1. Introduction

oing over organizations of different sizes, industries as well as countries with a clear-sighted view brings to light that the efficient and effective exploitation of tangible assets only is far from enough the endeavor capital needed to effectuate fine organizational performance. Variegated drivers were recommended in a vast bundle of organizational literature to ameliorate OP. However, many organizations are still shunning instead of running after those recommendations. Similar standpoints found in the literature signified the importance of both physical and intellectual assets for organizations to enhance OP (Wanjala, 2013). Even though the historical regard of the economic assets as a foremost measure of OP, new trends were emerged and justified using the intellectual assets as a complementary indicator of OP (Hudgins, 2014). Instances of these trends embody the remarkable gap between book value and market value of the organization (Chen et al., 2005 andCurado et al., 2014) in favor of market value (Smriti and Das, 2017), which signifiesthat the added value is devolved upon latent assets or, in other words, intangible or intellectual assets. Such intellectuals are more difficult to imitate than tangibles (Ghatak, 2013), on top of the nature of these intangibles as rare (Pucci et al., 2015) and hard to substitute assets (Amin et al., 2014).

Hence, one vein of the literature called organizations upon to pay more attention to intellectual capital as a well-established mean used to induce better levels of OP (Wang and Chang, 2005 Gogan et al., 2016 andKoc, 2017).

More than one view of ICwere detected in the literature. One general view took it as invaluable knowledge generating value to the organization (Hashim et al., 2015). A more specific view rated IC as a multi-dimensional concept made up of accumulated capitals pertaining human, structural and relational assets that furnish the organization with essential competencies required to make its objectives real (Awan andSaeed, 2015 andChein, 2013). A third view of the concept considered a combined perspective embraced the aforesaid views. It defined IC as a collection of knowledge sources that exist in the organization's people, structure and customers and can be processed into value (Wu and Sivalogathasan, 2013;Noordin andMohtar, 2013 andJoshi et al., 2013). It was acknowledged that IC covers abundant components related to these three bins of IC. Examples of these components are similar to organizational knowledge, culture, and innovation (Janosevic et al., 2013a), organizational technology, capabilities, and relationships (Badrabadi and Akbarpour, 2013), organizational

2. Year ( )

A strategies and organizational structure (Janosevic et al., 2013b).

Despite the absence of consensus on one clearcut definition of IC (Ozkan et al., 2016 andKoc, 2017), the concept was operationalized with a common voice as a structure encompasses three principals: human capital, structural capital, and relational or customer capital (Stewart, 1997 (Chen et al., 2004) and process capital (Lin, 2015). One study (Wang and Chang, 2005) divided structural capital into innovation and process capital.

IC has been figured up as a main source of the competitive advantage of organizations (Smriti and Das, 2017;Saeed et al., 2013;Ogbo et al., 2013and Seleim et al., 2007) and sustainable organizational performance (Mondal and Ghosh, 2012). A well contribution of IC to OP in particular was cited in sundry empirical studies carried out in different industries and countries similar to information technology industry in Taiwan (Wang and Chang, 2005); software companies in Egypt (Seleim et al., 2007), pharmaceutical companies in USA (Bramhandkar et al., 2007) (Nuryaman, 2015); drinking water distribution companies in Romania (Gogan et al., 2016) and tourism and automobile industry in Turkey (Koc, 2017). In agreement with the above-listed research, the main aim of the present study is to explore the influence of IC on OP. However, the contribution of this study followed clearly from IC and OP operationalization, the sample and the model of the study, as well as the setting where the study took place.

The study is structured as follows. The following section contains a review of the related literature, from which study hypotheses were drawn. The same section presents examples of definitions of the study variables and dimensions of IC and sub-dimensions of human capital, structural capital, and relational capital. The third section shows the methodology used in the study. It comprises sample of the study, measures used to assess the study variables, as well as data collection. Section four demonstrates data analysis and results. Section five sets forth discussion of the results and implications concluded. Finally, section six sets down limitations and future research directions provided by the study. Nuryaman (2015) defined IC as a main component of the organization market value since which composed of the economic capital plus the intellectual capital of the organization. According to the author, IC represents a difference between book value and replacement assets of an organization.

