1. Introduction

ndian microfinance sector is expected to grow nearly ten times by 2011 to a size of about Rs250 billion from the current market size of Rs27 billion, at a compounded annual growth rate of 76%. Microfinance in India started evolving in the early 1980s with the formation of informal Self Help Group (SHG) for providing access to financial services to the needy people who are deprived of credit facilities. National Bank for Agriculture and Rural Development, the regulator for microfinance sector, and Small Industries Development Bank of India are devoting their financial resources and time towards the development of microfinance.

2. a) Significance of the Study

The world has recognized the gravity of the rural indebtness in developing and underdeveloped countries and a consensus emerged for designing and implementing poverty alleviation schemes in such a manner that the poor would be encouraged to take loans for productive economic activities of their own. The poor in these countries are encouraged to form small groups of people having relatively equal economic status where mutual thrift and credit activities are initiative for meeting their emerging credit needs. As part of poverty alleviation measures, the Government of India has implemented self-employment programmes like Swarnajayanti Gram Swarojagar Yojana, where the measure emphasis is laid on Self-Help Groups formation, social mobilization and economic activation through micro credit finance.

3. b) Motivation of the Paper

Tribals constitute about 8.6% of the total population in India. The tribals in India are predominantly rural living in mostly in forests and mountains somewhat isolated from the general population, are overwhelmingly illiterate and more than 50% population live below the poverty line. Though the welfare and development of tribals has been given a very propriety right from the beginning of the first five year plan but still it remains the most backward ethnic group in India on the three most important indicators of development, i.e. health, education and income.

The National Commission review on the working of the Constitution (May, 2001) clearly indicates that a lot needs to be done for further development and welfare of tribals. The overall development of tribals of the society should include their empowerment through Self-Help Groups in educational, social, economic and political sectors while keeping in view of their culture, heritage and traditional identity in terms of age-old rights and privileges of this people along with maintaining harmonious relationship of social and economic development in line with all other sections of the society.

This proposed study will be directed to study the efficiency of the Micro Finance provision to solve the specific peculiar problem of the Tribal people.

The scheduled areas in the states of Orissa comprises of the districts of Mayurbhanj, Sundargarh and Koraput, KuchindaTahasil of Sambalpur, Telkoi, Keonjhar, Champua and Barbil Tahasil of Keonjhar district. Kandhamal, Baliguda and Ghumusar, Udayagiri Tahasil of Phulbani district, R. Udayagiri tahasil, Gumma Block and Rayagada Block, SurudaTahasil, Thuamul Rampur Block and Langigarh Block of Kalahandi district and Nilgiri Block of Balasore district.

Scheduled Caste and Scheduled Tribe population in the state as per 2001 census comes to 60.82 lakhs and 81.45 lakh respectively which is 16.5% and 21.1% of the total population of the state as against 16.2% and 22.2% in the previous census i.e. 1991. The decennial growth of SC and ST population during 1991-01 is 18.6% and 15.8% respectively. Similarly as per 2001 census the sex ratio among SC and ST people is 979 and 1003 respectively as against 936 and 978 at the national level.

Therefore there is ample scope to study the impact of micro finance in the tribal society for the socioeconomic development of tribal people. The outcome which is observed in case of non-tribal people and society cannot be generalized for tribal society. Hence an attempt has been made through study to evaluate the Role of Micro Finance in Poverty Alleviation of Nilagiri ITDA block of Balasore district, so as to analyze the relevance and suitability of micro-finance system in tribal society.

4. c) Objective of the study

The present study is an attempt to analyze the growth and role of micro finance in developing the socio-economic profile of the tribals in Nilgiri ITDA Block of Balasore district in Orissa. The specific objectives of the study are as follows: a) To examine the role of micro finance in the socioeconomic development of tribal's. b) To assess whether the micro finance system is capable of raising the productivity level of the beneficiary families in the field of agriculture, horticulture, animal husbandry, small industry and allied activities.

5. d) Scope of the study

The proposed study as purely analytical and empirical in character is based on both primary and secondary data. Besides descriptive survey method can also be adopted for the study. As the targeted area is confined to Nilagiri ITDA block of district Balasore in Odisha which are covered under the study to explain the micro-finance system in tribal society residing in those areas.

