1. Introduction

he success and the failure of any business depend upon the behavior of customers in a specific market. Hence the centre of all marketing activities is the customer. It is always difficult to understand and to predict consumers' behavior in urban and rural areas (Kashyap, Pardeep & Siddhartha). India is a highly populated country. Its population is approximately 15% of the whole world. It has a population about 1.21 billion (census 2011). About 68.84% of total population live in 6, 40,867 villages and rest of population live in urban areas. India has 2.4% 0f world geographical areas, 4% water resources and about 15% of live stock and all this require more production to feed increasing population and livestock. Now starts the role of agriculture and that depends upon farm mechanization and farmers. Penetration of tractor in agriculture is imperative. Tractor is a mean of production, cultivation, transport, construction, electricity generation, and is also used for non agricultural purposes. India is an agricultural country with 68.86% rural population where 48.16% people get employment. Thus, agriculture directly impact Indian economy. Indian rural market includes more than 740 millions consumers and it adds about one million new consumers in market every year .Thus its potentials are very important and very lucrative for the marketers. Rashami Chawla states that during the worst time of global recession, it was rural market of India that escaped Indian economy from the bad impact of global recession. In India, companies adopted rural marketing strategy to avoid recession impacts (Rashami Chawla, 2008). Reviewing all above stated, this paper strives to understand the consumer behavior in tractor market because this aspect directly influences the agriproduction and rural consumption which in turn Indian economy.

2. a) Rural Market

Census of India defines rural as any location or any habitation with a population density of less than 400 per sq. km and where at least 75% of the male working force is engaged in agriculture and where there is no municipality or board. Reserve Bank of India defines as any location with population up to 10,000 will be considered as rural and 10,000 to 1, 00,000 as semiurban. FMCGs and agri-inputs companies define as a place with a population of up to 20,000 and durable goods companies consider any location with a population below 50,000 as a rural market. NABARD defines rural market as a locations except of villages or towns, up to a population of 10,000 is considered as rural (Kashyap and Raut 2010). Collins co Build dictionary (2001) states the anyplace which is away from towns &cities is called rural. Population of Haryana is about 2.53 Cr which is about 2.09% of Indian population. The Haryana has four divisions, 62 subdivision, 83 tehsils, 47 sub-tehsils and 6841 villages. In Haryana Urban populations is 34.79% and rural population is 65.21%, whereas literacy level of urban areas in Haryana is 83.83% &in rural area, literacy level is 72.74% (esaharyana.gov.in/). It means more demand for consumption items, cloth, textiles, automobiles, various electrical household-appliances, education health-facilities, hotels, transportation and agro-based products. This gives marketers an obvious understanding and insights to reach the rural.

3. b) Some Important Highlights of Rural Marketing in India

? 49% motor cycles are purchased in rural India.

? 59% cigarettes are consumed in rural India. These immense potentials of rural market can be realized if marketers understand the rural consumer. The future of rural market has been emphasized by McKinsey's (2007) GOLDEN BIRD REPORT on Indian market that rural market, in next 20 years, will be larger than total consumer markets of countries like South Korea or Canada at present and its size will be four times more than today's Indian urban market and it will account for USA$ 577 billion. Thus it can be concluded that at present as well as in future, rural market will be very attractive. About 3/4 th of Indian population lives in rural areas and majority of them depend on agriculture. In Indian GDP, agriculture's contribution is near about 24.7% and it contributes 13.1% in total export of country. Agriculture sector provides employment to 48.9% of Indian work force. So, it can be said that development of India depends upon development and prosperity of rural population and that in turn depends on growth of agriculture (Ahmed, 2013). In Haryana more than 65% population depends on agriculture for livelihood. In state's GDP, contribution of agriculture is about 15.6 %( 2013).Total arable area in Haryana was 45.99 lakh hectares in 1966-67 and 62.43 lakh hectares in 2013-14. Likewise, total agricultural production was 47.71 lakh tones in 1970-71 and it reached up to 176.41 lakh tones in 2013-14.Wheat and rice are the major contributors in state's total agricultural outputs. In 1970-71, rice production was 4.60 lakh tones and 39.98 lakh tones in 2013-14.Similarly, wheat production in 1970-71 was 23.42 lakh tones and 123.30 lakh tones in 2013-14(Gupta R, 2016). Thus, it can be concluded that there have been agricultural inputs of improved quality and tractor has been playing a pivot role in agricultural productivity and production.

