1. Introduction

rofitability and liquidity are two important variables which give information about the performance of any business entity. For long-term survival and healthy growth both profitability and liquidity should go parallel to each other .Profitability is one of the major goals of any business. Without being profitable it is not possible for a business to survive and the business growth is difficult. To generate profit a business need short-term funds to fulfill its day to day needs in operations and other requirements. Business will be more profitable when this short-term need of funds is generated by business operation not through external debts. So the liquidity tells about the business capability to meet short-terms need of funds by the business and profitability tells about the profit generated from the operations of business.

The reason to choose this title is that many studied have been conducted in past to find the tradeoff between profitability and liquidity and there is a huge variation in the results. As Pakistan's economy is different from other economies this study will put light on relation of these two variables in context of banking sector in Pakistan. Pakistan economy is different from other economies due to some its unique natures.

For the study banking sector is selected and standard chartered bank Pakistan is the main focus of the study. The reason to choose standard chartered bank is that it is the largest and oldest international bank in Pakistan. It is first international bank to get the license

2. Literature Review

Profitability helps in taking decisions and constructing policies according to Osiegbu and Nwakanma (2008). Liquidity tells about the firm's ability to meet short-term need of funds says Ibenta (2005). Performance of any business entity is judged by its liquidity management (Bardia 2007). Efficient liquidity management has a great significance for a business to run smoothly (Valrshney, 2008).According to Samilogu and Dermirgunes (2008) the relationship of working capital management to profitability is negative. Decisions related to liquidity have no impact on profitability but the use of forecasting of liquidity and short-term financing during crisis effects profitability positively Lambery and Valming (2009). According to Amit et al (2005) there is no any relation between profitability and liquidity. Narware (2004) in his study on NFL concluded that; there is both negative and positive relationship between profitability and liquidity. According to Sur et al (2001), Bardia (2007), Bardia (2004) and Sur and Ganguly (2001) the relationship between profitability and liquidity is positive. As liquidity has a close relation with day to day activities so the study of liquidity is important for the internal analysts as well as external analysis in their study (Bhunia, 2010).

By taking Current ratio as tool to find the relation between profitability and liquidity found that there is negative relation between the business's liquidity and its profitability Abuzarand Eljelly (2004).Working capital management is important due to its direct relation with the firm's profitability and liquidity Singh and Pandey (2008). According to Walt (2009) Profitability can be turned into liquid asset that's why it is more important but this never means that company is profitable if its liquidity is high. Liquidity is more important than profitability because it has impact on the survival of the company Don (2009).According to Dong (2010) Working capital management affects the liquidity and profitability of any firm. Fixed and current assets are important for the successful running of any business and these both have direct impact on liquidity and profitability Saswata Chatterjee (2010) .According to Deloof (2003) and Wang (2002) the working capital management increases profitability by reducing average collection period and inventories. According to Afza and Nazir (2007) there is a negative relation between the profitability and business's working capital investment and the financing policies.

Mahmood and Qayyum, (2010) argue that the liquidity and profitability are important to achieve two main objectives profitability is related to the wealth maximization goal of the shareholders and liquidity is important for the continuity of business. Correlation and regression study of Eljelly (2004) founded that Current ratio is more important to measure profitability and cash conversion cycle is more important to measure liquidity. According to Shim and Siegel (2000) Liquidity is business capacity to pay short-term debts means their maturity is less than one year. Economic success achieved by any business by investing capital in it is said to be its profitability and it is determined by the net profit margin (Pimentel et al, 2005). High financial cost and business's inability to pay its obligations are the results of low liquidity (Maness & Zietlow 2005).Liquidity tells about the firm's degree of independence against the creditors and it also tells about the difficulties and crises face by the company Matarazzo (2003). Financial strength of a business is measure of it liquidity Chandra (2001). Profitability will be lower the more funds are invested in current assets Assaf Neto (2003).The relation of profitability to liquidity is inverse according to Marques and Braga (1995) and Renato Schwambach Vieira (2010).Liquidity is commonly measured by current ratio and profitability is commonly measured by ROI Vishnani and Shah (2007).

3. III.

4. Measurement a) Operational definitions

i. Accounting Liquidity It measures the company's ability to meet its short-term obligations using its most liquid assets. That is, accounting liquidity is the ease with which a company can pays its bills and liabilities over the next year, especially if it must convert its assets into cash in order to do so. Two common ways to measure accounting liquidity are the current ratio and the quick ratio. (financial-dictionary.thefreedictionary.com, 2010) ii. Profitability Ratios A class of financial metrics that are used to assess a business's ability to generate earnings as compared to its expenses and other relevant costs incurred during a specific period of time. For most of these ratios, having a higher value relative to a competitor's ratio or the same ratio from a previous period is indicative that the company is doing well. (www.investopedia.com, 2010).

IV.