Niilgiri Nilgiri is a backward hilly region in Balasore district, predominantly inhabited by aboriginal people. Nilgiri is the only ITDA Block of Balasore district which is densely populated by tribal people. Hence the purposive sampling method can be justified to fulfill the aims and objectives of the research study.

6. e) Hypothesis for the Study

The study is carried out with the following hypothesis: 1. Is there a positive relationship between Micro-credit and improved living standards of recipient of these micro credits in the study area?

2. Are low income earners able to obtain credit easily from the Government owned micro finance institutions in the study area?

7. II. Classification and Sources of Data

The traditional classification of data for an empirical study like this has been be followed in this section. Both secondary and primary data sources have been used for data collection. The most important limitation to this paper is the data gap.

It is in fact the reason why a general theoretical approach has been developed for this study. The fact that a field research cannot be conducted reduces the whole exercise to developing a paper proposal for the actual research phase in Nilagiri ITDA Block of Balasore. During the same period, the total expenditure of Nilgiri ITDA under SCA to TSP as well as Article 275(i) was Rs.484.62 lakh (95.76%) while the expenditure under SCA to TSP was exceeded the allotment, the expenditure under Article 275(i) was Rs.155.25 lakh (84.89%). This section therefore discusses formulation of the research framework, that is, how data collection and analysis for the actual paper writing on this subject are conducted.

8. Allotment and

9. a) Growth of Micro Credit Institutions

A pilot project for purveying micro credit by linking Self Help Groups (SHGs) with banks was launched by NABARD in 1991. Its view was facilitating smoother and more meaningful banking with the poor. RBI had been advancing commercial bank to actively participate in this linkage programme. The scheme has since been extended to RRBs and cooperative banks. The running of SHG is also a great lesson in governance. It teaches the value of discipline both procedural and financial, well run SHGs are subject to external audits that enforce prudence.

10. III. Demographic Profile of Study Area

(Nilagiri itda of Balasore, Odisha)

Balasore district is one out of the thirty districts of Qdisha. This is the district having interacted with different compositions of population, different culture and confluence of sea, land, horizon of rail road and facility of strong transport system. As the History says Balasore is composed of Bala-E-Shore. It means a city on the coast of the sea. This has been a place of prime importance since the British rule. The district is also famous for defence base and fishing business.

11. b) Demographic Profile

As per 2011 census, the total household and population of Nilgiri ITDA are 31679 (including 18319 households) and 1,29,360 respectively. Out of the total population, 64,713 are males and 64647are females. These ratio is 969 in total (ST-990, SC-977).The density of population is447 persons per square kilometres. The average population on size per village is 800 and household size is6.Out of the total population; 12761 persons (9.48%) are SC and 74701 persons (56.16%)are ST.As regards population growth during 1991-2001,the ST with 21.58% population growth is slightly more than the population growth of SC (18.46%) and all communities (14.42%). Over a period of three decades ) the proportion of ST population of the ITDA has been increased by 2.93%, which shows a positive impact of socio-economic development intervention by the ITDA for ST people. The infant mortality rate of the area during 2003-04 was 48,6%.The sex ratio of STs in the area as per 2011 census is 990 females followed by SCs (977) and all communities (969).

Nilgiri ITDA area indicates arise in literacy rate of total population by 12.71% over the decade 1991-2001. As per 2001 census, the general literacy rate is estimated at 56.60% as against 43.89% in 1991. The males with 43.89% literacy rate are much ahead of the Iiteracy rate of 26.31% by their female counterpart. Though there is arise of literacy of ST from 15.60% in 1971 to 22046% in 1991, still they are educationally logging for behind the total population and SC population. The ST female literacy is extremely low, lessthan10%.

The main work force in Nilgiri ITDA area comprises 32% of its total population 77% of it depend on Agro based economy. The cultivators from 34.16% of the workforce, agricultural labourers comprise 41.44% and 1.12% earn their livelihood from allied agricultural activities like livestock forest and fisheries.

12. Impact of increase in amount of microfinance on poverty reduction and entrepreneurship attributes

IV.