In Haryana, agriculture and manufacturing industry have been growing at sustainable growth rate since 1970s. About 86 %(3.8 million hectare) geographical area of Haryana is arable out of total geographical area (4.42million hectares) which is 1.4% of India After analyzing this, it can be said that demand of agricultural-inputs like tractors and others will be high and lucrative for the marketers (Doon vikas,2016). Haryana is economically a very rich state in India and during 2012-2013, the state had the second highest per capita income in India at Rs 1, 191, 58(us$1800) and during 2013-2014, it was Rs1, 33,427 (us$1900) and this includes a large number of millionaires in India (esaharyana.gov.in/). India occupies 2.4% of world geographical area 4% water resources, but feeds to 17% world population as well as 15% of livestock. Approximately 92% farmers have an average of less than four hectare land in India .Today higher farm production is required to feed increasing population. Sunil Duggal, ceo, Dabur India, said about the budget (2016) that farmers and people of rural will be on prime focus, and millions of farmers will be benefited and this will boost their confidence as well as process of consumerism in rural India (ruralmarketing.in). Rural development is the process of increasing level of per capita income in rural areas as well as standard of living of people which is ensured with nutrition level, health, literacy and security. In India's production of food grain and milk, contribution of Haryana is very good. With passage of time, concept of rural development has got changed. Traditionally, it was fixed with maximum utilization of land intensive natural resources but now it states -overall holistic development of area, environment and its people. In fact, rural development depends on growth of farmers, rural artisans, shop-keepers, micro and small entrepreneurs and all other concerned with rural phenomena (Akoijam Sunildro L.S, 2012).In sum, real rural development process starts with farmers. So, facilities like credit, subsidies, IT training and new agric-inputs should be made available to them. Because when agriculturalactivities run successfully, then the process of rural development can be actualized in real sense (Akoijam SunildroL.S, 2012).

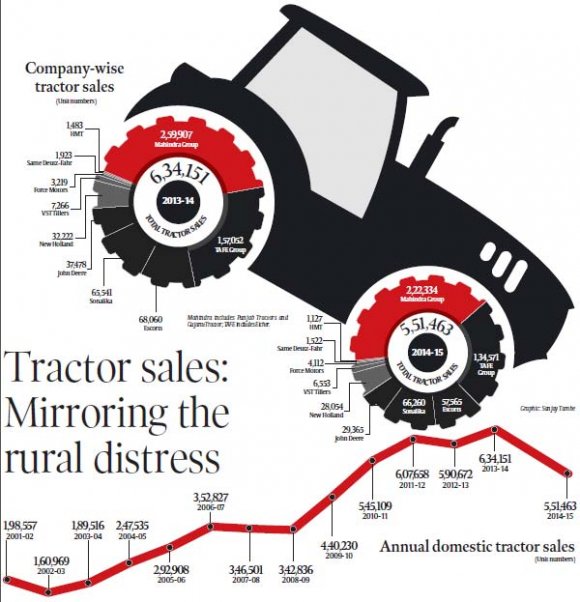

4. c) Tractor Industry In India

Tractors have been playing a significant role in increasing agricultural production and productivity since 1961 when tractor production started in India. Production started with five native manufacturers. Eicher, Gujarat Tractors, Tafe, Escorts, M. & M are major manufacturers. This industry is biggest industry in the world and accounts for 1/3 of total global tractors. Tractor industry has grown at an annual growth rate of 10% during the last four decades. Indian tractor manufacturers' association estimated that industry would stabilize at about 3, 50,000 tractors per year with 60,000 tractors for export by 2010. In Indian tractor industry, duration of 2001-2003 was not good and tractor industry took right track in mid 2004 and after that has been growing at a CAGR of 19.5%. Proper and timely monsoons, bank-credit facilities including govt. as well as private banks impact this industry directly (Srivastav Nitin & Kokra Ajay, 2009).In Indian tractor industry, Utter Pradesh contributes about 19% of total sales and this is the largest in India. UP. is followed by Andhra Pradesh (10.7%), Rajasthan (8.4%), Maharashtra (8.3%), Punjab (7.6%), and Haryana (7.5%) and so on (Srivastav Nitin & Kokra Ajay, 2009).