3. II

Pursuant to these definitions, IC was defined in this study as an integral part of the market value of an organization along with its economic capital, embodies all intangibles related to the organization itself such as management, procedures, trademarks, image, reputation, patents, culture, strategies, to the people of the organization such as knowledge, skills, experience, education, creativity, innovation, commitment, and engagement, and to the organizational relationship, either within the organization or with external stakeholders like customers and suppliers.

4. Global Journal of Management and Business Research

Volume XVII Issue V Version I Year ( ) A key component of an organization's value. Zéghal and Maaloul (2010) The entire accessible knowledge used by an organization to create value.

A5. Wu et al. (2012)

A set of organization-related abilities integrated with three types of capitals; human, structural and relational capital Nuryaman (2015)

A major component of an organization's market value b) Dimensions of intellectual capital IC, in general, has been conceptualized in the literature as a construct comprised three main dimensions: human capital, structural (organizational)capital, and relational (customer or social) capital. Problem-solving and value creation procedures. Nuryaman (2015) Hardware and software infrastructure, products and services innovations.

6. Koc (2017)

Management philosophy, organizational culture, information and network systems, patents and copyrights, and trade secrets.

iii. Sub-dimensions of RC Relational capital (RC), social or customer capital as called in some studies, incorporates all organizational relationships, either internal relationships between the management and employees or among employees themselves, or external relationships with stakeholders such as customers, suppliers (Nuryaman, 2015), research and development institutions as well as government (Mumtaz and Abbas, 2014). Moreover, RC includes all relationship-based outcomes like customer satisfaction (Khalique et al., 2011a), customer loyalty, organizational agreements (Koc, 2017), distribution channels, number of key customers (Wang and Chang, 2005). Mumtaz and Abbas (2014) attached other parts such as knowledge related to promotions and advertising practices (Table 5).

7. c) Definition of organizational performance

The literature of OP is loaded with definitions with this construct. Definitions of OP reported by Awan and Saeed (2015) indicated that OP represents the result of employees' task-oriented activities. In their definition of OP, Badrabadi and Akbarpour (2013) described OP as a result of the organizational processes execution and organizational goals achievement that embodies all success-related concepts. Lee at al. (2015) defined OP as an indication of the organization's competency to achieve its strategic goals and compete.

8. d) Dimensions of organizational performance

Dimensions of OP in the literature can be divided into: financial and non-financial measures. Kaplan and Norton (1996) The main focus of the present study is the influence of IC dimensions on OP. Lin (2015) used market value to measure OP. In a study conducted by Pucci et al. (2015) to explore the relationship between IC and OP, OP was measured using return on investment, return on assets, return on sales, capital turnover, and return on equity. In a study of Egyptian firms (Seleim et al., 2007), OP was evaluated by export density of software companies.

9. e) Human capital and OP

Cabrita and Bontis (2008) used a sample consisted of 253 participants selected from 53 banks in order to collect the required data to examine interactions among IC dimensions and OP. The results found significant interactions between the dimensions of IC, human capital, structural capital, and relational capital. In a word, the study concluded that IC together significantly impact OP. Particularly, human capital directly and indirectly affects OP. The same result was echoed in many prior studies ( 2015) concluded a non-significant impact of structural capital on OP. Based on these results, the study hypothesized that: H2: structural capital has a significant impact on organizational performance.

10. g) Relational capital and OP

It was revealed by many studies that relational capital has a significant impact on OP (Wang and Chang, 2005).The results of Yang and Lin (2009) showed that relational capital mediates the relationship between human resource practices and OP. That is, relational capital has an association with OP. Chen et al. (2014) studied the relationship between IC and new product development. Specifically, they estimated the effects of human capital and organizational capital on customer capital which in turn affect the performance in terms of new product development. Their results showed that customer (relational) capital mediates the relationship between human capital and organizational capital and new product performance. In fact, many studies confirmed the positive impact of relational capital on OP (Ghatak, 2013 andAwan andSaeed, 2015). Based on these results, the study suggested that:

H3: capital has a significant impact on organizational performance.

