1. Introduction

anks have several advantages in granting loans to customers. Among others, that enhances profit levels of the institutions if debtors meet their obligations. Also, that increases financial resources to the creditors for increased capital base for promotion of investment, for economic growth among others. Therefore, if loans are not effectively managed in the banking sector it has negative effect on banking institutions and the macro economy in general. This study was initiated to examine credit risk management practices in terms of their effectiveness and efficiency within the banking industry.

The introduction of the banking Act, 1993 (Act328) in Ghana increased the number of bank and non-bank institutions in the financial sector. With a liberalised financial sector, competition among banks in creased leading to loose operations in the banking industry with the view to undercutting competitors. That has led to low margins, and other challenges facing the banking sector.

Presently, easy access to financial information has given stakeholders in banking industry, the ability not only to assess returns on investment but also critically examine policies and framework used to manage risks in the financial sector and safety of their investments. This attitude of shareholders has been intensified by poor banking practices in recent times which are attributed largely to the weaknesses of the regulatory frameworks and the risk management practices in banks being major factors that have led to bankruptcy of some notable banks.

After the recent credit crunch, in Unite States of America which in turn escalated to a full-blown global financial crisis in 2008-2009 which led Leman Brothers, a major U.S bank with global presence going bankrupt in 2008 thus producing challenges in the global financial market. This has necessitated a close examination of the numerous issues related to the operation of financial markets to identify the main causes of the crises. Main issues isolated and discussed included capital adequacy levels in the banking sector, the role of rating agencies in financial regulation, the fair-value assessment of banking assets and risk management. Among the revelations of situation analysis, on the experience, was that risk management of financial institutions was not adequate enough.

This implied that managing credit risk in a financial institution is critical for the survival and growth of the institutions. Generally, Credit Risk Management in a financial institution includes risk management policies, industry specific standards, the establishment of sound lending principles and efficient framework for managing risk just to mention a few.

Credit creation which is the main income generating activity for banks involves huge risks to both the lender and the borrower. Since credit risk is that risk which can easily and most likely prompt bank failure, a bank with high credit risk has high bankruptcy risk that puts the depositors, assets in jeopardy. Many banks in Ghana are performing poorly as the irnon-performing loans grow year after year, despite the existence of Credit Risk Management Departments responsible for managing credit risks of the banks. Available data show a rise in the value of non-performing loans in many of the banks. For instance, one bank recorded annual average impairment charge amounting to 27million Ghana Cedis (GHS) between 2007 and, 2011.

For in depth analysis the study adopted a case approach was a case study method and concentrated on both exploratory and explanatory principles. The interviewees were top level credit managers, middle level managers, branch managers of the bank selected for research and other staff in Credit Risk Management and, Credit Operations Departments. Both primary and secondary data were used as they provided in-depth quantitative and qualitative information appropriate for the study. While the staff provided primary information, sources of secondary data included the Bank's Credit Risk Management policy manuals, reports and the financial statements of the Bank from 2007 to 2011.

2. II.

3. Review of Concepts

Since concepts do not have universal definitions, it is important that studies are based on specific working definitions. For example, in this study, the concept of credit and loans are used interchangeably. Some working definitions of crucial concepts for the study are outlined as follows:

4. a) The Credit Policy

Credit policies cover, among others, the credit risk philosophy governing the extent to which the institution is willing to assume that risk. That is general areas of credit in which the institution is prepared to engage or is restricted from engaging. Again, credit policies establish the rules and framework for effective management operation of credit portfolio. Credit policies, if effectively implemented enable the financial institution to maintain sound credit underwriting standards. Also, it assists the institutions to assess, monitor and control credit risk. Again, it covers evaluation of new business opportunities, identify, administer and collect challenging credits. This implies that credit policy framework for addressing risk has to be comprehensive.

