1. Introduction

aluation in emerging markets is a topic that is extensively discussed in the literature. Companies that operate in emerging markets are exposed to a series of risks that are not faced by mature-market companies. Consequently, investors require a higher return than that requested in a mature market, and hence the cost of equity needs to be adjusted to reflect the additional risk perceived, taking into account a country risk premium. The majority of the models of country risk proposed in the literature do not consider the fact that a firm incorporated in an emerging market might operate mainly in mature markets and viceversa, i.e., a firm incorporated in a developed market may have a significant amount of operations in undeveloped markets. Therefore, each company has a different exposure to country risk, depending on where it operates, and the adjusted cost of equity needs to reflect this exposure.

The main literature in this field (Damodaran, 2003) proposes three methods, called "lambda", to estimate companies' effective exposure to country risk. The first method is based on the percentage of revenues that the company earns in the local market, compared with the revenues that the average company earns in the local market. The second approach is based on a comparison of the change in earnings per share of the company, denominated in the country's currency, and the change in the country sovereign bond denominated in US dollars. The last method (regression approach) considers the sensitivity of the company stock returns to the returns of the country sovereign bond denominated in US dollars.

The aim of this paper is to propose three new methods to measure the effective exposure to country risk of emerging-market companies. The first method, called the "Prospective Lambda", represents the effective exposure according to analysts' estimates of growth. The second method, called the "Retrospective Lambda", represents the ex-post effective exposure to country risk; hence, it refers to historical data, while the "Company Effective Risk Premium" is a generalization of the Retrospective Lambda and expresses the premium effectively requested by investors to invest in that specific company.

The country risk premium model implemented in our analysis is the one proposed by Damodaran (2003), which is called the "melded approach". This model considers both the country bond default spread and the volatility of equity markets in a country relative to the volatility of the country bond denominated in US dollars.

The results demonstrate that, in 2013, the extra return asked to invest in Brazil was on average greater than the value of the country risk prem ium obtained from existing measures. This result confirms that the approaches to measure the exposure to country risk proposed in this study can be effectively applied by financial analysts to stable-growth companies that operate in emerging markets.

We improve upon the existing literature by proposing new approaches to measure the effective exposure to country risk that yield estimates of both the premium effectively requested by investors in the past and the premium linked to future growth estimates. Moreover, the latter approach can be generalized to allow for a first period of high growth.

The paper is structured as follows: Section 2 presents a literature review. Section 3 reports the results obtained using the regression approach. Section 4 is dedicated to the new approaches to measure companies' exposure to country risk. Section 5 presents the results of the empirical analysis. Conclusions are offered in Section 6.

2. II.

3. Literature Review

The main models proposed in the literature for estimation of the cost of equity in emerging markets have been classified according to their nature and to the investor's nature and amount of diversification. We classified the models according both to the investor's nature and the nature of the model, with the latter factor reflecting whether the model is based on the CAPM. Table 1 reports our classification.

4. Table 1 : Classification of the main models developed for estimation of the cost of equity in emerging markets

The majority of the models proposed in the literature are CAPM-based models, which can be applied to estimate the cost of equity in emerging markets in the case of a globally well-diversified investor. The most widely known models are the Global CAPM and the Local CAPM (Stulz, 1995).

Several authors, such as Damodaran (2003), Pereiro (2001) and Lessard (1996), adjusted the cost of equity by adding a country risk premium taking in consideration the risk of investing in emerging markets. All of the models proposed in the literature, with their respective formulas, are summarized in Table 2.

Table 2 : Main models for computation of the cost of equity (K e ) in emerging markets Because to the fact that not all firms are equally exposed to country risk, we believe that the effective exposure to country risk is needed in company valuation. Damodaran (2003) was the first one to address this problem proposing a measure of a company's exposure to country risk, called "lambda" (?), and the following approaches for its estimation:

? The revenues approach ? The accounting earnings approach

5. ? The regression approach

The first approach takes into consideration only where the revenues are generated, stating that a company that derives a small percentage of revenues in the country should be less exposed to country risk than the average company should. Thus, lambda is estimated as follows:

? x =% of revenues got in the country for company ?? % of revenues got in the country for the average company

(2.1)The second approach compares the change in earnings per share, denominated in the country's currency, with the change in the sovereign bond denominated in US dollars with 10-year maturity.

