1. Introduction

n recent years, the developing countries, Nigeria inclusive faced several problems hindering economic development, the most visible ones are the increased deficit of the state's general budget, the increased balance of payment deficit, the rise of inflation rates, either demand inflation or production costs inflation, the rise of unemployment rates and the existence of structural defects between fiscal and monetary policies. Besides, the economic deformations resulted from the difference between social and political targets, on the one hand, and the economic targets in managing and mobilizing the available economic resources.

Over the past decades, the Nigeria economy has been exemplified by high-ceilinged balance of payment deficits and declining trade balances. Several doubt, the uniqueness of national income accounting warrants that national budget deficits must create either a surplus of private saving over investment or an excess of imports over exports. Typical economic reasoning suggests that government borrowing reduces the domestic supply of funds available to finance new investment that piloted an inflow of funds from abroad. A counterbalance adjustment to balance of payment account is essential to reinstate domestic account balance.

Under this consideration, an issue that has engaged the minds of governments for past decades is the effectiveness of monetary policy in influencing economic variables. Udegbunam (2003) argued that despite the lack of consensus among economists on how it actually works and on the magnitude of its effect on the economy, there is a remarkable strong agreement that monetary policy has some measure of effects on the economy. Monetary policy refers to the combination of measures designed to regulate the value, supply and cost of money in an economy, in consonance with the level of economic activities. It can be described as the art of controlling the direction and movement of monetary and credit facilities in pursuance of stable price and economy growth in an economy (CBN, 1992).

The monetary authorities "i.e. the Central Bank" must take a deliberate effort to control the money supply and credit conditions for the purpose of achieving broad economic objectives. Monetary policy rests on the relationship between the rates of interest in an economy, that is, the price at which money can be borrowed, and the total supply of money. Monetary policy uses a variety of tools to control one or both of these, to influence outcomes of macroeconomic stability which involves the achievement of internal and external balance. The internal balance refers to achievements of price stability (inflation), low unemployment, high and stable economic growth, while the external balance refers to achievements of balance of payments Year 2015

2. ( )

A equilibrium and exchange rates stability (Chibundu, 2009). Kemp (1975) identified two major shortcomings that were apparent towards the exploration of the body Y BOP Y BOP researchers believe that these characteristics are intimately, and even feasibly causally, related. Without a of research dealing with the balance of payments. First, there are no widely accepted theories of balance payments which simultaneously incorporate the current and capital account. The great majority of models used in payments theory consider either the capital account or the current account separately. Second, there have been very few attempts to include even the fundamentals of portfolio choice theory in balance of payments (BOP) models. In spite of this, this is surprising in view of the essential monetary nature of payment theory. The conversation of balance of payments problem and what should be done about its empirical research will invariably involve the mentioning of monetary policy. In addition, anyone who discusses an economy's monetary policy will almost certainly mention the balance of payments situation (Grove, 1965). Hence, observation and logic therefore convinces that monetary policy and balance of payment are intermeshed to such a degree that one cannot be fruitfully discussed without the other.

However, the main relevance of the study lies in its attempt in establishing the growth effect of monetary policy and balance of payments problems. In particular, by using Nigeria as an empirical evidence, the research provide quantitative information which enable us know and when to use monetary policy to restore economic growth to its long-run path being distorted by balance of payments problems. If a significant negative relationship is established between balance of payment and domestic credit expansion, the implication for monetary management will be that the manipulation of domestic credit by the monetary institutions or authorities will enhance balance of payments viability overtime especially at this critical moment of the nation's economic circumstances. On the other hand, if no significant negative relationship is established, it follows that the Nigerian monetary and fiscal authorities should give greater priority to other policy instruments or measures to achieve balance of payments stability.