11. III.

12. Methodology a) Study tool, sample and data collection

A questionnaire was developed based on the literature. IC dimensions were measured adopting items from previous studies (Wang and Chang, 2005 Elfar et al., 2017). It included 20 items, each of the variables (HC, SC, RC, and OP) was measured using 5 items. Items of HC covered employees' knowledge, skills, experiences, education, motivation, commitment, creativity and innovation. SC items referred to organizational efficiency and effectiveness, procedures, culture, product or service-oriented innovation, and intangibles such as patents, image and trade secrets. On the other hand, RC items included organizational relationships with stakeholders, agreements, customer contribution and satisfaction. Finally, OP was measured using indicators concerned customer, employee development, individual and job fit, and knowledge performance. All items were measured using a five-point Likert scale ranged from 1 (strongly disagree) to 5 (strongly agree). A total of 500 employees were randomly selected from public hospitals operating in the northern region of Jordan. Exactly, 473 questionnaires were returned and used for statistical analysis.

13. b) Reliability and validity

Reliability of the study tool was measured using Cronbach's alpha (?). The results of reliability illustrated in Table 6 showed that the alpha values of HC, SC, RC, and OP were above 0.7 (Hashim et al., 2015) to confirm the reliability of the questionnaire used in this study. The Average Variance Extracted (AVE) was used to evaluate the validity. The results of AVE confirmed that the items of each variable were correlates to the theoretical foundation of that variable. AVE values considered acceptable if these value is greater than 0.5 (Hair et al., 2011).

14. Global Journal of Management and Business Research

Volume XVII Issue V Version I

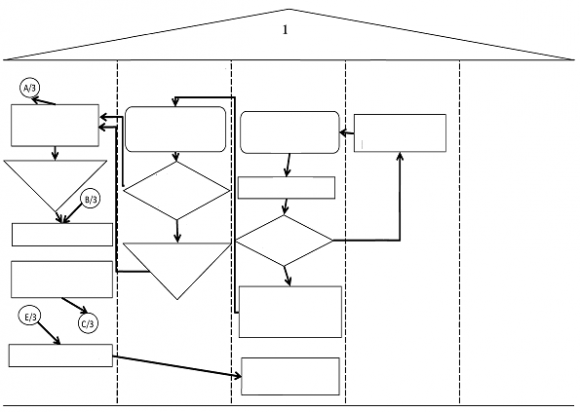

15. Year ( ) c) Model of the study and statistical methods used

The model of the study is shown in Figure 1. It includes three main independent variables; human capital, structural capital, and relational capital.

16. Data Analysis and Results

17. a) Correlation matrix

The results shown in Table 7showed significant correlations among independent variables (HC, SC, and RC) and dependent variable (OP). HC is significantly correlates to SC and RC (r = 0.579, 0.668. Sig. = 0.001, respectively) and to OP (r = 0.496, Sig. = 0.000). SC is significantly related to both RC (r = 0.643, Sig. = 0.002) and OP (r = 0.428, Sig. = 0.000). Moreover, RC is significantly associated with OP (r = 0.399, Sig. = 0.001).

18. b) Regression prior assumption: Multicollinearity

Collinearity statistics, i.e., tolerance and variance inflation factor (VIF) were calculated to check the assumption of multicollinearity. The results (Table 8) indicated that HC, SC, and RC have tolerance values greater than 0.1 and VIF value less than 10, which means that multicollinearity was not overreached (Hashim et al., 2015).

19. c) Multiple regression analysis

The results of the study, as shown in Table 9, indicated that all predictors of intellectual capital explained 76.1% of the variance in OP as expressed by R square (R 2 = 0.761). Human capital has a significant impact on OP (Std. beta = 0.274, t = 11.314, Sig. value = 0.000) that is, hypothesis H1 was accepted. Furthermore, structural capital has a significant impact on OP (Std. beta = 0.287, t = 9.112, Sig. value = 0.000). this result means that H2 was supported. Finally, the results pointed out a significant impact of relational capital on OP (Std. beta = 0.239, t = 7.845, Sig. value = 0.000). The results showed that structural capital has the largest beta value (0.287), followed by human capital (0.274), in comparison with relational capital (0.239). The results shown in Table 9 is also depicted in Figure 2.