The last approach is the regression method. It consists of estimation of lambda through a regression of company stock returns against the return of the 10-year sovereign US dollar-denominated bond issued by the emerging country. The slope of the regression indicates the sensitivity of the stock prices to country risk and is taken as a measure of lambda.

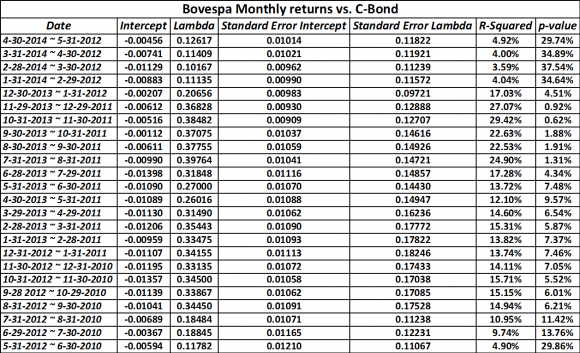

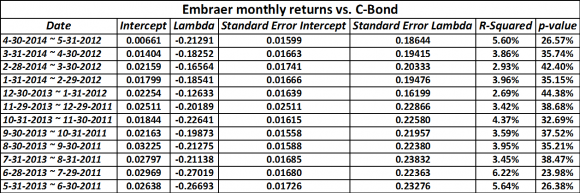

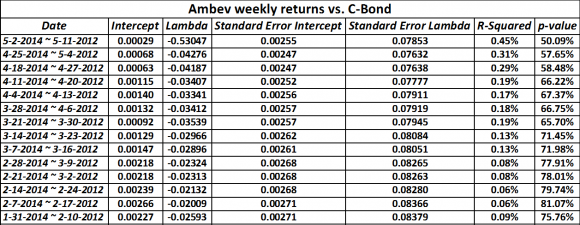

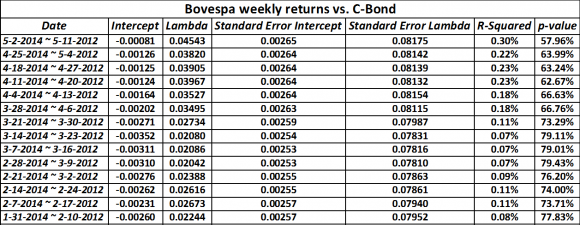

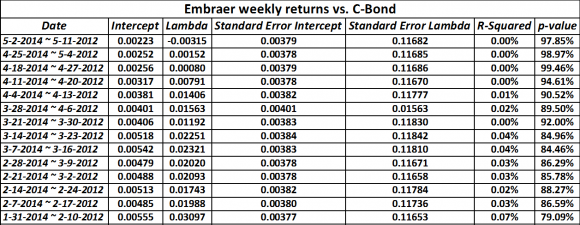

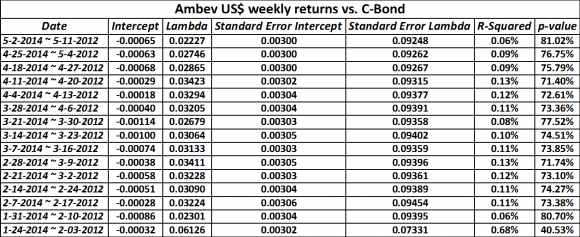

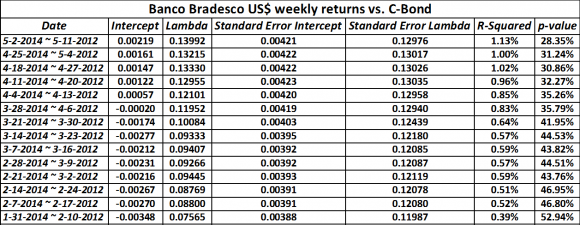

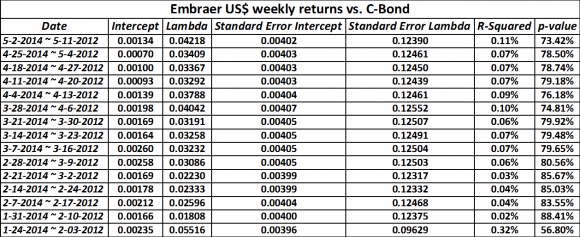

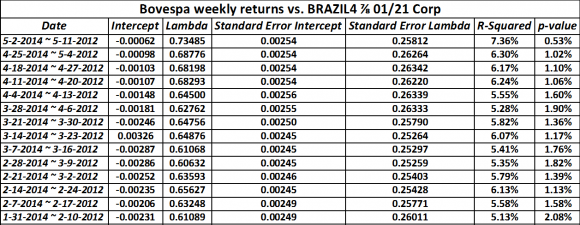

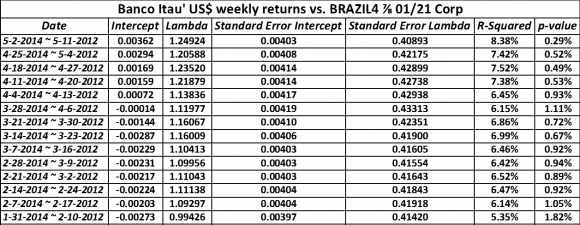

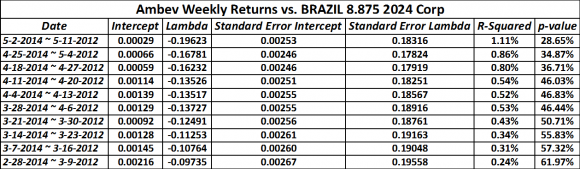

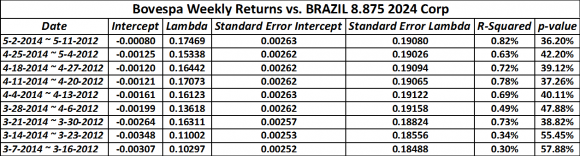

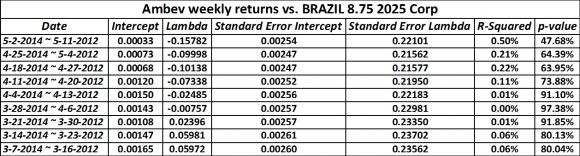

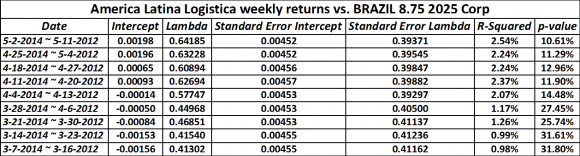

In our study we decided to test only the regression approach, in order to have a significant number of observations. In particular, we regressed the stock returns of Brazilian companies listed on the Ibovespa against the 10-year Brazilian sovereign bond

6. Year ( )

7. 2016

C denominated in US dollars. The idea was to calculate lambda to check how the effective exposure to Brazil's country risk of each company of the Brazilian equity index changed over the period of 2012-2014 as Brazil's country risk premium changed. The results of the regression analysis are presented in the next section.

Starting from Damodaran (2003), we propose new methods to determine the effective exposure to country risk of emerging-market companies, and we test them with the companies of the leading indicators of the Brazilian stock market's average performance: the Bovespa Index.