In Haryana, there are 27.82% cultivators and 17.14% agricultural labors of total rural population .Financial assistance plays a vital role in the total sale of tractors. It accounts for almost 90% of total tractors sale, sold to farmers .Farmers seek longer duration of loan and smaller installments .And farmers prefer six monthly installment because it with their six month crop cycle (Srivastav Nitin and Kokra Ajay, 2009). Agriculture contribution in Indian GDP is approximately 25% .Agriculture is the means of livelihood of about 2/3 of Indian workforce and it employs about 62% of Indian population. Agriculture's contribution in total employment is given below; Indian Tractor Industry is the largest in the world and accounts for one third of world tractor production .While automobile industry is facing recession ,the tractor industry is growing at 9% .Near about 20% of global production of tractors is done in India .Tractors with HP between 31-40 dominate Indian market. States like Punjab, Haryana & Uttar Pradesh is dominating states so far as demand of tractor is concerned.

Because in these states, there is plenty of alluvial soil and does not require deep tilling. The tractor industry has an overturn of 10,000 crore and total investment is 8,000 crore .It provides employment to 28,000 people directly and 15,000 people indirectly (researchand markets.com/reports/607322/). A major part of tractor industry is concerned only with 12 states and 93% tractors are sold in these states namely Uttar Pradesh Punjab Haryana Karnataka Madhya Pradesh Orissa Gujarat Andhra Pradesh Bihar and Maharashtra (Mandal Kr.Subrata, 2013).Market capitalization of tractor industry is about RS 6000 crore with an average of 40000 tractors are produced and sale is 260000(indianmirror.com). In India, there are 27.4% million rural middle class households and this is very close to 29.5% urban middle class households. During 1980-2001, rural literacy has increased from 36% to 59%, no. of puce houses has doubled (22% to41%) as well as no. of poverty houses declined(50% to46%).Thus it can be said that rural marketing is very attractive not only at present but also in future. Government has planned to intervene in farm and non-farm sectors to double income of farmers by 2022. For agriculture and farmers' development, government of India announced a budget of RS. 35,984 crore .This is Pradhan Mantri Krishi Sinchai Yojana-to strength it. There will be implementation of 89 irrigation projects on fast track. About nine thousand crore has been announced for farmers credits and for Pradhan Mantri Fasal Bima Yojana RS. 5,500 crore has been announced. (ibef.org/news/). Thus, it can be concluded that farm security and income is going to increase and demand for tractors is likely to increase.

5. Global Journal of Management and Business Research

6. d) Factors affecting demand of tractors in India

Cropping intensity (area), real price of tractor, demand in previous year and area of high yield productivity are the major factors which influence the Indian tractor industry. It is not the farm work which is core for the buying of a tractor but there are nonagricultural works also which propel purchase of tractors (Gandhi and Patel, 1997). The most mechanised states like Punjab, Haryana, and Utter Pradesh are facing transformation in landholding patters in last three decades with splitting of families and land, but requirement of tractors is steady increasing due to new crops system and increasing farm income (Singh, 2004). Role of monsoons cannot be ignored in this context. Approximately, 54% of Indian farmers depend upon rain for agriculture and this brings uncertainty. The low and weak monsoons badly impacts farm productivity and production. However, we are hopeful that new crop insurance scheme named-Pradhan Mantri Fasal Bima Yojana announced by central government will help to protect farmers from uncertainty of nature and will reduce their risk at large-extent(rural-marketing.in). Thus, it can be concluded that rains, farmers' income, and price for crops directly influence the sale of tractors. But in Haryana, role of monsoons is not of much importance as in other states because 50% of irrigation work is done with tubules, 48% by canals and rest of 2% by other means and Haryana state has the second highest per capita income during 2012-13 and 2013-14 in India. Therefore, it can be stated that better crop price, higher income, improved terms of trade for farmers enabled the farmers to purchase the tractors in Haryana.