Similarly, different views and analyses were given by various scholars on the definitional approaches to balance of payment; the fact still remains that balance of payments problem persistent and its inherent growth consequences. Invariably, these problems dictate macroeconomic performances, amidst the ineffectiveness of monetary policy instruments in the growth adjustment process. This argument forms the main thrust of this paper to investigate the in Nigeria between 1980 and 2013. This covers the pre structural adjustment programme (pre-SAP, 1980(pre-SAP, -1985)); SAP era (1985)(1986)(1987)(1988)(1989)(1990)(1991)(1992)(1993), post-SAP (1994)(1995)(1996)(1997)(1998)(1999)(2000)(2001)(2002) and the current National Economic Empowerment Development Strategy (NEEDS) era (2003)(2004)(2005)(2006)(2007)(2008)(2009)(2010)(2011)(2012)(2013).

The remaining part of this paper is structured into five sections. Section two covers the theoretical and empirical review, followed by stylized facts on economic growth, balance of payments, and monetary policy nexus in Nigeria as presented in section three. Section four presents the econometric model and employed methods of estimation. The results and discussion are shown in section V. Section six concludes and recommends.

3. II. Theoretical and Empirical Review

Historically there have been different approaches to the question of how or even whether to eliminate current account or trade imbalances. With record trade imbalances held up as one of the contributing factors to the financial crisis of 2007-2010, plans to address global imbalances have been high on the agenda of policy makers since 2009. Within the international economics literature, there have been three principal approaches to analyzing devaluation. These are the elasticity approach, the absorption approach and the monetary approach. Differences among these approaches have occasionally been the focus of sharp controversy, most notably in the case of elasticity and absorption, and recently in the case of the monetary approach as contrasted with the others. It should be noted that each approach has its own sets of arguments; hence, the three approaches are elasticity approach, absorption approach and monetary approach.

There are plethora of studies on the effect of monetary policy on balance of payments and growth, but very few studies have documented for the simultaneous nexus among economic growth, balance of payments, and monetary policy in Nigeria. This empirical gap justifies the focus of this study. However, some of the documented studies in those aspects with different views are reviewed herein. For instance, Egwaikhide (1999) shows that between 1953 and 1989, imports as proportion of GDP did not fall below 10 per cent except for 1974 and 1986. Nwani (2005) investigates the long-run determinants of balance of payments dynamics in Nigeria over a period of 22 years i.e. 1981 to 2002 using three methods of analysis, namely OLS, Co-integration and ECM. The results gotten from the research study indicate that balance of payment co-integrated with all the identified explanatory variables, suggesting that balance of payment fluctuations in Nigeria could be caused by the level of trade openness, external debt burden, exchange rate movement and domestic inflation.

On the degree of openness, Aliyu (2007) discovers that the measure of openness was 40% in 1989, 64.8% in 1992, 86.9% in 1995 and then fell to 73.6% in 1997. The study further shows that for ten

4. Global Journal of Management and Business Research

Volume XV Issue VIII Version I Year ( ) A years, that is, from 1989-1998, except for 1993, 1995 and 1998 the BOP balance was consistently in deficit. Thus, the size of the openness of the economy and the pattern of disequilibrium in BOP explain how this disequilibrium is transmitted promptly and widely to the rest of the economy.

Radulescu, (2007) examined the monetary factors influencing the elements of the balance of payments in Rome using OLS and ADF. From his study, he observed that the monetary policy of the central authority did not support the efforts for the recovery of the economy. Almost during the entire decade, the monetary policy was harsh, restrictive, basically oriented towards controlling inflation, thus neglecting the other macroeconomic variables, such as the local savings discouraged by the high inflation and the investments that would have supported the economic growth.

Gulzar and Feng (2007) studied how balance of payments can act as a constraint to the rate of growth of economic output in long-term in Spain within 1850 to 2000. They discovered that the Spanish rate of GDP growth was slightly above both the EU's growth rate, and the balance of payments-constrained growth rate, so that the foreign sector would have worked to some extent, although very mildly, as a constraint to the growth of the Spanish economy in the long run.