8. III.

Testing Existing Measures of Company Exposure to Country Risk using Brazilian Firms

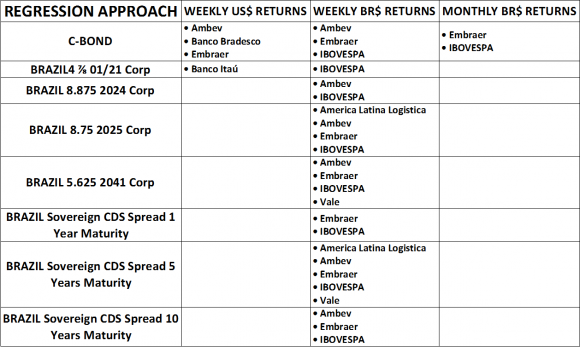

To test the effectiveness of Damodaran's regression approach for lambda estimation, we regressed the stock returns of the companies listed on Ibovespa against C-Bond returns (the 10-year Brazilian US dollar-denominated sovereign bond). The companies used in the analysis and the results are reported in Appendix A.

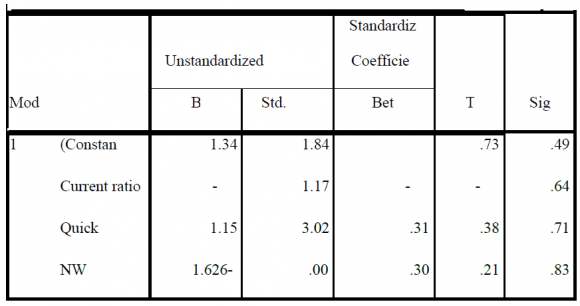

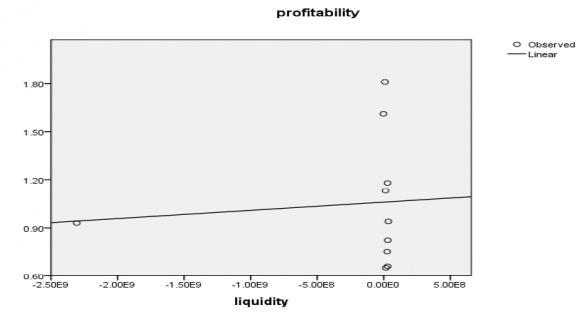

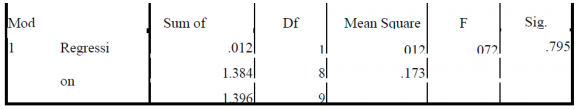

The results of the regression analysis indicate very low R-squared values and high p-values. The value of each slope was meaningless and, consequently, cannot be used as a proxy of the companies' exposure to country risk. This result could be mainly due to problems regarding the use of a "fixed-maturity bond", the 10-year one. In fact, the benchmark of the tenor on the curve usually changes from one year to another, but the analysis needs to be implemented with data that span many years to have a sufficient number of data points for the linear regression to be sensible.

The prices of different bonds, with different characteristics, comprise a time series that represents the price of the 10-year-maturity sovereign bond at different times. The time series is thus composed at each time by the bond that has a ten-year maturity at that time; then, one year after, for example, when that bond has a maturity of nine years, another bond with a 10-year maturity becomes the benchmark of the tenor. Hence, the value of the lambda obtained with the regression approach using a ten-year curve composed of multiple bonds will certainly be skewed. We encountered this problem using the C-bond: over the period of 2012-2014, two different bonds were part of the ten-year curve: EC359050 Corp until November 2013 and EJ901174 Corp afterwards. When the benchmark changed, the price of the curve also changed (from 135.2 to 94.75), thus making the value of the obtained lambda unreliable even if the statistics of the regression did not turn out to be meaningless. Moreover, for many periods, the 10-year benchmark does not even exist, as can be observed from Figure 1.

