1. Introduction

t was on the 90's that was verified a big impulse on investigation about intangible assets and its potential on the increment of publications about Intellectual Capital. Notwithstanding, Rodrigues et al. (2009) mention having distinct strategic and operational barriers in management of intellectual capital, essentially, in the hard task of identifying and measuring these intangible assets and establishing objectives and plans to them.

Many times the intellectual capital is recognised by authors as an intangible asset. Silva, Bilich and Gomes (2002) adopt an analysis of intellectual capital as a significant intangible asset. In their studies, the intellectual capital is a term used to describe organisations of Knowledge that use their intangible assets as resources to get competitive advantages. They also utilise other intangible assets like, techniques, specific products, patented processes, know how inherent to production and to market knowledge. As detaches, the authors mention Brooking (1996) in understanding of intellectual capital as a combination of intangible assets, each time more valorised by changes brought with knowledge management.

Thus, the identification, valour generation and other classifications related to intellectual capital, dispenses of approaches that can verify them and measure them in organisational context.

In this scope, is denoted the importance of intangible assets, that must be sought for measurement of intellectual capital, because, as regards non-corporeal property and highly subjective, it's possible to apply tools that make them quantifiable. (HOSS et al., 2009).

In this way, this article has as objective making a review of models for measurement of intellectual capital to assist the decision making. It is organised by the following way: (i) introduction with scope and study objective; (ii) intangible assets, intellectual capital, with differences and similarities; (iii) methodology; and (iv) results and discussions with the classification of the intellectual capital and evaluation models; at last, the bibliography that gave support to the study.

2. II.

3. Theorical Referential a) Intangible Assets

The importance of knowledge in the socialeconomical context became frequent in the end of the 20th century, due to pioneer works, like Alvin Toffer's (1990) work, and Petter Drucker's (1981) work, regarding the ascension of intellectual work and the importance of knowledge are stressed.

Yet, Graciolli (2005) says that between many chains of studies that there are about knowledge in organisations, there is one that focuses on intellectual capital. The main argument in this chain can be summarised through observation that there are assets generically called intangible, as shown by Sveiby (1998) and Edvinsson (1998), that provide the development and valorising o the organisation, and not those necessarily present in physical property of the company. These elements suggest a new way of visualising how organisations generate value, for the necessary assets to the creation of wealth wouldn't be exclusively the land, physical work, mechanical tools and factories, but would be assets based in knowledge, that is, intangible assets (STEWART, 1998).

Guthie (2001) highlights that, the intellectual assets of the information era are the most important elements for competition between organisations. Since, it's possible to say that these intellectual assets, like knowledge, ideas, experiences and innovations of individuals, that, when identified, add value to the business.

In Sullivan's (2000) the conception of the evolution and importance of intangibles to the organisations was a result of the improvement of techniques and methods for the management of intellectual capital, that was presented as discipline, following a pattern that is detected in retrospective, though for people involved in the beginning there was no distinguishable pattern in that moment.

However, Bukh et al. (2003), emphasizes that the component intangible assets of intellectual capital of a company frequently interacts with the tangible assets or financial assets to create corporative value of economic growth. This can be observed, for example, in the case of a brand (intangible asset) that valorises a product of the company (tangible asset).

However Dzinkowski (1998), explains that in the way how it's released the word intellectual capital it still has many complex connotations, being frequently used as synonyms of "intellectual property", "intellectual assets"or "knowledge assets", for this way of capital can be thought as total inventory of resources of knowledge or liquid value based in the formalised knowledge that the company has and, as such, it can be final result of a process of application of knowledge or of own knowledge used under a way of information by the organisations and their methods of production.

4. b) Intellectual Capital

The companies of this century are not only connected to their predecessors of the industrial era, they are as well as more dependent of their employees, says Lev (2001), as they add knowledge to the productive processes and to the management in general.

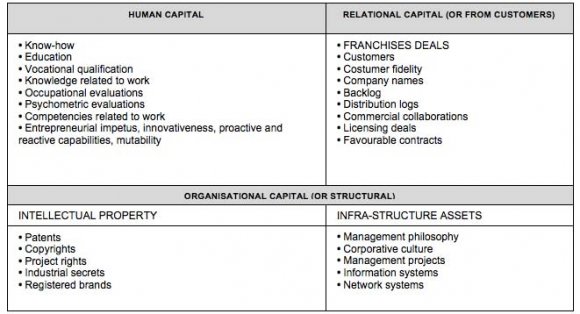

The table 1, provides a general view of the categories of existent resources amidst an organisation, and, at the same time, analyses them in topics, what constitutes the material resources (tangible) and immaterial (intangible) likely to be capitalised.