20. Discussion

Exploring the extent to which each of IC dimensions significantly has an impact of organizational performance was the main purpose of this study. Expressly, this study sought to determine the impact of human capital, structural capital, and relational capital on organizational performance. The results obtained by the study confirmed that these three dimensions have significant influences on organizational performance. The significant impact of human capital on organizational performance was supported by the current data. Similar result was found by many prior studies. Yang and Lin (2009) found that human capital mediates the relationship between human resource management practices and organizational performance. According to Bontis and Fitzenz (2002), human capital plays a critical role in the enhancement of organizations' profitability. Nuryaman (2015) indicated that human capital components such as individuals' capabilities and commitment enhance the organizational efficiency and productivity, which in turn affects the organization's ability to generate profit. The results of this study in relation to the impact of structural capital on OP were in line with results of numerous previous studies. The components of structural capital like organizational strategies, structure, and culture help the organization to achieve its organizational objectives (Nuryaman, 2015). In agreement with numerous studies, the results confirmed that relational capital significantly predicted organizational performance (Yang andLin, 2009 andWu et al., 2012). Inconsistent with Hashim et al. (2015), the present study found a significant influence of human capital and structural capital on organizational performance. In general, many positive outcomes of intellectual capital found in the literature in correlation to OP Sivalogathasan, 2013 andWanjala, 2013). Smriti and Das (2017) concluded that IC is a predictor of organization's profitability not organization's productivity or market value.

21. VI. Conclusion, Recommendations and Limitations

The results showed that intellectual capital dimensions, human capital, structural capital, and relational capital play a significant role in improving hospitals performance. That is, the intellectual capital is no less important than the economic capital. Based on these results, the study give advice to organizations in general, specially hospitals to pay more attention to their intellectual capital using their human resource practices like training and development programs, staffing, and motivation with a focus on people knowledge, skills, experiences, innovation, creativity, and job evaluation, individual and job fit, problem-solving, organizational structure, supporting infrastructure, and long-term effective relationships with customers, suppliers, and other stakeholders. However, the results of this study were drawn based on crosssectional data. Future research should conduct a longitudinal study to explore the influence of IC on OP in a given period of time. Additionally, the results were revealed base on a sample consisted of participants selected from hospitals. It is recommended to study the impact of IC as a whole construct, or its dimensions on OP using samples from different sectors.

| a) Definition of intellectual capital |

| IC has been defined from different perspectives as |

| can be seen in Table 1. In 2008, The Organization for |

| Economic Co-operation and Development (OECD) defined |

| IC as an economic value proceeded from two types of |

| intangibles which are organizational and human capitals. |

| Wang and Chang (2005) indicated that IC is a key |

| component engenders organization's value. Zéghal and |

| Maaloul (2010) classified IC as the entire accessible |

| knowledge can be utilized by the organization to create |

| value. Conceptually, Wu et al. (2012) regarded IC as a set |

| of organization-related abilities integrated with three types |

| of capitals; human, structural and relational capital. |

| Authors | Definitions |

| OECD (2000) | Economic value results for organizational and human capitals. |

| Wang and Chang (2005) |

| Authors | Dimensions | |

| Wang and Chang (2005) | Human capital, customer capital, innovation capital, and process capital. | |

| Cabrita and Bontis (2008) | Human capital, structural capital, and relational capital | |

| Yang and Lin (2009) Wu and Sivalogathasan (2013) | Human capital, organizational (structural) capital, and relational (social) capital | |

| Khalique et al. (2011a) | Human capital, structural capital, and customer capital | |

| Sumedrea (2013) Wanjala (2013) | Human capital, structural capital, and customer (external) capital | |

| Nuryaman (2015) | Human capital, structural capital, and customer capital | |

| Gogan et al. (2016) | Human capital, structural capital, and relational capital | |

| i. Sub-dimensions of human capital | (Wang and Chang, 2005; Yang and Lin, 2009; Sumedrea, | |

| Human capital(HC), as a key element of IC, has | 2013; Wanjala, 2013; Nuryaman, 2015 and Koc, 2017). | |

| been defined as a collection of employee characteristics | According to Wanjala (2013), HC is considered the major | |

| and abilities revealed in forms of knowledge, skills, | part of intellectual capital. Examples of these | |

| experiences, education, creativity, commitment, innovation, | characteristics and abilities or sub-dimensions of HC are | |