Vasquer, Javier and Chaquero, (2007) proposes a methodology for analyzing the effect of balance of payments liberalization on measures of poverty and distribution problems in Jamaica with a glossary look at both micro and macro simulation of the cost of rent seeking. In the application to Jamaica, we find that the reallocation of resources away from rent-seeking activities in the presence of exchange controls is significant and has large macroeconomic effects. Opening up of the current account has little effect on poverty, but liberalization of the capital account reduces poverty, especially amongst the very poor.

Umer, Abro and Ghazali (2010) examined how Pakistan's balance of payments deficit is being influenced by different factors using OLS, Cointegration, ECM. The results show that the roles of monetary variables for Pakistan's balance of payment do not determine economic growth empirically.

5. III. Stylized Facts: Economic rowth and Balance of Payments in Nigeria

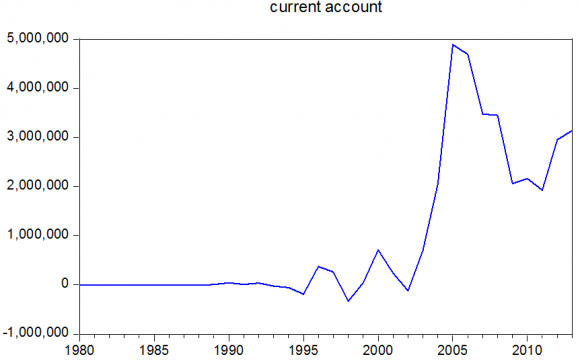

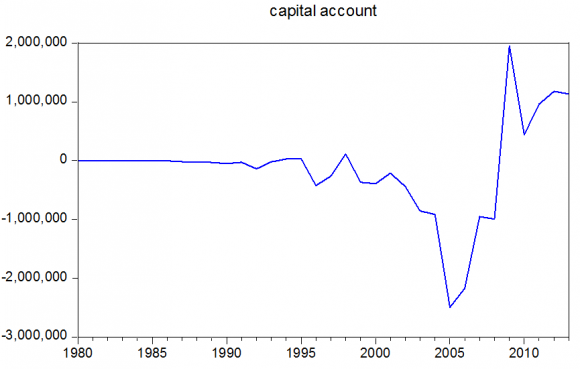

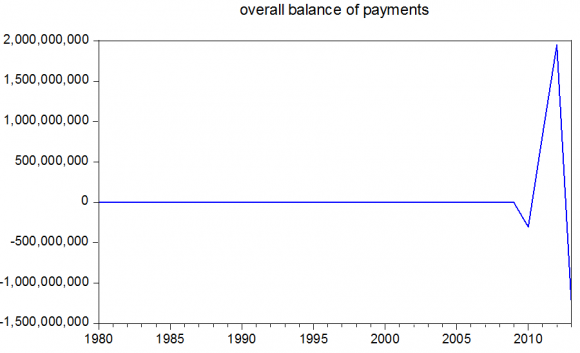

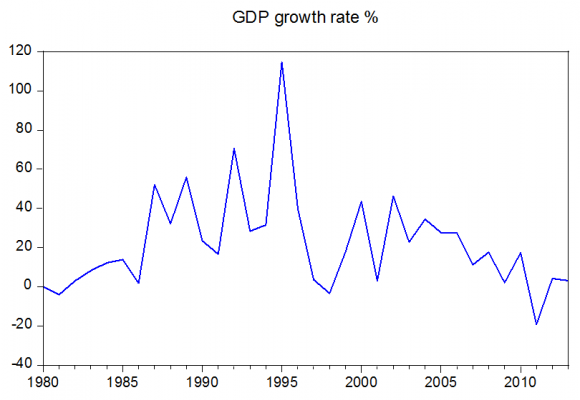

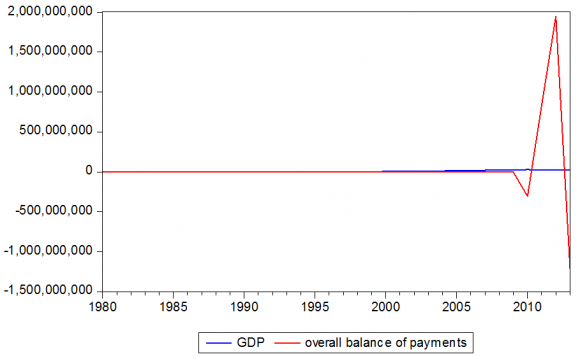

This phase of the paper accesses the trend of balance of payment in relation with economic growth in Nigeria between a decade after independence (1970) and 2010. This enables to determine causal relationship between balance of payments components (current and capital account) and economic growth proxy as growth rate of gross domestic product (GDP). The time series plot of current and capital accounts are presented in Figure 3.1 and 3.2 respectively, the total balance of payments is presented in Figure 3.3, while the plot of gross domestic growth rate is shown in Figure 3

6. Econometric Methods: Specification and Description

This section of the paper presents the methodological description for the effect of balance of payments and monetary policy on economic growth in Nigeria between 1980 and 2013. The time frame is chosen to cover the eras of economic programmes in Nigeria, like the Pre Structural Adjustment Programme (SAP), Structural Adjustment Programme (SAP), Post-Structural Adjustment Programme (Post-SAP), and the current National Economic Empowerment Development Strategy (NEEDS) era. In order, to achieve the research objective precisely, this section of the study focused on the model description of the methodology employed for detailed econometric analysis.

7. a) Model Specification

The econometric model employed by Kallon (1994) within the general framework of Thirlwall and Hussain (1982) as described by the simple openeconomy LM model is employed to derive the long-run BOP Growth constraint equation. Balance of payments (BOP) constrained growth model equation is also known as Thirlwall's law and it states that an increase in the income elasticity of demand for imports reduces equilibrium income growth rate with respect to the balance of payments. The econometric specification of the equation is proposed by Thirlwall and Hussain (1982) as follows