5. b) Credit Risk

Credit risk is the first of all risks in terms of its effects on the operations in banking industry. Credit risk arises from uncertainty in counterparty's ability or willingness to meet its contractual obligations. It involves inability or unwillingness of a customer or counterparty to meet commitments in relation to lending, trading, hedging, settlement and other financial transactions. Default risk, a major source of loss, is the risk that customers failure, to comply with their obligations to service debt. Again, credit risk is the risk of loss due to a deterioration of the credit standing of a borrower. According to the Basel Committee (1999) Credit risk is the potential that a bank borrower or counterparty will fail to meet its obligations in accordance with agreed terms. The goal of credit risk management is to maximize a bank's risk-adjusted rate of return by maintaining credit risk exposure within acceptable parameters. As the Basel II put it, banks need to manage the credit risk inherent in the entire portfolio as well as the risk in individual credits or transactions. Banks should also consider the relationships between credit risk and other risks. The effective management of credit risk is essential to the long-term success of any banking institution.

6. c) Bad Loans

Many studies have examined causes of bad loans occurrence in financial institutions. Berger and De Young (1997) identified poor management as one of the major cause of problem loans. They stated that managers in many banks with problem loans do not practice adequate loan underwriting, monitoring and control. Also, it has been observed that "the accumulation of non-performing loans is generally attributable to a number of factors, including economic downturns and macroeconomic volatility, terms of trade deterioration, high interest rate, excessive reliance on overly high-priced inter-bank borrowings, insider lending and moral hazard among others" Goldstein and Turner (1996). Again, it the problem of loans could emanate from overdrawn account where there is no overdraft limit, the latter being overdraft taken on an account which has not been actively operated for some time and overdraft taken in excess of reasonable operational limits, lack of good skills and judgment on the part of the lenders as a possible cause of bad loans. The other issues are that banks have experienced credit losses because of the failure to use sufficient caution with certain leveraged credit arrangements. Credit extended to highly leveraged borrowers is likely to have large losses in default. Lending against non-financial assets is one of the causes of bad loans. In this context, the lending banks fail to make adequate assessment of the correlation between the financial condition of the borrower and the price changes and liquidity of the market for the collateral assets. Related challenge is that

7. Global Journal of Management and Business Research

Volume XV Issue VI Version I Year ( ) C many banks do not take sufficient account of effect of business cycle on lending. As income prospects and asset values rise in the ascending portion of the business cycle, credit analysis may incorporate overly optimistic assumptions, such as competition among financial institutions in terms of growth, profitability and the desire to be a market leader has the ability to cause financial institutions to lower their standards or improperly price their loan products. These observations point to the fact that credit risk management challenges in the banking industry is a complex issue comprising several interrelated, and interlocking variables which are not easy to dismantle nor easy to handle fully.

8. d) Framework for Credit Risk Analysis

The framework for analysis was guided by specific principles including Basel Committee submission on Banking Supervision, (Basel, 1999). The observation is that an effective credit approval process is the first step against excessive counter party credit risk which should begin with comprehensive financial and non-financial information which provides a clear picture of the counterparty's risk profile and risk management standards.

In addition, the credit assessment process should identify the purpose, structure of the transaction for which approval is requested while providing a forward looking analysis of the repayment capacity from various scenarios. Some of the processes one might follow to identify and analyse the components of credit risk include non-financial issues such as knowledge of customer, credit referencing bureau and financial factors namely awareness of the purpose for credit, identification and assessment of sources of repayment, financial gearing, security analysis and assessing the business risk of the borrower.

An issue that cannot be overemphasized is a bank's knowledge of their customers, it implies that .a bank should be familiar with the counter party and be confident that it is dealing with an entity of sound repute and credit worthiness (Base1999). This can be achieved in a number of ways such as asking for references from known parties, accessing credit register, evaluating legal status and becoming knowledgeable about the individual responsibility for managing counter party. This could enhance the integrity of the banking system by reducing the likelihood of banks becoming a vehicle for money laundering and so on. Also, knowing your costumer (KYC) could be facilitated by a credit referencing bureau. A credit referencing bureau, a repository of credit information is an entity that collates customer credit information by soliciting creditors such as banks, insurance company and lending institutions to contribute and share the credit information of their customers. It helps lending institutions with an easy means of carrying out their KYCs and enables banks to better manage their risk exposures. The Parliament of Ghana has passed Credit Reporting Act, 2007 (Act 726) which is the foundation for the establishment of a credit referencing bureau in Ghana.