13. Research Methodology

The goal of the research process is to produce new knowledge or deepen understanding of a topic or issue. The Quantitative data collection methods rely on random sampling and structured data collection instruments that fit. Comparative and experimental methods of analysis are also adopted by taking interviews of various persons associated with the study. Data will be tested and analyzed through the computer based statistical techniques like, Mean, Standard Deviation and Coefficient of Variation (C.V.), Correlation Coefficient between indicators in the study area is applied to examine the result.

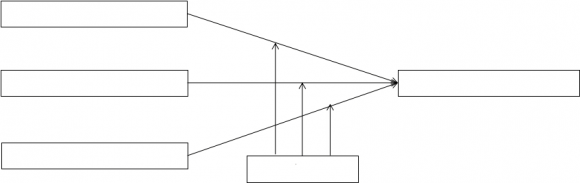

Y = C 0 + C 1 X 1 + C 2 X 2 + C 3 X 3 + C 4 X 4 + C 5 X 514. a) Functional Analysis

The poverty is made up of many factors such as income, consumption, asset, health and education. But in quantitative research only income, Age and education of the family is considered. However, the impact of microfinance is analysed on the basis of income, age and education of the family and are considered to be benefiting the family with the productive use of loan.

15. i. Multiple Regression Model

In order to examine the contribution of the indicators in causing more economic development, linear model is used. The analysis is based on multiple regression technique. The specification and justification of variables included in the analysis are used as To achieve the objectives of the study i.e. primarily to assess whether the micro finance system is capable of raising the productivity level of the beneficiary families in the field of agriculture, horticulture, animal husbandry, small industry and allied activities and whether there is upgradation of tribal living standard, health and hygiene and housing, drinking, water education, infrastructure situation in tribal areas after Micro Finance linkage of the area in the study In the above table it is observed that there is less variation in case of Age (X 1 ) followed by Socio-Economic Status indicator (X 5 ), this shows more consistency of opinion collected from the study area. It is also found that in case of the indicator Education (X 3 ) there is more variation i.e. 39.99, which shows less consistency of data in the study area.

Y = f (X 1 X 2 X 3 X 4 X 5 ) Where Y = Economic Development X 1 = Age, X 2 = Income, X 3 = Education X 4 =Tabulated value of t-test at 5% level of significance = 1.960 and for 1% level of significance = 2.576.

Here, the t-statistic for the indicators considered viz. Age, Income, Education, Family Size and Socio-Economic Status are significant both at 5% level of significance and 1% level of significance. iii. Correlation Co-efficient (`r' value)

The correlation co-efficient is a statistic descriptive of the magnitude of the relation between two variables. Correlation coefficients are traditionally defined in such a way as to take values extending from -1 to +1. A negative value indicates a negative relation i.e. X decreases as Y increases. The main purpose of the study is to find out the relationship between the variables.

16. iv. Analysis of Variance test

In the analysis, the total variations are split into explained and unexplained variation. This suggests that one can compute an analysis of variance type of table for analysis.

accuracy, less consistency of data. Less variation of data shows more accuracy, more constancy of data.

Formula of coefficient of variation is

100 x x . V . C ? = .F-statistic is computed as since our model consists of five explanatory variable

The null hypothesis Ho is Ci = 0 if calculated F > tabulated F with (k-1) and (n-k) degrees of freedom with chosen level of significance we reject the null hypothesis and accept that the data is significant.

If calculated F < tabulated F, then we accept the null hypothesis and conclude that data is not significant. In the above case strong and positive correlation exists between age and income (0.87), age and education (0.81), age and family size (0.81), age and socio-economic status (0.83), income and family size (0.77), education and family size (0.73), education and socio-economic status (0.74). It is observed from the above correlation matrix table that there is almost all the indicators considered for the study are strong and positive correlation exists between the two dependent variables.

17. b) Chi-square ( ? 2 ) test i. Testing of research questions

The data presented in this chapter are analyzed according to the questions used in this study and the questionnaires administered for the research. In analyzing the research questions, the chi-square (? 2 ) test is used at 95 percent confidence interval or 5 percent level of significance. The decision rule is to accept the null hypothesis (H 0 ) and reject the alternative hypothesis (H 1 ), if the calculated chi-square is less than the critical value of the chi-square using the requisite degree of freedom. The reverse holds, i.e. reject H 0 and accept H 1 if the calculated chi square value is more than the critical chi square value.