????(?? ?? ) = ?? + ??????(?? ?? ) + ?? ??(1)Where ?? ?? is domestic income level, while ?? ?? is the value of domestic exports. This equation states that domestic income is determined by domestic exports. The implicit income elasticity of imports can be obtained by the inverse of coefficient ??. Using this framework, Kallon (1994) further restructured the theoretical equations in a LM model of the form:

?? ?? =? 1 ?? ?? +? 2 ð??"ð??" ?? +? 3 ?? ?? ð??"ð??" +? 4 ?? ???1 (? 1 ? 2 ? 3 ? 4 > 0) (2)Where equation ( 2) is the commodity market equilibrium, which is assumed to depend on the domestic interest rate (r), level of government spending (g), the relative price (P f ) and the real income (Y) of the previous year. On the other hand, the money market equilibrium (LM) equation is of the form:

M ?? = ?? 1 ?? ?? + ?? 2 ?? ?? + ?? 3 ???? ?? (?? 1 > 0, ?? 2 , ?? 3 < 0) (3)That is money market equilibrium is assumed to depend on real income (Y), domestic interest (r) and the domestic inflation rate (OP). BOP constraint growth model is assumed to be independent of real income (Y) with some lags, relative price (P f ) and the differential between the domestic interest rate and the sum of the foreign interest rate and the expected change in the exchange rate (er). Hence, the balance of payment constraint growth model is of the form:

?? ?? = ? 1 ?????? ?? + ? 2 ?? ?? ð??"ð??" + ? 3 ?? ??(4)The theoretical derived balance of payments constraint growth model (4) within the Thirlwall's law and IS-LM framework is further modified for the study of Nigeria balance of payment position. However, following the law of one price (i.e. purchasing power parity), the relative prices reflects the cross-country exchange rate between trading partners (i.e. between Nigeria and U.S). This justifies the use of exchange rate as a proxy of relative prices. The theoretical adopted model is modified with the incorporation of first lag of balance of payment balance (BOP t-1 ) and exchange rate (er) in order to ensure dynamism in the model as follows:

t t t t t t t u INT MS ER Y BOP Y BOP RY + + + + ? ? ? ? ? ? + ? ? ? ? ? ? + = ? 5 4 3 1Therefore equation ( 5

8. b) Apriori Expectations

The apriori expectation provides expected signs and significance of the values of the coefficient of the parameters under review on the part of the empirical evidence and theoretical assertions. All, the incorporated variables in theoretical modified model balance of payments constraint and monetary policy growth model ( 5) within the Thirlwall's law and IS-LM framework are expected to enhance economic growth positively excluding lending rate.