5. Table 1 : Categories and Resources of a company

Source: Granstrand (1999, p. 7).

In general, these immaterial categories (intangible) depend on, directly or indirectly, in the existence of qualified human resources and, therefore, as long as there is preoccupation with intellectual capital, there will be also a bigger valorisation of the human factor in companies.

Stewart (1998, p. 13) says that the intellectual capital "constitutes the intellectual-knowledge matter, information, intellectual property, experience that can be used to generate wealth. It is the collective mental capacity". Hence, the Intellectual Capital is admitted, as a whole of occult values that add value to organisations, allowing their continuity. Taking into account such concepts, it can be said that the Intellectual Capital is a set of values, be it capital, an asset or a resource, both find themselves occult and all tend to add real values to the organisation. Lynn (2000), from a variety of sources, it is developed a model of three components for intellectual capital that had been identified in Dzinkowski's (1998) research:

6. i. Human Capital

According to Lyn (2000, p.2), the human capital is presented as know-how, capabilities, abilities and specialisations of human resources of an organisation, it is one of the critical assets in the group of intellectual capital, since the management of human capital frequently creates and sustains the wealth of an organisation, in another words, the human capital can be seen as a set of abilities and knowledge of individuals in an organisation, and this can be measured and published.

7. ii. Organisational or structural capital

Covers the remaining elements of intellectual capital, including systems of information and values, along with elements of intellectual property, like patents,

8. MATERIAL (TANGIBLE) IMMATERIAL (INTANGIBLE)

? Fixed asset involves its organisational capability, including its management planning and control systems, processes, functional networks, policies and even its culture, in another words, all that helps a company to generate value. Understanding that internal systems, networks and culture are valuable assets that concentrate the attention of the organisation in ensuring that these assets appreciate themselves and add value, instead of allowing them to decline or get stagnated in face of the inappropriate policies and unhealthy strategic efforts (PACHECO, 2005).

iii. Relational capital (customers and suppliers) It is identified as an entity apart and, according to Lyn (2000, p.2), encompasses "any of the connections that people out the organisation have with it", along with loyalty of the customer, slice of market, level of orders, etc. It regards to the connections of an organisation with its customers and suppliers, what also creates value through fidelity, better markets, speed and quality. In this way, it can be translated in measures of habitual customers that their fidelity generate sells and reduce the costs of seeking new costumers. In the same way, the cultivation of good and dedicated suppliers can increase the efforts of just-in-time, raising the quality (settling already in the first time, principles of lean production) and reinforcing the necessary speed to reach the goals of commercialisation. This kind of capital can also be measured and capitalised as organisation resources.

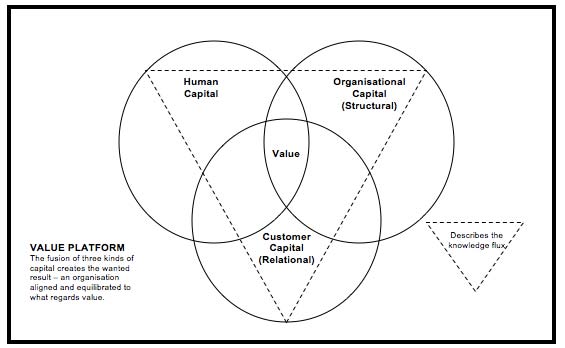

According to Dzinkowski (1998), there is a model of creation of value of intellectual capital that is composed by three instances that inter-relate to form the value of human capital, customer capital (relational) and organisational (structural). The creation of value, complement, and is the main goal of all commercial activities, while the fundamental function of traditional accountability is to provide trustable information to the external investors, and for this it depends of the sub adjacent economy of all the commercial activities, as shown in picture. While these characteristics imply that the management of intellectual capital will be singular in each organisation, it is presumed that the human capital act as a construction block of the organisational capital of a company, and the human capital and the organisational capital (structural) interact to create the costumer capital (relational) (DZINKOWSKI, 1998, p.4). In fact, the more circles are overlaid, the more value is produced. The structure of management of intellectual capital described here offers new ways of seeing the organisation and its core-competencies. However, many management concepts and methodologies that it proposes are parallel and well established management practical accountabilities (EDVINSSON & MALONE, 1998, p.133).

Lynn (2000), says that to comprehend better the intellectual capital and how to create organisational value, it must first be translated in more practical terms, seen that part of problem in this way of asset is that many organisations don't understand its sub adjacent power, and that, despite being intangible, this capital can be measured and capitalised.