Identifying the purpose of Credit has to be undertaken by the bank in an effort to analyse the credit risk of counterparty. The purpose of the credit facility is important to the lending institutions as it enables them to assess the legality of the transaction it is contracting with customers, relative to laws of the country in which they operate. Again, identification and assessment of sources of repayment is also a major tool for analysing credit risk of customers of bank. A borrower's repayment capacity is measured by identifying the source of repayment, and carefully reviewing future cash income from that source to ensure that it is enough to meet borrower's needs and help generate enough cash flows from the core business to repay debt, pay a competitive return to shareholders or owners and replace long term operating assets.

Assessing the business risk is another way of analysing the credit risk in banking. Business risk is the variability in operating cash flows or profit before interest (Pike et al, 2006). A firm's business risk depends on the underlying economic environment within which it operates. This is a factor exogenous to the bank A business variability in operating cash flows can be heavily affected by the cost structure of the business and hence the operating gearing.

Financial gearing is a way banks analyse the risk of the borrower. It is the risk over and above the business risk from the use of debt capital. (Pike et al, 2006). It seeks to assess the impact of the credit on the capital structure of the counter party. By financial analysis, lending institutions are able to assess the borrowing needs, capital structure and borrower's ability to meet their obligation as per terms of contract.

Financial risk analysis gives an indication of the proportion of both external and internal funding used to finance the assets of the business. Another important factor in the process is security analysis. Because business risk is always present, most financial institutions rely heavily on the security of their portfolio as a means to offset the impact of credit risk on their loan portfolio. (Rose et al 2008). The security analysis in credit risk management involves the evaluation of the marketability of the security, security control and price stability of security being offered.

9. e) Loan Portfolio Quality

In discussing credit risk management it was found necessary to examine the process of measuring loan portfolio quality which is considered the key to loan portfolio management. Assessing the current performance of the most important asset of a financial institution (the loan portfolio) is a basic requirement for being able to actively manage the level of risk exposure and the profitability of that institution.

In general, portfolio quality indicators identify performing and non-performing aspect of the loan portfolio and relate them to specific indicators which provide a view or a snap shot of the status of the portfolio's performance. By comparing indicators at different points in time, trend analysis is carried out to identify upturn or downturn developments. In assessing the quality of a loan portfolio, classification and provision for bad debt are very crucial.

Therefore, to determine the level of loan provisions to be made in line with banking regulations, The Bank of Ghana has provided the following indicators and standards namely; Current; Other Loans Especially Mentioned (OLEM), Substandard, Doubtful and Loss Table 1, (Bank of Ghana, 2008) for assessment. The classification serves several purposes namely; it assists banks to monitor the quality of their loan portfolio by identifying performing and nonperforming loans, in line with banking regulations. Again, the classification helps banks to know the structure of their loan portfolio and for that matter their assets quality.

In Ghana, a major factor considered in granting loans is the ability of the borrower to repay. However to mitigate the risk of default, banks ensure that loans are well secured. Even though advances shall be granted on the basis of the borrower's ability to pay back the advance and not on the basis of sufficient pledge to cover the advance in case of default, it is highly desirable for all advances made to customers and staff to be well secured. This means that in the event of default the bank shall fall on the collateral used in securing the facility to mitigate the effect of loss of principal and interest (Banking Act, 2004). In view of this, banks take into account the assets used in securing the facility to determine the level of provision to be made. Bank of Ghana regulations indicate that certain amount of provisions are made on the aggregate outstanding balance of all current advances, and aggregate net unsecured balance of all other categories.

Another method for measuring portfolio quality is the Risk Coverage Ratio. This measure shows what percent of the portfolio at risk is covered by actual loan loss reserves. It gives an indication of how prepared a bank is for a worst-case scenario. While a higher risk coverage of 100 per cent should generally be preferred, there are cases that justify lower levels of coverage. For instance, in a situation where collateral-backed lending makes up the majority of the portfolio, a ratio below 100 per cent is common. For formalized institutions, regulators, and particularly the tax code, usually set minimum limits on provisions.

Loan write-off ratio is stated as a good measure of portfolio quality. This indicator simply represents the loans that the institution has removed from its books because of a substantial doubt that they will be recovered. The writing off of a loan is an accounting transaction to prevent assets from being unrealistically inflated by loans that might not be recovered. The writing off of a loan affects the gross loan portfolio and loan loss reserves equally. So unless provision reserves are inadequate, the transaction will not affect total assets, net loan portfolio, expenses or net income. Write-offs have no bearing whatsoever on collection efforts or on the client's obligation to repay. Some banks undertake aggressive write-offs in as attempt to bring sanity into their portfolios. They will then show a low portfolio at risk, and only the write-off ratio will allow an analyst to detect that this improvement is apparent than real.