| life and business-related attitudes, and motivation, etc. | shown in | |

| Year | ||

| Volume XVII Issue V Version I | ||

| ( ) | ||

| Authors Wang and Chang (2005) Yang and Lin (2009) Sumedrea (2013) Nuryaman (2015) Koc (2017) ii. Sub-dimensions of structural capital Employee education Employee knowledge, skills and experience. Sub-dimensions of HC Employee motivation and commitment Intellectual ability, creativity and innovation Technical knowledge, job evaluation, creativity, team work, initiatives, problem-solving, analytical and conceptual thinking. creation as vital sub-dimensions of SC. Table 4 shows | Global Journal of Management and Business Research | |

| Structural capital (SC) refers to organization- | examples of HC sub-dimensions. | |

| based intangible assets like efficiency, effectiveness, | ||

| innovativeness, culture, knowledge, strategies, procedures, | ||

| patents, trade secrets, information and network systems | ||

| etc. (Cabrita and Bontis, 2008;Yang and Lin, | ||

| 2009;Sumedrea, 2013;Nuryaman, 2015 and Koc, | ||

| 2017).Lee et al. (2015) added problem-solving and value | ||

| Authors | Sub-dimensions of SC |

| Yang and Lin (2009) | Process effectiveness, knowledge integrating and sharing |

| Sumedrea (2013) | Databases, organizational procedures, trademarks, organizational strategies related infrastructure. |

| Lee et al. (2015) |

| Authors | Sub-dimensions of RC |

| Wang and Chang (2005) | Contribution of customers to growth in sales |

| Cabrita and Bontis (2008) | Relationships with stakeholders |

| Yang and Lin (2009) | Internal relationships among individuals within the organization and external relationships between the organization and other organizations. |

| Amiri et al. (2010) cited in Khalique et al. (2011a) | Customer loyalty and satisfaction. |

| Nuryaman (2015) | Relationships with internal and external parties |

| Koc (2017) | Brands, business name, distribution channels, license and franchising agreements, customer loyalty. |

| H1: human capital has a significant impact on |

| organizational memory. |

| f) Structural capital and OP |

| Gogan et al. (2016) studies relationships among |

| human capital, structural capital, relational capital and |

| organizational performance and found a significant |

| association between the structural capital of IC and OP. |

| According to Yang and Lin (2009), Khalique et al. (2011a), |

| Ghatak (2013) and Awan and Saeed (2015) structural |

| capital has a significant influence on OP. On the other |

| hand, Hashim et al. ( |

| Variables | Items | Mean (SD) | Alpha * | AVE ** |

| Human capital (HC) | 1-5 | 4.23 (0.587) | 0.774 | 0.69 |

| Structural capital (SC) | 6-10 | 3.86 (0.780) | 0.814 | 0.70 |

| Relational capital (RC) | 11-15 | 4.01 (1.010) | 0.798 | 0.71 |

| Organizational performance (OP) | 16-20 | 3.97 (0.851) | 0.836 | 0.68 |

| * Acceptance level of alpha: alpha > 0.70 | ||||

| ** Acceptance value of AVE: AVE > 0.5 |

| Variables | HC | SC | RC | OP |

| Human capital (HC) | - | |||

| Structural capital (SC) | 0.579 ** | - | ||

| Relational capital (RC) | 0.668 ** | 0.643 ** | - | |

| Organizational performance (OP) | 0.496 ** | 0.428 ** | 0.399 ** | - |

| ** Correlation is significant at the 0.01 level (2-tailed). |

| Model | Tolerance * | VIF ** |

| Human capital (HC) | 0.331 | 3.120 |

| Structural capital (SC) | 0.284 | 4.016 |

| Relational capital (RC) | 0.294 | 4.770 |

| * Tolerance is accepted at value > 0.1 | ||

| ** VIF is accepted at value < 10 |

| Model | Standardized Coefficients -Beta | t | Sig. |

| Human capital | 0.274 | 11.314 | 0.000 |

| Structural capital | 0.287 | 9.112 | 0.000 |

| Relational capital | 0.239 | 7.845 | 0.001 |

| Dependent variable: organizational performance | |||

| R 2 : 0.761 | |||

| Df (total): 471 | |||

| F: 63.59, Sig.: 0.000 | |||