5. Hypothesis

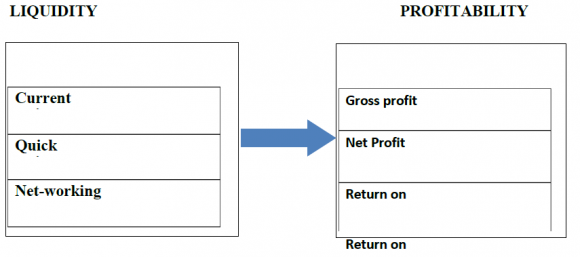

For the study seven hypotheses have been constructed: Ho: No relation exists between the liquidity and profitability. H1: There is significant relationship between liquidity and profitability H2: There is a positive relation between current ratio and profitability. H3: There is a negative relation between current ratio and profitability. H4: There is a positive relation between quick ratio and profitability. H5: There is a negative relation between quick ratio and profitability. H6: There is a positive relation between Net-working capital and profitability. H7: There is a negative relation between Net-working capital and profitability

6. Conceptual Framework

VI.

7. Methodology a) Research Design

The purpose of this research paper is to know the relationship between two important ratios of the financial statements the profitability and liquidity. The study is conducted on the basis of actual data available in the financial statements of the standard chartered bank, so our interference in this study is low. The study is done on a real business scenario so this study is noncontrived study. No artificial data is used actual data is used for the study purpose. The unit of analysis for this study is organization that is standard chartered bank Pakistan. Standard chartered bank Pakistan is largest international bank in Pakistan with 116 branches. The study is conducted on the basis of the financial statements of standard chartered bank from 2004 to 2013.The data of last ten years of standard chartered bank is taken as a sample for the study. The data to find the relation is not collected of just one specific point but it is collected at ten different points from the year 2004 to 2013.So the study is longitudinal. For this study the secondary data collection method is used. The data is collected from the annual reports of standard chartered bank Pakistan.

8. VII.

9. Findings and Results

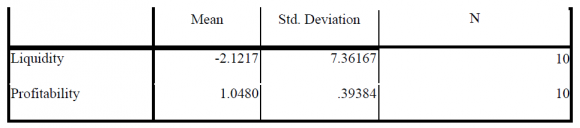

10. a) Descriptive statistics Table 1.1 : Descriptive Statistics

From the descriptive statistic table 1.1 its can be concluded that the mean of liquidity is negative that is mainly due to the large negative figure of net-working capital .The negative figure of net-working capital is due to access of current liabilities to the current assets. The mean of profitability is positive because all the four ratios are positive. The standard deviation of profitability is low that is due less variation in the ratios. The standard deviation of liquidity is high due to the large variation in the figures of the liquidity ratio.

11. Conclusion

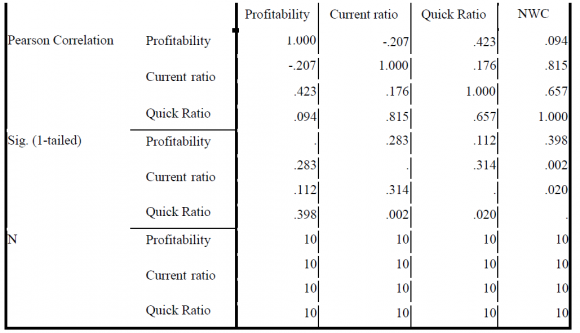

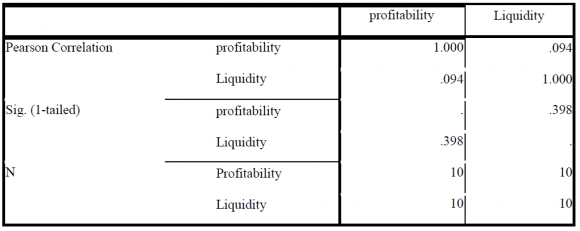

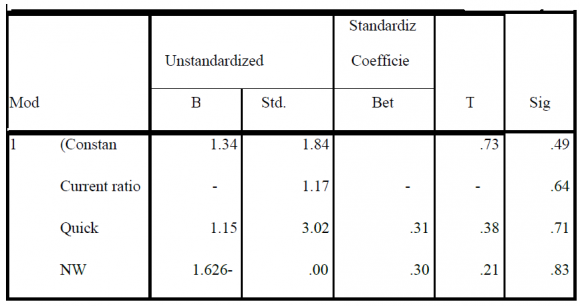

From the findings and results of the study we can conclude that there a positive relation between profitability and liquidity .So the null hypothesis is rejected and alternate hypothesis 1 is accepted. There is negative relation between current ratio and profitability so the alternate hypothesis 2 is rejected and alternate hypothesis 3 is accepted. There is positive relationship between quick ratio so the alternate hypothesis 4 is accepted and alternate hypothesis 5 is rejected. There is positive relation between net-working capital and profitability so alternate hypothesis 6 is accepted and alternate hypothesis 7 is rejected.

IX.

12. Limitations

The study is concentrated to only banking sector. The results and findings of this study is based on the financial statement of standard chartered bank Pakistan. Only past ten years data is taken under consideration for the study. Considering other countries will result in more reliable and accurate results, findings and relation between the variables.