All the independents variables are expected to have positive relationship with the dependent variable.

And this implies that if there is increases in the independents variables there will also be a proportionate increase on the dependent variable and vice versa.

9. c) Diagnostic Test i. Pre Estimation Diagnostic Test

The time series properties of the variables incorporated in the dynamic model ( 5) is examined using the Augmented Dickey-Fuller unit root test in order to determine the long-run convergence of each series to its true mean. The test involves the estimation of the following:

? = ? ? + ? + + = ? n i t i t i t t Z Z Z 1 1 1 0 ? ? ? ? (6) ? = ? ? + ? + + + = ? n i t i t i t t Z t Z Z 1 1 1 1 0 ? ? ? ? ? (7)The time series variable is represented by Z, t an t ? as time and residual respectively. The equ. (6) and ( 7) are the test model with intercept only, and linear trend respectively. Also, the paper examined the long-run relationship or cointegration among economic growth, balance of payments and monetary policy in Nigeria using single equation residual based techniques such as Engle-Granger two procedure test. The test has the null hypothesis of "series are not cointegrated".

ii

10. . Post Estimation Diagnostic Test

The specified autoregressive model ( 5) is estimated through the use of Classical Normal Least Square Estimator and other time series diagnostic tests are employed like Ramsey RESET test for the entire structural stability of the model in line with underlining classical assumptions; residual diagnostic tests like Histogram normality test, and Breusch-Pagan-Godfrey (BPG) Heteroskedasticity test.

11. d) Required Data and Sources

The required data for the empirical estimation of the specified econometric model is gross domestic product (GDP), real GDP, broad money supply, interest rate or monetary policy rate, and exchange rate of naira vis-a-vis U.S dollar. Based on the nature of incorporated variables in the formulated model, secondary data is employed for detail analysis. The time series data are sourced from the Central Bank of Nigeria (CBN) Statistical Bulletin, Volume 21, 2013 and World Development Indicator (December, 2013).

V.

12. Results and Discussion

This section of the paper presents the results of estimated Augmented Dickey-Fuller (ADF) unit-root test models in 5.1 and the estimated regression result for the dynamic model is shown under section 5.2.

13. a) Time Series Stationary Test and Cointegration Results

The stationary test results of the incorporated times series variables in the dynamic model expressed in equation ( 5) is presented in table 5.1 using the ADF unit-root test. The test result indicated that the time series variables, log of real gross domestic product (

14. RY ln

);exchange rate of naira via-a-vis U.S dollar (ER); log of broad money supply (lnMS), and monetary policy rate or interest rate (INT) were found to reject the null hypothesis "no stationary" at first difference. This indicates that those incorporated series in the dynamic regression model have no unit-root or are stationary at first difference and this implies that these series in their first difference are mean reverting and convergences towards their long-run equilibrium. Also, unlike other enumerated series, balance of payments as a percentage share of gross domestic product ( Y BOP ) is the only time series variables found to reject the null hypothesis "no stationary" at level. However, the linear combination of log of real gross domestic product ( RY ln

), balance of payments as a percentage share of gross domestic product ( Y BOP ), exchange rate of naira via-a-vis U.S dollar (ER), log of broad money supply (lnMS), and monetary policy rate or interest rate (INT) yields the estimated error term ( t t u ect = ). The estimated error term ( t ect ) as shown in Table 5.1 was found to reject the null hypothesis "no stationary", which implies the null hypothesis "no cointegration" is rejected following the Engle-Granger cointegration procedure.