10. III.

11. Analysis, Results and Discussions

These discussions start with a review of Credit Risk Management policies that guide operations of a bank. The primary data were collected from experienced staff of the bank studied, and analysed.

12. a) Credit Risk Policies and Decision Making

In terms of decisions made that were based on credit risk policies of the bank, 97per cent of respondents indicated that decision staken by the bank on credit risk is based on laid down policy. Therefore, credit risk management of the bank is in accordance with management policy on risk.

Table 2 shows the credit management policy was ranked by staff of branches, and departments.

13. C

The relevance of credit risk management policy in Table 2 shows that49 per cent of the management staff considers credit risk management policy as highly relevant while another 49 per cent regarded it as relevant. Generally, 98 per cent of the management staff upholds the relevance of the credit risk policy of the bank. Generally, effective use of the credit risk management policy in decision making was the result of training on credit risk given to the staff. Sixty (60) per cent of branch managers indicated that they undertake credit-related training every three months while 40 per cent of them undertake credit-related training every year. The training has made them familiar with the content of the bank's policy, as well as bringing them abreast with current issues on credit risk management which they pass on to the staff.

14. b) Application of Credit Policy Indicators

The strategies for implementing risk policies were examined consequent upon the fact that an institution could formulate relevant policy but its implementation could be ineffective hence inability to address challenges.

The survey revealed that Credit Risk Management (CRM) policy of the bank under study has some implementation challenges. The study indicated that monitoring of credit in the bank was considered inadequate which was attributed to limited logistics, understaffing, ineffective supervision, by management and poor access to project site for physical inspection among others.

Also, there were delays in submission of application for loans caused by the customers' inability to meet approval requirements, rigid approval procedure, liquidity challenges and slow credit appraisal among other tall list of requirements for customers to satisfy. Since time is of essence in risk analysis, the factors responsible for delays in approval of credit to applicants have negative effect on the time line of the purpose for raising loans and repayment.

Qualitative analysis was made on factors that account mainly for bad loans in the bank. A Likert Scale between 1(Least responsible) and 5 (highly responsible) was attached to some suggested factors for ranking. The mean scores and standard deviations for each factor were determined for general ranking of the factors. Using various ranking of variables, per total number of respondents the means in Table 3 rank order of the variables indicate that ineffective monitoring, poor credit appraisal, ineffective credit review process, among others are major factor responsible for bad debt, whilst delay in loan approval is the least effect on creation of bad debt. The low standard deviations indicate that, in terms of scatter diagram, the scores from the respondents were close to their means.

15. c) Portfolio at Risk Assessment

Based on Tor J et al in their analysis of portfolio quality; any portfolio at risk (PaR) exceeding 10 per cent should be a source of concern to management of any financial institution. The application of the standard revealed that apart from the year 2007 in which the bank recorded a PaR of 7.95 per cent Table 4. In all other years the bank recorded a PaR above 10 per cent. The year 2009 was the year the bank recorded the highest PaR which was 44per cent. This is an indication that the portfolio of the bank was bad thus calling for effective management strategies to address the challenges.

16. d) Risk Coverage Ratio

This measure shows what percent of the portfolio at risk is covered by actual loan loss reserves. It gives an indication of the institution's preparedness for a worst-case scenario. Normally a higher ratio is preferred. It can be seen from Table 4 that the in the years 2008 and 2009 bank showed enough preparedness to cover the risky portion of the portfolio, but the bank performed poorly in subsequent years.

17. e) Write-Off Ratio

This indicator simply represents the loans that the institution has removed from its books because of a substantial doubt that they will be recovered. A lower ratio is preferred. The main purpose is to serve as a control indicator that will allow a better understanding of portfolio at risk. From Table 4 the ratios were higher in 2008 and 2009 which is an indication that all was not well with the bank. After making huge impairment charges for these years the trend started to decline in 2010 and further declined in 2011 showing some improvement in the portfolio.

