consumer demands and product differentiation process. The old traditional-cost method therefore led to strategic failures in many companies across India. Based on the study results, the researchers found that the ABC system is a significant tool to solve all problems of inaccuracy costs that result from the traditional-cost method. Unlike a traditional-cost method, ABC system as an effective method can contribute positively to make the top managerial decision-making process, such as pricing decisions (See, Kumar & Mahto, 2013).

In Nigeria, Tobi, Osasrere, and Adeniran (2015) examined the effect of ABC system and target cost management (TCM) system on the pricing decision process in (22) manufacturing companies in Ogun state. By cross-sectional survey design, different results have been shown in the using of both ABC and TCM systems on the pricing decision process. Specifically, the results showed that there was no statistically significant difference in the use of ABC on the pricing decision process in the Nigerian manufacturing companies. On the other hand, the use of the TCM system has a statistically significant difference in the pricing decision process in such companies.

Although the aforementioned studies have provided several pieces of evidence that ABC system is an effective strategy in giving the correct signals in decision making and therefore more value-added (Tuccillo and Agliata 2018). However, it has been argued that the most of the existing literature on cost accounting generally have lacked the empirical studies that investigate managers' views about the importance of ABC system as a cost-managerial approach to deal with the corporate pricing decisions. On the other hand, the majority of ABC studies are carried out in different countries in Western Europe, Africa, and East Asia. relationship between ABC and pricing decisions that have not explored in Arab economies like Jordan.

From the preceding section, the focus of this paper will be on the corporate pricing decisions influenced by the ABC system in a developing country like Jordan. Thus, a broad research question that could be raised here is: What is the effect of applying of ABC system for decision-makers in the Jordanian industrial sector.

4. a) Research Problem & Questions

In developing countries, Jordan as a case of these countries, (pre-2000s) most of the pricing decisions were often in the hand of corporate managers. Compared to the management accountant, most managers in Jordan are not familiar enough with the cost estimation and allocation for pricing. Therefore, the majority of their pricing decisions are mainly not based on accurate cost estimation. This issue led to uncertain costing information and thus choosing the wrong pricing strategy.

According to Jordanian economists, the abovementioned issue could be the main cause that made Jordan local products subjected to different pricing policies arising from different views of corporate managers. As such, Jordan industrial environment has suffered from a severe imbalance between product cost and its price in the mid of 1990s. Therefore, this period witnessed a slowdown in industry growth and an unwarranted rise in prices of products and services leading in a collapse of the national trade and a growth recession rate.

However, Jordan's accession to the World Trade Organization (WTO) in 2000 contributed heavily in speeding up of liberalization of trade within the local economy. The introduction of the foreign product to the local market competition in the 2000s has drawn the attention of some economists to adopt and implement new cost management systems for improving productivity and facing such competitive pressures.

Based on the earlier discussion on such selective adoption of ABC system in the Jordan industrial as one of new cost management systems, there was a clear desire for the researchers to investigate how a corporate pricing decisions could be influenced by this system in the Jordanian industrial sector. Thus, based on the discussion above, the broad research questions to be raised here are: However, answering the study questions above requires developing some hypotheses.

?5. b) Research Hypotheses

Total of five research hypotheses were developed based on some relevant studies and their variables to answer research questions of this study. Therefore, the paper explores the impact of ABC variable on pricing decisions variables by sampled companies from a Jordanian industrial sector by testing the logical relations in as depicted in figure.1 below.

Consequently, the study will test the following hypotheses:

6. H01: ABC has NO impact on setting the initial price H02: ABC has NO impact on determining products discounts H03: ABC has NO impact on setting the final price.

H04: ABC has impact on competitive pricing analysis.

7. NO

The Effect of Activity b ased Costing (ABC) System on the Corporate Pricing Decisions in the Jordanian Industrial Sector

Based on the broad question above, the research main-questions will be through discussing a research problem below.

8. III. Research Method & Methodology a) Population, Sampling & Data Collection

The population of the study comprises all employees working at the accounting department in the Industrial Public Shareholding Companies, from which a random sample consists of 352 participants has been selected. Data were collected via a questionnaire distributed to 400 employees and 392 have been returned, of which 40 questionnaires have been excluded. From the above discussion, the aim of this study is to explore the effect of using the ABC system on the four dimensions of producing pricing decision in the Jordanian manufacturing companies. According to the nature of data for the study, the quantitative approach was required. Therefore, the questionnaire tool has used for gathering the data targeted that serve the exploratory nature of the study.

9. b) Quantitative Approach & Data Analysis

Once the research hypotheses are setting out, the next step is to verify whether acceptance of the hypothesis happens. However, it is argued by Kawulich (2004), that the process of verifying the research assumptions of social sciences research could be conducted from different perspectives, which typically depends on the way of research design.

According to Punch (2005), a research design is the most significant step that helps researchers in selecting appropriate data analysis methods. In other words, it is the researcher guideline for choosing an appropriate research methodology and method.