Calculate the chi square statistic ? 2 by completing the following steps: Hypothesis-1: There a positive relationship between Micro-credit and improved living standards of recipient of these micro credits in the study area.

18. Test Statistics

Chi-Square 213.973 a df 3

Asymp. Sig. .000 a. 0 cells (.0%) have expected frequencies less than 5. The minimum expected cell frequency is 75.0.

From the above statistics, we reject H 0 and accept H 1 if the computed ? 2 is more than the critical value or vice versa. Thus, computed ? 2 (213.973) is greater that the critical value of (7.815), thus, we accept the alternative hypothesis H1. This shows that microcredit availability has a positive impact on living standards of recipient of these micro credits in the study area. The reason for this assertion is that when people with micro enterprises have access to credit, they are able to expand their businesses, employ more people and also not only improve their living standards, but also, improve the living standards of people they employ. Hypothesis-2: The low income earners are able to obtain credit easily from the Government owned micro finance institutions in the study area. It reveals from the above table that correlation coefficient (`r') value between income and socioeconomic status is 0.92, this shows there exists strong and positive correlation between these two indicators.

Next strong and positive correlation exists between income and education i.e. 0.89. Thus, the critical value of ? 2 (7.815) is less than the calculated value (126.960), thus, we reject the null hypothesis (H 0 ) and accept the alternative hypothesis (H 1 ). The implication of this decision is that there are difficulties encountered by the poor or low income earners in obtaining loans from micro credit institutions. This may be as a result of these microfinance banks not having confidence on these low income earners in repaying back the loan collected; or these low income earners not being able to meet the requirements of these microfinance banks in getting a loan, etc.

19. c) Regression Results

Linear Regression estimates the coefficients of the linear equation, involving one or more independent variables that best predict the value of the dependent variable. Below table describes the main regression results. It shows the effect of the indicators adopted for the study. Reliability analysis allows studying the properties of measurement scales and the items that compose the scales. The Reliability Analysis procedure calculates a number of commonly used measures of scale reliability and also provides information about the relationships between individual items in the scale. Intraclass correlation coefficients can be used to compute inter-rater reliability estimates.

20. Independent variables

A significant challenge for microfinance is to serve as a development of microeconomic. As Where, tabulated value of F-test at 5% level of significance for (4,299) degree of freedom = 2.42 and tabulated value of F-test at 1% level of significance for (4,299) degree of freedom = 3.41, Here, in case of the above table between the indicators (row) is highly significant. The calculated value is 541.222. This shows calculated `F' value is more than tabulated `F' value both at 5% and 1% level of significance. observed, in the study area, family size followed by the socio-economic status of the tribal in Nilgiri ITDA Block of Balasore district has played the major and significant role for the economic development. It is also observed that indicators like income and socio-economic status varying in the same and positive direction. If socioeconomic status is increasing, the income on an average is also increasing in the study area, which indicates effective impact on economic developmental of microfinance activities. The development of microfinance sustainable poverty alleviation tool, is reaching is undoubtedly critical in improving access to finance sufficient scale to fulfill demand for financial services. This emphasis on Microfinance seems to have generated a view that Microfinance development could provide an answer to the problems of rural financial market development. Beholding the present situation, we must take a long an active people-centred and growth-oriented poverty alleviation strategy -a strategy which seems to incorporate particularly tribal aspirations, dynamism and involvement.

A general conclusion that emerges from this research study is that access to finance is important for tribals of Nilagiri to unlock them from the shackles of poverty to realise their full potentials. The statistical reported results derived using quantitative analysis suggests that all three variables: income, education and family size are significant and have a high correlation with access to finance. A closer examination of results suggest that an increase in income of the family is positively correlated with the size of loan up to a point but this relationship does not holds when the size of loan reached a certain size. So, there may be an optimal loan size which MFIs should offer. Thus the relationship between increase in income and increase in amount of loan has inverted U shaped. These results have implications for microfinance organisations themselves, donors and policy makers at large. The logistic regression results show that with the increase in amount of loan, there is probability of increase in children education.