9. C

majority of the times and, even when they were acceptable, the R-squared value was close to zero. These negative results may be related to the different characteristics and liquidity of bonds with different maturities. As countries become less risky over time, as Brazil did over the last decade, the country bonds may no longer carry the risk connotations that they used to carry. Therefore, the lambda obtained using returns on a government bond that will mature in 2040 is linked to investors' expectations and beliefs that are completely different from the ones that investors have for a sovereign bond that will mature in 2020. Moreover, the price of a bond moves closer to its face value as it approaches its maturity date, making the choice difficult. Finally, we regressed the companies' stock returns against the returns on the sovereign CDS spread, implementing the approach proposed by Damodaran (2009b). The uncertainty regarding the choice of the CDS was again related to the maturity: in the market, sovereign CDSs with several different maturities are traded, and their returns are highly correlated, as shown in Figure 2. We performed an analysis to check whether there was a significant relationship between the returns on the Brazilian CDS spread and the returns on the Ibovespa companies' stock price, but the results were again unacceptable.

A significant value was obtained only when we performed the analysis against the Bovespa Index, which is the main indicator of the average performance of the Brazilian stock market. The R-squared value was on average near 20%, and the p-value was approximately zero, but lambda had a negative value. The negative slope obtained reflects the fact that as the returns on the Brazilian CDS spread increase, the returns on the Bovespa Index usually decrease. When investors' perception of the country risk increases, the average return for the whole market decreases. Moreover, a negative slope cannot be used as a measure of lambda because it would mean decreasing the cost of equity instead of augmenting it because of the additional risks that affect an emerging country. As clearly shown in Figure 3, the sovereign CDS spread is highly volatile and thus should not be used to estimate lambda. We believe that Damodaran's regression approach does not work because the majority of investors do not consider historical prices for government bonds in the market; what they normally consider is the yield. The reason for this difference is that benchmark bonds issued at different times have different characteristics, such as the terms of maturity and coupon. Because of the differences in these characteristics, a bond may be priced very differently between two benchmarks for the same tenor. For instance, if a 20-year-maturity bond issued 10 years ago that bears a coupon of 7.5% is now rolled up to become the current 10-year benchmark bond because of its reduced maturity, the bond still pays the same 7.5% coupon. This coupon may be very different from the coupon of a 10-year benchmark bond issued today, which may have, for example, only a 5% coupon. Differences such as these will have an impact on the price of the bonds; therefore, a comparison between them is not meaningful.

10. IV.

A Proposal to Measurecompanies' Exposure to Country Risk

The impossibility of determining a reliable measure of a company's exposure to country risk using existing approaches inspired us to develop the following new measures:

? The Prospective Lambda ? The Retrospective Lambda ? The Company Effective Risk Premium

11. a) The Prospective Lambda

The "Prospective Lambda" is based on future expected growth rates. The formula is a variant of the implied equity risk premium formula 3 , and can be implemented for each company. Lambda (?) is estimated breaking the cost of equity down into the sum of the risk-free rate, the product of beta and the mature market equity risk premium (ERP), and the portion of country risk premium that affects the company. The last is the product of lambda and the country risk premium (CRP), where lambda is the only unknown parameter.

12. b) The Retrospective Lambda

The Retrospective Lambda relies only on past data for estimation of lambda. It represents an ex-post measure of the effective exposure to country risk over the past year and is suitable for stable-growth firms only.

? t = [?Beta t * ERP t + Normalized FCFE t+1 Company x Market Cap t ] CRP t ?(4.2)13. c) The Company Effective Risk Premium

In order to avoid the uncertainty regarding the choice of the model for the country risk premium to implement, we derive the Company Effective Risk Premium by taking the product of lambda and the country risk premium:

Company Effective Risk Premium t = [?Beta t * ERP t + Normalized FCFE t+1 Company x Market Cap t ](4.3)The company effective risk premium should be added to the cost of equity to correctly estimate the adjusted discount rate when valuing stable-growth companies.

14. V. Testing the Retrospective Lambda and the Company Effective Risk Premium Onbrazilian Companies

To check the reliability of the models proposed in the previous section, we calculated the Retrospective Lambda and the Company Effective Risk Premium for 23 companies listed on the Bovespa Index 4 For the purpose of our analysis, we calculated the Retrospective Lambda and the Company Effective . 4 Preferred stocks and units were excluded because of the infeasibility of the approach when not considering common stocks. We also decided to exclude banks and insurance companies because of the impossibility of having a reliable estimate of the free cash flows of the firms in these industries. Companies reporting negative FCFE were excluded from the analysis as well.