7. II.

8. Conclusion

The paper reviews the tractor industry scenario in Haryana as well as in India. It has been found that many factors influence the demand for tractors. In the recent time, tractors have been used for agricultural operational as well as for non-agricultural purposes. About 20% usage of tractors is for non-agricultural purposes. Thus, demand of tractors is derived from agriculture as well as from non-agricultural activities. Although, tractor industry in India is comparatively novice at international level but this is the biggest in the world. In India, tractors' demand is greatly influenced by monsoons and it accounts for 54% sales of tractors in India. But in Haryana, role of monsoons is not as much impressive as in other states of India to influence the demand of tractors. Other factors like availability of credit, period of repayment, farm size and productivity, government subsidies, price of tractors, demand in previous year and government plans in regard of exports-imports of food grains equally influences tractors demand in Haryana as well as in other states. A few factors like fuel efficiency of engine, after sale service, brand image, and maintenance are getting importance. Government should strive to establish tractor testing centres and to enhance the exports of agricultural commodities so that farmers can be incentivized and this will lead an increment in incomes of farmers. At present, tractor testing facility is available in India only at C.F.M.T.T.I., Budni. There is need to promote the developments related to the tractor technology to bring about improvements in efficiency of tractors and to motivate the industry , to develop new designs with native technology, rather than looking for foreign collaboration. Size of tractor depends upon the utility and price of tractor. The tractors with 31-40 HP dominate the Indian market but recently, tractors with high HP are getting penetration in market. Cost of tractor is very huge and this makes credit an important determent for sale of tractors. About 80-90% tractors are bought on bank credits. So provisions for timely availability of credit should be made because tractor is a mean for transport, tillaging, cultivation, generation of electricity, haulage, construction and for non-agricultural purposes and in this way directly influence the process of development. In fact, tractor is a hidden driver of Indian economy. It directly influences the lives of rural people, rural consumption and process of rural development. Rural development process starts with farmer because they are directly attached with agriculture and which in turn depends upon farm mechanization for productivity and production. Shorly, we can conclude that tractor market is having huge potentials for marketers and there is need to understand the behaviour of consumers, and their problems to avail these potentials.

| . 1.0 | |

| Estimated Annual Size of Rural Market in India | |

| FMCG | INR= 65000crore |

| Durables | INR =5000 crore |

| Agric-inputs(including tractors) INR=45000 crore | |

| Two/ four wheelers | INR=8000 crore |

| Total | INK=1,23,000 crore |

| Source (Francis kanoig 2002) | |

| 1.1 | |||

| SECTOR | 1999-2000 2004-2005 2011-2012 | ||

| Agriculture &allied | 59.9% | 58.5% | 48.9% |

| Manufacturing | 16.4% | 18.2% | 24.3% |

| Service | 23.7% | 23.3% | 26.9% |

| (Source: Rangrajan, C.Seema & E.M, & E.M Vibeesh (2014) | |||

| Description | Units | World Total/Average | India | Rank |

| Arable land | Million Hectare | 1444 | 170 | 2 |

| Irrigated land | Million Hectare | 249.6 | 45.8 | 2 |

| Tractors in use | Tractors per 1000/ Hectares | 28 | 10.5 | 8 |

| Population | No. of villages Percentage of total villages | |

| Less than 200 | 114,267 | 17.9% |

| 200-499 | 155,123 | 24.3% |

| 500-999 | 159,400 | 25.0% |

| 1,000-1,999 | 127,758 | 19.7% |

| 2,000-4,999 | 69,135 | 10.8% |

| 5,000-9,999 | 11,618 | 1.8% |

| 10,000-&above | 3,064 | 0.5% |

| TOTAL | 636,365 | 100% |

| (Source: Government Of India 2001(37) | ||

| Year | Number of Tractors |

| 1966-67 | 4,803 |

| 1970-71 | 12,312 |

| 1980-81 | 52,689 |

| 1985-86 | 83,120 |

| 1990-91 | 1,30,246 |

| 1995-96 | 1,62,030 |

| 2000-01 | 2,09,613 |

| 2005-06 | 2,46,914 |

| 2010-11 | 2,62,236 |

| 2012-13 | 2,70,238 |

| 2013-14 | 2,71,729 |

| Source: (esaharyana.gov.in) | |

| Sales | of |

| tractors increased by 20% during 2013-14, with units' | |

| sales of 6, 33,656. Indian tractor industry is expected to | |

| grow in range of 10-12% CAGR in next five years. | |

| Financial year 2014 was very good for Indian tractor | |

| industry with sales of six lakh tractors, additional one | |

| lakh units over 2013(indianmirror.com/indianindustry in | |

| 2015). | |