The qualitative analysis shows microfinance loans have positive impact on poverty reduction. Access to finance leads to an increase in income, product knowledge, especially when this is supported with peer mentoring for the new members of microfinance institution.

The increase in, product knowledge and peer mentoring help to reduce information asymmetry and the regular monthly meetings and repayments help to build bonds, create a sense of belonging, learning relating to business practices and in instilling business discipline.

There is excessive focus amongst MFIs to support start-ups who may have potential to become independent earners. Therefore it is concluded from the fact that ensuring the MFIs have a desired positive impact on poverty reduction amongst Tribals.

21. V. Summary of Finding, Conclusion and Suggestion

Nilgiri is a backward hilly region in Balasore district. Nilagiri ITDA block of district Balasore in Odisha which are covered under the study to explain the microfinance system in tribal society residing in those areas. Nilgiri is the only ITDA Block of Balasore district which is densely populated by tribal people. Therefore the research in Nilagiri, Balasore district of Odisha, has been adopted in the case study method for the assessment of the impact of microfinance on the lives of the rural poor in selected rural settings and the research method for empirical inquiry that investigates a contemporary phenomenon within the real-life context.

The interventions so far made in the Nilagiri ITDA areas on various components indicates that a large number of interventions in the field of income generating schemes, infrastructure development schemes and on information, education and communication (IEC) have been extended in the project area, but there are some missing critical socioeconomic and physical infrastructures.

The overall strategy of the micro-financing programme focuses on empowering the tribals and enabling them to enhance their food security, increase their incomes and improve their overall quality of life through more efficient natural resources management based on the principles of improved watershed management and more productive environmentally sound agricultural practices and through off farm/nonfarm enterprise development.

It is observed that female (60%) is numerically more than male (40%), which shows the dominancy of tribal's and plays important role in the poverty alleviation of tribal through microfinance in the study area. Microfinance is also providing financial services to the poor who are not served by the conventional formal financial institutions -it is about extending the frontiers of financial service provision.

The provision of such financial services requires innovative delivery channels and methodologies. The needs for financial services that allow people to both take advantage of opportunities and better management of their resources.

The importance of education recognized for growth i.e in the study area 1.67% only are College/University, 8.33 % are matriculate, 50% are Year ( )

22. 2017

23. B

Role of Micro Finance in Poverty Alleviation of Tribals of Nilagiri ITDA of Balasore, Odisha, India below matric and 40% of the respondents are found illiterate. This is definitely an issue and challenge for the nation's growth. The more the people educated obviously takes the opportunity of microfinance system.

Microfinance is one of the effective tool amongst many for poverty alleviation. However, it should be used with caution -despite recent claims, the equation between microfinance and poverty alleviation is not straight-forward, because poverty is a complex phenomenon and many constraints that the poor in general have to cope with. We need to understand when and in what form microfinance is appropriate for the poorest; the delivery channel, methodology and products offered are all inter-linked and in turn affect the prospect and promise of poverty alleviation. The access to the formal banking services is difficult for the poor.

Thus, it is clear that majority of the borrowers are not repaying their loans in regular instalments. This may be mainly due to unproductive utilization of loan or insufficient return on investment.

Since change in social status was under multiple responses it was stated separately. Thus it is c l ear that socio-economic developments of the borrowers were caused under different parameters by effecting utilization of loan.

The facts concerning the income level i.e 70% of the family of respondents earn monthly more than Rs.12000 and 30% of the sample earn monthly below Rs.12000 annually. The study depicts that income distribution of the respondents is skewed and found that the higher income group is predominant in the sample area. It is also observed that the trend of the modern time is that the size of the family in general has been reduced, i.e. from an estimated number of eight to two or four. Many as 67% respondents are having mud and thatched house, 20% are having semi-pucca houses and only 13% are having pucca houses in the study area. So most of the respondents possessed mud and thatched houses. Only 10% of the land are under irrigation. Almost 90% of people do the single crop in the sample area i.e the traditional food crop rather than commercial crop. The people in the sample area prefers to acquire loans from the formal financial institutions i.e regional rural bank and nationalised bank. The duration of loans is 5 years as in case of 80% of the people and they utilised it it productive purpose. In addition, the process of acquiring a loan entails many bureaucratic procedures, which lead to extra transaction costs for the poor. Formal financial institutions are not motivated to lend money to them. In general, formal financial institutions show a preference for urban over rural sectors, large-scale over small scale transactions, and non-agricultural over agricultural loans.