The distinction between human capital and structural captain shows many similarities with the distinction between individual knowledge and shared knowledge. In general, the human capital of a company is based, above all, in individual knowledge, whilst its organisational capital (structural) is composed mainly of shared knowledge. (DZINKOWSKI, 1998).

9. III.

10. Methodology

This research had qualitative nature regarding the handled subjects, it was made research in scientific literatures and technical rules published in the last years. From the point of view of the objectives, this study classifies itself as exploratory and regarding to its technical procedures as bibliographic; as data base were used dissertations, technical books, articles and journals that address the subject. (GIL, 1999; LAKATOS e MARCONI, 2000).

The construction of the present article was developed through bibliographic survey covering the subject Intellectual Capital addressing its objectives, peculiarities and definitions, being presented next the various models to measuring the subject and the conclusive analysis of the work.

IV.

11. Results and Discussion

12. a) Classification of the Evaluation Methods

The methods of evaluation include the intangible assets and the intellectual capital complementarily, once the meaning of each can be considered unique for its comprehension.

The process of measuring the intangible assets takes into account its capability of generating wealth, regarding the past, present and future (HOSS et al., 2009). Complementarily, Sveiby (1998) reaffirms that the fluxes of knowledge and the intangible assets are not financial elements and demand financial actions as well as non-financial actions. Tiepolo and Rebelato (2004) emphasize that the main indicators of performance in companies are not limited only to financial data.

Under this perspective, in Tiepolo and Rebelato (2004), it is said that the indicators of performance are the basic components of a Performance System Measurement (SMD). To reaffirm the general objective of a SMD, that is to conduct the company to improve its activities, by the providing of aligned actions with the environment and the strategic objectives. These actions can be seen as essence of the improving of performance.

To Harvard Business Review (2000), the methods for development of new indicators of performance need to evolve with the raising of the level of knowledge of the company, and that the subject regarded is a new philosophy of evaluation of performance that addresses the task as a process in constant evolution. Frost (2000) defines three steps for the methods of measurement of performance: performance topics, critical factors of success and indicators of performance. Also determines that the metrics must provide better performance, measuring the capability and allowing comparability.

Consequently, Sveiby (1998) describes the indicators of growth and renovation, indicators of efficiency and indicators of stability, for three intangible assets, competency, internal structure and external structure.

In addition to this description, classifies the methods of evaluation of intangible assets and intellectual capital in four categories:

13. a) Direct Methods Intellectual Capital (DIC)

Estimates the value of intangible assets by the identification of its many components. Since these components are identified, they can be directly evaluated, individually or as an aggregated coefficient.

14. b) Market Capitalization Methods (MCM)

Calculates the difference between the market capitalisation of the company and its liquid patrimony as the value of its intellectual capital or intangible asset.

15. c) Return on Assets Methods (ROA)

The average of profit before the taxes of a company in a moment is divided by the average of tangible assets of the company. The result is a ROA of the company that is then compared with the average of the industry. The difference is multiplied by the average of tangible assets to calculate an annual average income of the Intangible. Division of the remuneration earned above the average cost of the company capital or interest rate, can derivate an estimated value of its intangible assets or intellectual capital.

16. d) Scorecard Methods (SC)

The different components of the intangible assets or intellectual capital are identified and the indicators and indexes are generated and related in the scorecards or as graphics. SC methods are similar to DIC methods, an index composed can or cannot be produced. Sveiby (2012) explains that the methods provide different advantages and disadvantages. The methods that offer valuations, like the methods of ROA and MCM are useful in situations of fusion and acquisition and evaluations of the stock market, they can also be used for comparisons between companies of the same sector and are useful to illustrate the financial value of intangible assets, a characteristic, which tends to draw attention of the CEOs.

Finally, because it build rules of established accountabilities and are easily communicated in the account work. Its disadvantages are that, translating all in financial terms can be superficial.

The ROA methods are very sensible to the interest rate and to the discount rate. The presupposed and the methods that measure only in the standard of the organisation are of limited use for management purpose, many of them are of no use to organisations without lucrative meanings, whole departments and organisations of the public sector, this is particularly true for the MCM methods.

The advantages of DIC and SC methods are that they can create an broader image of organisational health and financial metrics that can be easily applied at any standard of an organisation. They measure closer an event and reports and can, therefore, be faster and more precise than the pure financial measures. Once that they don't need to measure in financial terms, they The methods are also new and not easily accepted by societies and managers that are used to see everything from a purely financial perspective. The extensive approaches can generate oceans of data, which are too difficult to analyse and to communicate.