15. b) Dynamic Model Results

The estimated dynamic regression model that captures the effect of balance of payments and monetary policy variables on economic growth is shown in Table 5.2. The coefficient, residual and stability diagnostic tests results are reported in Table 5.3 and 5.4 for the estimated dynamic model. The estimated dynamic regression model in Table 5.2 indicated that balance of payments as a percentage share of gross domestic product ( Y BOP ), first lag of balance of payments as a percentage share of gross domestic product

( ( ) 1 ? t Y BOP), exchange rate of naira via-a-vis U.S dollar (ER), log of broad money supply (lnMS), and monetary policy rate (INT) have positive effect on log of real gross domestic product ( RY ln

) in Nigeria between 1970 and 2010. These conform with the apriori expectations excluding the effect of interest rate as a monetary policy variable.

In magnitude term, a percentage change in balance of payments to gross domestic product ( Y BOP ), first lag of balance of payments to gross domestic product ( ( )

1 ? t Y BOP), exchange rate (ER), and monetary policy rate (INT) results to 1.65%, 1.16%, 0.1%, and 4.3% change in real gross domestic product (lnRY) respectively during the considered time-frame. However, in partial significance test using t-statistic indicated that among all incorporated factors, it is only first lag of balance of payments to gross domestic product ( ( ) 1

16. ? t Y BOP

) and exchange rate (ER) that does not have significant effect on real gross domestic product (lnRY) as a measure of economic growth in Nigeria. This further revealed that balance of payments and monetary policy have significant effects on economic growth in Nigeria during the reviewed periods.

Similarly, the F-Statistic results indicated that balance of payments, monetary policy variables and other control variables have simultaneous significant effect on economic growth in Nigeria. This complements the results of the adjusted R-squared that revealed that 98.5% of the total variation in economic growth proxied by real gross domestic product is accounted by changes in that balance of payments as a percentage share of gross domestic product ( Y BOP ), first lag of balance of payments as a percentage share of gross domestic product ( ( ) 1

17. ? t Y BOP

), exchange rate of naira via-a-vis U.S dollar (ER), log of broad money supply (lnMS), and monetary policy rate (INT). The diagnostic test presented in Table 5.3 indicated that the residual generated from the dynamic model shown in Table 5.2, is found not to reject the null hypothesis of "normally distributed" at 5% significance level. Similarly, the White heteroskedasticty test result also indicated that the test statistics are insignificant at 5% and thus call for the acceptance of the null hypothesis "homoskedasticity". However, the overall stability of the model is examined using the Ramsey RESET test and the non-significance of the test statistics suggests that no specification error and justify the structural fit of the model for policy simulation. These diagnostic tests indicate that there is no violation of the classical linear regression considered assumptions for analyzing the effect of balance of payments and monetary policy on economic growth in Nigeria between 1980 and 2013. The reported co-efficient diagnostic test in Table 5.4, Variance Inflation Factor is employed to examine the presence of multicollinearity. The result indicated that centered VIF value for each of incorporated explanatory variables is less than 10 benchmark value. This indicates that none of the explanatory variables [balance of payments as a percentage share of gross domestic product ( Y BOP ), first lag of balance of payments as a percentage share of gross domestic product ( ( ) 1

18. ? t Y BOP

), exchange rate of naira via-a-vis U.S dollar (ER), log of broad money supply (lnMS), and monetary policy rate (INT)] is found co-linear. This implies that there is no multicolinearity problem in the estimated dynamic regression.

19. VI.

20. Conclusion and Recommendation

This study critically examined the precise effect of balance of payment deficit and monetary policy on economic growth in Nigeria between 1980 and 2013. This ranges from the period of Pre and Post Structural Adjustment Programme (SAP) eras. During these eras, the Nigerian economy has undergone series of economic reforms over the years. The study also incorporates the significance effect of balance of payment, money supply and interest rate on economic growth. On this basis, a dynamic econometric model

21. Global Journal of Management and Business Research

Volume XV Issue VIII Version I Year 2015 ( ) A was formulated and the results indicated that balance of payments and considered monetary policy variables (money supply and monetary policy rate) were found to exert positive and significant effect on economic growth in Nigeria. The joint significance of the incorporated time series using F-Statistics yield the conclusion that "balance of payments deficit and monetary policy have significant effect on economic growth in Nigeria" during the reviewed periods.