24. a) Conclusion

Microcredit and microfinance have received extensive recognition as a strategy for poverty reduction and for economic empowerment. Microfinance is a way for fighting poverty, particularly in rural areas, where most of the world's poorest people live rural development and poverty reduction are commonly related to the issue of rural employment. In Nilagiri ITDA of Balasore district the tribal households livelihood strategies comprise several options, including farming and non-farm activities, local self-employment and wage employment, and migration. Microfinance has proven to be an effective and powerful tool for tribal development and poverty reduction.

Poverty is a threat to the tribals, because they cannot meet up his primary or basic needs of life, that of his family or his dependents. Poverty is like that which sucks the blood for its livelihood. It exists where people are unable to make both ends meet for better livelihood. Finally it is concluded that this study is set out to establish the relationship between microfinance and poverty reduction, the difference between microfinance and traditional savings rotating system and loan repayment and poverty reduction.

After a theoretical and empirical exploration of relevant literatures, it is concluded that there is a significant relationship between microfinance and poverty reduction; significant difference between microfinance and traditional savings rotating system; loan repayment and poverty reduction.

On the premises of the revelations from this study, we conclude that thus microfinance alone cannot reduce the level of poverty in any given society except the government provide the basic infrastructural facilities such as good road, constant power supply, good transport system etc that is when microfinance will play an effective and efficient role of poverty reduction instrument in contemporary society. Therefore, the following recommendations were provided to stimulate the use of microfinance as a poverty reduction strategy in tribal societies

25. b) Suggestions

Numerous traditional and informal system of credit that were already in existence before micro finance came into vogue. Viability of micro finance needs to be understood from a dimension that is far broader-in looking at its long-term aspects too .very little attention has been given to empowerment questions or ways in which both empowerment and sustainability aims may be accommodated. Failure to take into account impact on income also has potentially adverse implications for both repayment and outreach, and hence also for financial sustainability. An effort is made here to present some of these aspects to complete the picture.

The organizations involved in micro credit initiatives should take account of the fact that:

? Credit is important for development but cannot by itself enable very poor tribal's to overcome their poverty. ? Making credit available to tribals does not automatically mean they have control over its use and over any income they might generate from micro enterprises. ? In situations of chronic poverty it is more important to provide saving services than to offer credit.

? A useful indicator of the tangible impact of micro credit schemes is the number of additional proposals and demands presented by local villagers to public authorities. India is the country where there is a collaborative model between banks, NGOs, MFIs and Tribal development organization exists. It is clear that micro finance need to look beyond just increasing tribal's access to savings and credit and organizing self help groups to look strategically at how programmes can actively promote higher in poverty alleviation.

| Sample Villages | ||||||||||

| Village | G.P | House hold | Popu-lation | Male Female | ST House hold | ST Population | Male Female | % of ST literacy | ||

| Kaduani | Chatrapur | 276 | 1146 | 600 | 546 | 87 | 711 | 406 | 305 | 51.9 |

| Khuntadiha | Chjatrapur | 100 | 381 | 194 | 187 | 59 | 178 | 106 | 72 | 49.9 |

| Parasipal | Chatrapur | 98 | 384 | 196 | 188 | 51 | 171 | 97 | 94 | 53.8 |

| Madhupuria | Chatrapur | 91 | 332 | 169 | 163 | 60 | 150 | 94 | 56 | 54 |

| Kishore ch.pur KCPur | 283 | 1206 | 629 | 597 | 198 | 646 | 389 | 257 | 46.8 | |

| Kathagochhi | Mahisapat | 317 | 1363 | 672 | 691 | 191 | 1061 | 513 | 548 | 41.6 |