17. e) Methods of evaluation of the intellectual capital

With the understanding of the mentioned classification, follows the exhibition of 30 methods of evaluation cited and compiled by Sveiby (2012).

| ANO METHOD | AUTOR | DESCRIPTION | |||||

| 2009 ICU Report | Sánchez, | Elena | e | ICU is a result of an EU-funded project to design an IC | |||

| (Intellectual Capital University) | Castrillo | report specifically for universities. Contains three parts: (1) | |||||

| Vision of the institution, (2) Summary of intangible | |||||||

| resources and activities, (3) System of indicators. | |||||||

| 2009 IabM | Johanson, Koga & Skoog Intellectual asset-based management (IAbM) is a guideline | ||||||

| (Intellectual | Assets-based | for IC reporting introduced by the Japanese Ministry of | |||||

| Management) | Economy, Trade and Industry. An IAbM report should | ||||||

| contain: (1) Management philosophy. (2) Past to present | |||||||

| report. (3) Present to future. (4) Intellectual-asset | |||||||

| indicators. The design of indicators largely follows the | |||||||

| MERITUM guidelines. Described in Johanson & al. (2009) | |||||||

| 2008 EVVICAE* | McCutcheon | Developed by the Intellectual Assets Centre in Scotland as | |||||

| (Estimated | Value | Via | a web-based EVVICAE toolkit based on the work of Patrick | ||||

| Intellectual Capital Analysis) | H. Sullivan (1995/2000). | ||||||

| 2007 DYNAMIC | MONETARY | Milost | The evaluation of employees is done with analogy from to | ||||

| MODEL | the evaluation of tangible fixed assets. The value of an | ||||||

| employee is the sum of the employee's purchase value | |||||||

| and the value of investments in an employee, less the | |||||||

| value adjustment of an employee. | |||||||

| 2004 NICI | Bontis | A modified version of the Skandia Navigator for nations: | |||||

| (National Intellectual Capital | National Wealth is comprised by Financial Wealth and | ||||||

| Index) | Intellectual Capital (Human Capital + Structural Capital) | ||||||

| 2003 DANISH GUIDELINES | Intellectual | Capital | A recommendation by government-sponsored research | ||||

| Statements -The New | project for how Danish firms should report their intangibles | ||||||

| Guideline | publicly. Intellectual capital statements consist of 1) a | ||||||

| knowledge narrative, 2) a set of management challenges, | |||||||

| 3) a number of initiatives and 4) relevant indicators. | |||||||

| http://en.vtu.dk/publications/2003/intellectual-capital- | |||||||

| statements-the-new-guideline | |||||||

| 2003 IC-dVAL* | Bounfour | "Dynamic Valuation of Intellectual Capital". Indicators from | |||||

| (Dynamic | Valuation | of | four dimensions of competitiveness are computed: | ||||

| Intellectual Capital) | Resources & Competencies, Processes, Outputs and | ||||||

| Intangible Assets (Structural Capital and Human Capital | |||||||

| indices). | |||||||

| 2002 Intellectus Model | Intellectus | Knowledge | Intellectus Knowledge Forum of Central Investigation on | ||||

| Forum | of | Central | the Society of Knowledge. The model is structured into 7 | ||||

| Investigation | on | the | components, each with elements and variables. Structural | ||||

| Society of Knowledge | capital is divided in organizational capital and | ||||||

| technological capital. Relational capital is divided in | |||||||

| business capital and social capital. | |||||||

| 2002 FiMIAM | Rodov & Leliaert | Assesses monetary values of IC components. a | |||||

| (Financial | Method | of | combination both tangible and Intangible assets | ||||

| Intangible | Assets | measurement. The method seeks to link the IC value to | |||||

| Measurement) | market valuation over and above book value. | ||||||

| 2002 Meritum Guidelines | Meritum Guidelines - | An EU-sponsored research project, which yielded a | |||||

| União Europeia | framework for management and disclosure of Intangible | ||||||

| Assets in 3 steps: 1) define strategic objectives, 2) identify | |||||||

| the intangible resources, 3) actions to develop intangible | |||||||

| resources. Three classes of intangibles: Human Capital, | |||||||

| Structural Capital and Relationship Capital. The original | |||||||

| Meritum final report can be found here. Meritum is also | |||||||

| further developed by members of E*KNOW-NET. A | |||||||

| summary is found on P.N Bukh's home page. | |||||||

| 2001 Knowledge Audit Cycle | Schiuma & Marr | A method for assessing six knowledge dimensions of an | |||||

| organisation's capabilities in four steps. 1) Define key | |||||||

| knowledge assets. 2) Identify key knowledge processes. | |||||||

| 3) Plan actions on knowledge processes. 4) Implement | |||||||