18. f) Trend Analysis of Portfolio Structure

The trend analysis of quality of credit portfolio between 2007 and 2010 is based on The Bank of Ghana standards are presented in Figure 1. The line graphs in Figure 1 1was a result of ineffective policy. In terms of the fact that in 2008 the bank embarked on an expansion drive which led to granting of a lot of loans. Some of the loans were not assessed properly. In the year 2009, after assessing realization portfolio quality challenges, the management decided to slow down lending and work on the portfolio quality.

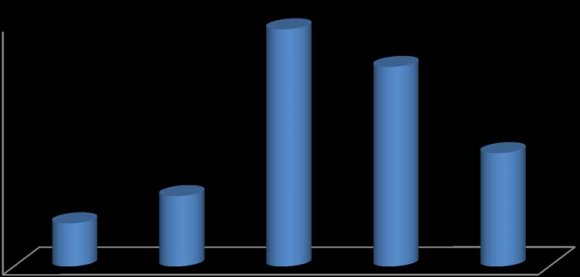

19. g) Trend of Impairment

The trend in Figure 2 shows impairments charge to income statement over a period of five years period (2007 to 2011). It is obvious that the impairments sharply rose in 2008 and continued to increase in 2009. It also began to decrease after 2009 to 2011. Impairment charges are actual amount that the bank charges to its income statement of which is deemed not recoverable. According to the bank this is a more prudent way of charging for bad loans where actual impairment charge is based on a proper assessment of the portfolio and that any portion identified to be irrecoverable is written off. But the decline in 2010 was the result of increase in the total portfolio as a result of aggressive lending the bank embarked on rather than actual significant decline in non-performing loan compared with the preceding years. In other the decline was the result of mathematical principle of ratios.

20. Data Source: Authors' construct

21. i) Risks Exposure

The study showed that the bank is exposed two main sources of risk namely, exposures to other financial institutions on the fiscal landscape and exposures to customers. Exposure to customers was identified to be the main cause of risk to lending in the bank. The main sources of risk exposures to customers identified were individual personal loans and commercial loans granted to private entrepreneurs. However, asset quality of the bank was not quite good as the portfolio deteriorated year after year within the period under review. Consequently, the bank developed its own internal risk management strategies. These include formulation of credit policies and strategies that outlined the bank's credit appetite, credit governance structures and credit risk management and control systems. It was also revealed that, the bank employs varied techniques to mitigate their credit risk exposures. Some of these measures included use of collaterals, portfolio diversification, exposures at default, probability of default, loan-given loss, use of credit referencing bureau and loan insurance. Against, this background, study revealed that challenges encountered during loan recovery included poor location of clients, and ineffective communication when a change in policy is made or a new policy is introduced.

22. j) Key Findings

The study has brought to the fore some salient issues in credit risk management of banks in Ghana. Some of the key findings include: low asset quality of the bank under review as its portfolio deteriorated year after year from 2007 to 2011.The bank recorded huge amount of non-performing loans especially in 2009 and 2011 from 44 and 37 percentage points of total loans respectively.

The non-performing loans ratios for the past five years, however, indicated a general marginal declining trend after the year 2010 which was attributed to the restructuring exercise the bank undertook in 2009 and the improvement in its loan monitoring and recovery activities in that year.

The bank was exposed to two main risks namely exposures to other financial institutions and to customers of the bank in lending. The main sources of risk exposures to customers identified were individual personal loans and commercial loans granted to private businesses and enterprises.

In line with the prudential requirement of Bank of Ghana, the bank developed its own internal risk management strategies for managing its credit risk. Some of these included credit policies and strategies that outlined the credit appetite of the bank, credit governance structures and credit risk management and control systems.

Again, the study revealed that, the bank employs varied techniques to mitigate its credit risk exposures. Some of these measures include collateralization, exposures at default, probability of default, loan-given loss, the use of credit referencing bureau and insurance of loans granted. That is, customers are required to pay a certain percentage as insurance for loans contracted. The insurance protects the bank against default as a result of the death of the customer or any permanent disability which will render the borrower incapable of paying the facility. Among the factors which accounted for loan default, were ineffective monitoring of loans, and poor credit appraisal. It was noted a major challenge encountered during loan recovery was inadequate information on customer location such as residential address which is either incorrect or not easy to trace. Also, new credit policies formulated are not communicated on time across the departments of the bank. This demon strates an institution alcommunication failure IV.