Noted that research methods were typically classified into three types, namely: the quantitative, the qualitative method, and the mixed method. However, it's documented that the data's nature is the main drive when selecting the most appropriate research method (Amaratunga et al., 2002) Based on the data of this study, where a quantitative method was perceived as an appropriate approach to test study hypotheses. As such, the descriptive analysis and statistical analysis were used to explore the effect of ABC system on product pricing decisions. Specifically, the quantitative data of this study refers to the simple and multiple regression model were the appropriate approaches for analyzing such quantitative data that has been recorded across Jordanian industrial companies through the SPSS system.

10. IV. Descriptive & Analytical Results

After a brief discussion of the nature of the quantitative data; some fundamental conditions of such data should be achieved. these conditions are initial tests of the researcher to check whether his research data are testable. It also helps the researcher to choose the right statistical tests.

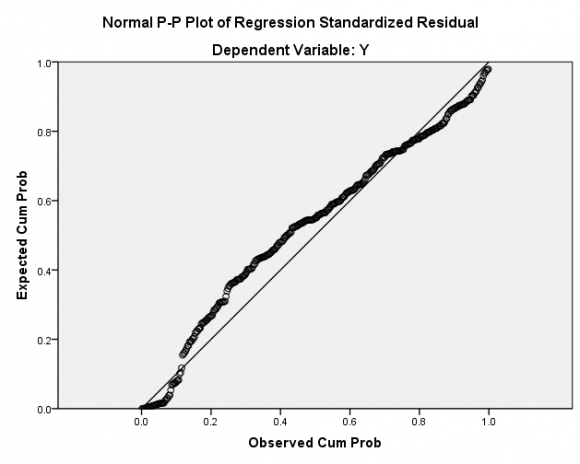

According to Field (2009), residuals independence test, normality distribution test, correlation coefficient test, and multicollinearity test are the key assumptions underlying the selection process for any regression models. In consistent with the study of Field (2009) these tests have been achieved before starting the empirical work. Therefore, the research model is found well fitted to test the effects of ABC system on pricing decisions in the industrial shareholding companies. (see appendixes section).

For the purpose of data analyzing, descriptive statistics and regression method were used as shown below.

11. a) Analyzing of Research Sample Characteristics

This section looks into the description of the sample structure includes several demographic information on the sample members of Jordanian industrial companies. Therefore, the study population were divided into characteristics of importance for the research. These include (level of experience, qualification, specialization and professional certificates) as presented in the below Table. Table 2 shows that the vast majority of the respondents about (%85) have few experiences in their work, which ranged between (less than 5) 199 respondents and 100 respondents have experiences between (5-less10 years). While the results on qualification index refer that the degrees of diploma and bachelor were constituted the vast majority of the sample. In particular, they represented (%91) out of total respondents. Furthermore, the respondents' attitudes towards their participation in ABC conferences and training, were unsatisfactory. 95% of respondents have no training or participation in any conference about the ABC system. It is noted by the researchers that there is less awareness about the importance of the ABC system by respondents and their organizations.

In the same vein, overall response rates about professional certificates of respondents were also negative, very small respondents have CIA, CPA, and CMA certificates, which were (2.8%, 4.3% and 6.3%) respectively. This could be attributed to the little experience that they have, as noted above. Moreover, about the scientific specialization, the descriptive analysis also indicates that there are no respondents outside the scope of economic and administrative sciences. In particular, respondents with accounting specialization were more than half of respondents with a rate of (59%), while other specializations have 0 respondents.

12. b) Descriptive analysis of the Study

The arithmetic means, standard deviation, and ranking of the item are generally the main descriptive analysis methods. These methods have been used to describe the recorded data regarding the effect of ABC system on pricing decisions. As such, the results on descriptive analysis were presented in Table 3 From Table 3, it is clear that all items on the application of the ABC system in the Jordanian industrial companies were ranked with medium level. Indeed, the mean rank of all independent variables has reached an average of (3.23). In particular, the mean that was also between the ranges of 3.14 -3.36 as in Table 3. However, the paragraph on spread awareness among workers of the importance of ABC application ranked as the first item between the items of ABC application with a mean of (3.36). While, the paragraph regarding the senior management support came in last place in the ranking the list, with a mean of (3.14).

About the pricing decision as a dependent variable of this study, also comes with medium level (mean rank= 3.14). More specifically, by comparing the means of four dependent variables, Table 3 showed that corporate decisions on setting the final price have placed as the first sub-dependent variable with a mean of (3.24). However corporate decisions on setting their initial price were the lowest ranked sub-dependent variable with a mean of (2.99).