| Mahisapata | Mahisapat | 385 | 1673 | 814 | 859 | 222 | 1479 | 710 | 769 | 43.7 |

| Tentulia | Tentulia | 364 | 1304 | 663 | 641 | 111 | 638 | 317 | 321 | 47.4 |

| Arbandh | Arbandh | 376 | 1586 | 788 | 798 | 188 | 965 | 491 | 474 | 43.2 |

| Pithahata | Pithahata | 452 | 1642 | 834 | 808 | 152 | 762 | 389 | 373 | 47.3 |

| Total | 2742 | 11037 | 5559 | 5478 | 1319 | 7061 | 3516 | 3545 | ||

| Source: Census, 2011 | ||||||||||

| 2017 | |||||

| Year | |||||

| Volume XVII Issue II Version I | |||||

| Education (X 3 ) Family Size (X 4 ) Socio-Economic Status (X 5 ) | 1.72 2.00 2.47 | ± 0.69 ± 0.63 ± 0.73 | 39.99 31.68 29.72 | 43.311 54.681 58.283 | Global Journal of Management and Business Research ( ) B |

| Residuals Statistics a | |||||||

| Minimum Maximum | Mean | Std. Deviation | N | ||||

| Predicted Value | 1.09 | 3.34 | 2.19 | .572 | 300 | ||

| Residual | -.495 | .658 | .000 | .331 | 300 | ||

| Std. Predicted Value | -1.921 | 2.006 | .000 | 1.000 | 300 | ||

| Std. Residual | -1.481 | 1.970 | .000 | .992 | 300 | ||

| a. Dependent Variable: Y | |||||||

| In most variables the calculated value of the | positive impact on development. It is observed that the | ||||||

| Age coefficient (Beta) in the regression equation is either -X 1 Income | - | X 2 indicator family size has significant contribution towards | |||||

| Education Socio-economic perverse or insignificantly different from zero. It shows -X .3 Family Size -the indicator family size (X 4 ) have more effect on X 5 Regression results -Effect of indicators in case of economic development in the study area -X 4 development in the study area. It is also revealed from the Multiple coefficient of correlation (R) table that economic development in the study area. Next followed calculated value of R square is 0.749, which indicated by the indicator `socio economic status' have effect on that there is a strong and significant relationship | 2017 Year | ||||||

| i. Dependent Variable -Economic Development development. Indicators like age, education have | between the indicators. | ||||||

| Model Summary b R Square Adjusted R Square .749 .745 a. Predictors: (Constant), X 1 , X 2 , X 3 , X 4 , X 5 Model R 1 .865 a b. Dependent Variable: Y ANOVA b Model Sum of df Mean Square Std. Error of the Estimate .334 Analysis of Variance (ANOVA) for the indicators in the study area Durbin-Watson .116 F Sig. Reliability Case Processing Summary N % Cases Valid 300 100.0 Excluded a 0 .0 Total 300 100.0 a. Listwise deletion based on all variables in the procedure. Squares 1 Regression 97.949 5 19.590 175.391 .000 a Residual 32.838 294 .112 Total 130.787 299 a. Predictors: (Constant), X 1 , X 2 , X 3 , X 4 , X 5 b. Dependent Variable: Y Coefficients a Model Unstandardized Coefficients Standardized Coefficients t Sig. B Std. Error Beta 1 (Constant) .198 .075 2.632 .009 X 1 .036 .057 .043 .631 .528 X 2 -.012 .086 -.015 -.143 .886 X 3 .032 .063 .033 .502 .616 Reliability Statistics X 4 .487 .054 .467 9.059 .000 X 5 .365 .069 .405 5.327 .000 a. Dependent Variable: Y Cronbach's Alpha N of Items .957 5 Alpha (Cronbach). This model is a model of internal consistency, based on the average inter-item correlation. ANOVA Source of variation Sum of Squares df Mean Square F Sig Between People 671.669 299 2.246 Within People Between Items 207.156 4 51.789 541.222 .000 Residual 114.444 1196 .096 Total 321.600 1200 .268 Total 993.269 1499 .663 Grand Mean = 2.29 | Volume XVII Issue II Version I ( ) B Global Journal of Management and Business Research | ||||||