23. Recommendations

From the observations through the study, submitted that, to improve upon credit risk management, banks should improve upon its loan monitoring as loans default could be minimized through regular monitoring and supervision of credit granted to customers. Again, effective monitoring would prevent diversion of funds into other business ventures instead of the intended purposes. Also, effective monitoring of loan facilities through field visits and reviewing of customers' accounts on regular basis enables the bank to assess borrowers' current financial conditions, ensure the adequacy of collaterals, ensures that loans are in compliance with the terms and conditions of the facility, and identify potential challenges in relation to loans, for necessary action to be taken.

Regular training programmes for credit staff in areas such as credit appraisal, risk management and financial analysis should be frequent as knowledge and technology in those are changing fast. Effective training modules must be designed to advance the knowledge and skills of Credit staff so as to improve the quality of credit appraisal.

It is necessary that banks participate actively in operations of the credit referencing bureau by providing the centre with relevant information on their borrowing customers. This will enable the banks to share information on their recalcitrant borrowers and reduce the risk of default. Also, customers with bad credit history could then be denied credit and improve the loan quality of the bank.

Additional motivation should be given to performing Credit Risk Departments on the basis of amount of loans as well as the quality of the loan portfolio, to improve upon the safe growth in assets of the bank.

V.

24. Conclusion

In conclusion, one could submit that banks, in Ghana have Credit Risk Management policies that comply with international standards and the worked out policies and strategies are satisfactory. However, there are some implementation challenges which have resulted to worsening quality of the loan portfolio. To improve upon the portfolio quality, some banks have restructured their credit programmes and have suspended lending to Small and, Medium Enterprises (SME) subsector, which is considered risk prone. Although that policy could have positive effect on the credit activities of the bank it is not poverty reduction friendly as many SMEs in developing countries are among the poor in society. Notwithstanding their profit motive and sustainability, the submission is that when banks are restructuring their policies with reference to Credit Risk Management they should formulate policies which are poverty friendly especially in developing countries to improve the effect of the banking industry on the society.

| Category | Provision (%) | Number of days | |

| of | |||

| Delinquency | |||

| 1 | Current | 1% | 0-Less than 30 |

| 2 | OLEM | 10% | 30-Less than 90 |

| 3 | Substandard | 25% | 90-Less than 180 |

| 4 | Doubtful | 50% | 180-Less than 360 |

| 5 | Loss | 100% | 360 and Above |

| Source: Banking Act, 2004, Section 53(1) | |||

| Management | |||||

| Variable | Likert Scale | ||||

| (1-5) | Mean | ||||

| Relevant (2) | 60 | 27 | 60 | 49 | |

| Neutral (3) | - | 6 | - | 2 | |

| Irrelevant (4) | - | - | - | - | |

| Very irrelevant (5) | - | - | - | - | |

| Total | 100 | 100 | 100 | 100 | |

| Source: Authors' construct | |||||

| Variables | N | Likert Minimum | Scale Maximum | Mean | Deviation Standard | Ranking |

| Ineffective monitoring | 32 | 1.00 | 5.00 | 3.3750 | 1.53979 | 1 st |

| Poor credit appraisal | 33 | 1.00 | 5.00 | 3.2727 | 1.68213 | 2 nd |

| Ineffective credit review process 32 | 1.00 | 5.00 | 3.1250 | 1.62143 | 3 rd | |

| Non-compliance with credit policy 34 | 1.00 | 5.00 | 3.1176 | 1.82183 | 4 th | |

| Moral Hazard | 30 | 1.00 | 5.00 | 2.8333 | 1.44039 | 5 th |

| Business cycles | 30 | 1.00 | 5.00 | 2.6333 | 1.47352 | 6 th |

| 2007 | 2008 | 2009 | 2010 | 2011 | |

| Portfolio At Risk (PAR) | 7.95 | 13.10 | 44.01 | 37.3O | 21.20 |

| Risk Coverage Ratio (RCR) | 9.65 | 42.20 | 22.20 | 9.30 | 3.2 |

| Write-off-ratio( WOR) | 0.77 | 5.52 | 9.75 | 3.50 | 0.69 |

| Source: Author's Construct |