13. c) Statistical analysis of the Study

Results of multiple linear regression that test the research hypothesis on the effect of the ABC system on the pricing decisions in Jordanian industrial shareholding companies were presented in below Table 4. On the overall, the results in Table .4 revealed that ABC system has a significant effect on corporate pricing decision. However, looking at each effect of independent variables of ABC system (M1-M4) on the dependent variables of pricing decisions (Y1-Y4); it can be concluded that there is a variation among relationships of each sub-variable. In particular, the results in Table .4 revealed that M2 and M4 of the ABC system are positively significant to Y1 of pricing decision with (B = 0.10 and 0.75) respectively. Furthermore, The R-squared of this model has a value of 0.49, meaning that the variables of M1 and M4 are capable of explaining 49% variation in the Y1 variable. Also, between M1 and M4, there is a significant effect on Y2 with (B = 0.20 and 0.80) respectively. Table 4. indicates that the value of R²=is 0.53 implying that the M variables in the model explain 53% variations in the Y2 variable. From regression results in Table 4, all sub-variables of M have a significant effect on Y3 variable with B value (<=0.05). The R-squared for this model is signifying that the ABC variables are capable of explaining 46% variations in decisions on setting the final price. About the effect of M independent variables on Y dependent variables, Table 4 indicates that only M4 variable has a statistical significance on Y4 variable (with B =0.00 and R²=0.34).

V.

14. Results Discussion

| Questionnaires | Number | Percentage |

| Total of Distributed | 400 | 100% |

| Total of Returned | 392 | 98% |

| Total of Excluded (Massing Data) | 40 | 10% |

| Total of final Respondents | 352 | 88% |

| Item | Variable | No | % |

| Less than 5 y | 199 | 56.5 | |

| 5y -lees than 10y | 100 | 28.4 | |

| Experience | 10y-less than 15y | 35 | 9.9 |

| More than 15 | 18 | 5.2 | |

| Total | 352 | 100 | |

| Diploma | 104 | 29.5 | |

| Bachelor | 217 | 61.6 | |

| Qualification | Master | 29 | 8.2 |

| PhD | 2 | 0.7 | |

| Total | 352 | 100 | |

| Yes | 15 | 4.3 | |

| Participation in ABC conferences | No | 337 | 95.7 |

| Total | 352 | 100 | |

| Accounting | 209 | 59.4 | |

| Business Administration | 76 | 21.6 | |

| Scientific Specialization | Finance & Banking | 51 | 14.5 |

| Financial Management Specialization | 16 | 4.5 | |

| Total | 352 | 100 | |

| CIA | 10 | 2.8 | |

| CPA | 15 | 4.3 | |

| Professional Certificates | CMA | 22 | 6.3 |

| Non | 305 | 86.6 | |

| Total | 352 | 100 |

| No. | Independent Items of ABC (M) | Code | Mean Ranking | ||

| 1 | The Availability of Advanced Accounting Systems | M1 | 3.36 | 3 | |

| 2 | The Availability of Qualified Workforce | M2 | 3.24 | 2 | |

| 3 | Raising Employee awareness on the Importance of ABC in an Organization | M3 | 3.20 | 1 | |

| 4 | Senior Management Support | M4 | 3.14 | 4 | |

| Total of items | 3.23 | ||||

| No. | Dependent Items of Pricing Decision (Y) | Code | Mean | Ranking | |

| 1 | Pricing Decisions on Setting the Initial Price. | Y1 | 2.99 | 4 | |

| 2 | Pricing Decisions on Determining Discounts. | Y2 | 3.22 | 2 | |

| 3 | Pricing Decisions on Setting the Final Price. | Y3 | 3.24 | 1 | |

| Year 2019 | 4 | Pricing Decisions on Competitive Pricing Analysis Total of items | Y4 | 3.12 3.14 | 3 |

| ( ) | |||||

| Item of M | *ß | T | Statistical Significance | R | R² | Adj-R² | F | **Overall Statistical Significance |

| Y1 | ||||||||

| M1 | 0.09 | 1.65 | 0.10 | |||||

| M2 M3 | 0.10 0.00 | 1.95 0.02 | 0.05 0.99 | 0.70 | 0.49 | 0.48 | 82.60 | 0.00 |

| M4 | 0.75 | 17.21 | 0.00 | |||||

| Y2 | ||||||||

| M1 | 0.20 | 3.68 | 0.00 | |||||

| M2 M3 | 0.02 0.04 | 0.45 0.78 | 0.65 0.44 | 0.73 | 0.53 | 0.52 | 96.70 | 0.00 |

| M4 | 0.80 | 18.95 | 0.00 | |||||

| Y3 | ||||||||

| M1 | 0.14 | 2.46 | 0.01 | |||||

| M2 M3 | 0.12 0.10 | 2.23 2.06 | 0.03 0.04 | 0.69 | 0.47 | 0.46 | 78.04 | 0.00 |

| M4 | 0.75 | 17.02 | 0.00 | |||||

| Y4 | ||||||||

| M1 | 0.11 | 1.78 | 0.08 | |||||

| M2 M3 | 0.10 0.08 | 1.72 1.45 | 0.09 0.15 | 0.58 | 0.34 | 0.33 | 44.33 | 0.00 |

| M4 | 0.64 | 12.82 | 0.00 |