However, the observed nature of the effect of balance of payment deficit and monetary policy on economic growth in Nigeria yields the following strategic policy options are proffered as follows: a) The central authority should adopt a policy of export promotion combined with an import substitution strategy could be rational in terms of policy prescriptions, since both strategies lead to moderate balance-of-payments constraints in the long run. b) It is observed that monetary policy stimulates growth better under a flexible rate regime but it is accompanied by severe depreciation, which could destabilize the economy. In other words, monetary policy would better stabilize the economy if it is used to target inflation directly than be used to directly stimulate growth. c) The government should acknowledge that Excessive money supply is the loss of reserves which is another fact for policy makers in case of Pakistan. So, monetary authorities should control money supply while considering the balance of payments. Economic growth can be achieved through money demand to remove the balance of payment deficit.

| ADF Tau Statistics | Order of | |||

| Variable | Intercept | Linear Trend | Integration | |

| ln | RY | |||

| Dependent Variable: | ln | t RY | ||||||||

| Method: Least Squares | ||||||||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. | ||||||

| c | 2.03338* | 0.452249 | 4.496149 | 0.0001 | ||||||

| ( | BOP | Y | ) t | 0.0165** | 0.008807 | 1.875912 | 0.0693 | |||

| ( | BOP | Y | ) 1 ? t | 0.011583 | 0.009192 | 1.260020 | 0.2162 | |||

| t ER | 0.001032 | 0.002385 | 0.432577 | 0.6681 | ||||||

| ln | MS | t | 0.90312* | 0.050947 | 17.72665 | 0.0000 | ||||

| t INT | 0.04279* | 0.014499 | 2.951764 | 0.0057 | ||||||

| R-squared | 0.986968 | F-statistic | 514.9795 | |||||||

| Adjusted R-squared | 0.985051 | Prob(F-statistic) | 0.000000 | |||||||

| S.E. of regression | 0.324486 | Durbin-Watson stat | 0.615324 | |||||||

| Note: * significant at 1%; ** significant at 5. The values shown in brackets are standard error | ||||||||||

| Source: Authors Computation, 2015 | ||||||||||

| Model 1 | |||

| Residual Normality Test | |||

| Jarque-Bera | 0.10384 | Prob(J.B) | 0.9494 |

| Heteroskedasticity Test: White | |||

| F-statistic | 1.6987 | Prob. F(20, 19) | 0.1268 |

| Obs*R-squared | 25.653 | Prob. Chi-Square(20) | 0.1776 |

| RESET Test | |||

| F-statistic | 0.8301 | Prob. F(1, 33) | 0.3688 |

| Likelihood ratio | 0.9937 | Prob. LR(1) | 0.3188 |

| Source: Authors Computation (2015) using E-Views 7. | |||

| Variance Inflation Factors | |||||||||

| Included observations: 40 | |||||||||

| Coefficient | Uncentered | Centered | |||||||

| Variable | Variance | VIF | VIF | ||||||

| c | 0.204529 | 77.70049 | NA | ||||||

| ( | BOP | Y | ) t | 7.76E-05 | 1.680750 | 1.578203 | |||

| ( | BOP | Y | ) 1 ? t | 8.45E-05 | 1.830828 | 1.718515 | |||

| t ER | 5.69E-06 | 10.45418 | 6.588567 | ||||||

| ln | MS | t | 0.002596 | 140.3733 | 7.176197 | ||||

| t INT | 0.000210 | 11.86074 | 2.231032 | ||||||

| Source: Authors Computation (2015) using E-Views 7. | |||||||||