Risk Premium, using a free cash flow-to-equity model in which the normalized free cash flows to equity of the year t+1 were replaced with the trailing12-months free For each week, we used the value of the mature market equity risk premium (calculated by Damodaran Bloomberg Professional Database.

We calculated beta as the ratio of the covariance between the Bovespa Index returns and the company stock returns to the variance of the Index returns using two-year weekly returns. ) that referred to the month of the week in which we estimated lambda.

For the purpose of the analysis, we used Damodaran's "melded approach": The default spread was calculated as the difference between the yield of the 10 years Brazilian bond denominated in US dollars (GTUSDBR10Y Govt) and the US 10 years T.bond yield (USGG10YR Index). The standard deviation of the previous two years of the emerging country equity index returns was used as the country equity standard deviation. For the country bond standard deviation, we used the two years' past returns of the bond EC359050 Corp (maturity 2024).

GlobalThe company stock price was obtained from Bloomberg Professional Database. Each lambda was calculated for every week of 2013; the values obtained are reported in the table below and represent the averages of the values for the fifty-two weeks of 2013. Among all the companies reported in Table 4, the average Retrospective Lambda is equal to 1.18. This means that in 2013,on average, brazilian companies had an exposure to Brazil country risk1.18 times greater than the country risk premium calculated with Damodaran's "melded" approach, which was 4.53% in 2013 (weekly average).

The average Company Effective Risk Premium is equal to 5.37%, meaning that in 2013, the effective rate of return required by investors for equity investments in Brazil was, on average, 5.37% greater than in a mature market.

15. VI.

16. Conclusions

In this paper, we propose three new approaches to calculate the effective exposure to country risk of emerging-market companies. The impossibility of estimating a reliable measure of company exposure to country risk with existing approaches inspired us to develop the Prospective Lambda, Retrospective Lambda and the Company Effective Risk Premium. The three methods are an implementation of the implied cost of equity approach, in particular, the Prospective Lambda, which is based on growth estimates. The Retrospective Lambda and the Company Effective Risk Premium were developed to overcome the bias underlying analyst estimates of growth that can make the final result relatively random.

The Retrospective Lambda reflects the exposure to country risk that a company effectively had over the past year, whereas the Company Effective Risk

The Retrospective Lambda and the Company Effective Risk Premium were tested on 23 Brazilian companies using trailing twelve-month free cash flows to equity data.

The results demonstrate that in 2013the extra return required by investors to invest in Brazil was on average greater than the value of the country risk premium obtained from existing measures. Hence, using our new approaches to estimate the company exposure to country risk would have resulted in a higher cost of equity, on average, thereby leading to lower company values.

We believe that our approaches are more reliable than existing measures because they provide an estimate of both the premium effectively requested by investors in the past and the premium linked to future growth estimates.

Applying our approaches, the cost of equity reflects the effective exposure of a company to country risk without being over-or underestimated, as is the case with other existing approaches.

| Company x Market Cap t = | FCFE t * Expected FCFE growth t+1 Ke t ? g t | (4.1) | |||

| So, | |||||

| Ke t ? g t = | FCFE t * Expected FCFE growth t+1 Company x Market Cap t | (4.1.a) | |||

| Decomposing the cost of equity (Ke), | |||||

| rf t + FCFE t * Expected FCFE growth t+1 Company x Market Cap t | (4.1.b) | ||||

| FCFE t * Expected FCFE growth t+1 Company x Market Cap t | (4.1.c) | ||||

| Thus, | |||||

| ? t = [?Beta t * ERP t + | FCFE t * Expected FCFE growth t+1 Company x Market Cap t | ] CRP t ? | (4.1.d) | ||

| where ERP | |||||