1. Introduction

ctions of influence are essential to the proper functioning of financial markets: they facilitate the allocation of resources which contribute in some way, to the adjustment of the positions of operators. In recent years they have become increasingly important to the point now of being an integral part of the strategies in major trading companies. Shown by actions of influence or by corporate lobbying, this activity is to conduct interventions designed to perform manoeuvres on the financial market to obtain, alter or oppose a decision.

In Morocco, the disaffection of investors, both domestic and foreign, generated an unprecedented decline in the stock market. As well as, falling stock indices in Casablanca, what concerns most professionals instead, is the anaemic level of trade recorded by the market within the last five years. This deterioration of liquidity generated in 2013 downgraded Morocco from being classed as an "emerging country" to a "border country" in the Morgan Stanley Capital International Emerging Market -MSCI EM 1 Therefore, Moroccan trading companies must provide more managerial effort in communication strategies and towards the influence of contributors in order to regain their confidence and thus restore the dynamism previously experienced before this period. In this way, the strong will of companies controlling the stock market push winning strategies by actions of influence to respond against operations of environmental destabilization. This study, is based on an analysis of the informative content of the actions of influence exercised by Moroccan companies listed between 2010 and 2013, and aims to measure the efficiency of such practices in terms of value creation.

2. II.

3. Influential Strategies Through Literature

While it is common to speak of lobbying in the US since the mid-eighties, the adoption of this terminology is not in our opinion a mere fad. Replacing the traditional terminology of financial communication has more to do with the idea of legal obligation, especially for trading companies; the influence of communication defends a different logic.

Considered a subjective construction of reality, the influence is a strategic process designed to increase awareness of the company's performance, promote its image, share strategic perspectives and express its values with investors and other stakeholders in order to maintain with them long-term relationships.

4. III.

5. The Theoretical Foundations of Influential Practices

The practice of influence appears as an object of research on the border of several disciplines: a) Political theories Approached in terms of theories of interest groups, the analysis of influence activities presents a real interest to the analysis of decision making. The different contributions in this area provide insights essential for the understanding of the practice as a way of defending the interests of companies. However, these theories do not address, or very rarely, issues relating to the purpose of economic and strategic actions of lobbying.

6. b) Economical theories

According to the treaties noted in the theory of the «resource dependence» (Pfeffer and Salancik, 1978), the influence allows the company to control vital resources necessary for its existence and to reduce uncertainty associated with it and therefore as a result give the procurer «guaranteed income» and thus increase its profits. For this part, the theory at play offers another interpretation, more hegemonic, it focuses on the analysis of the relationships between the players and

7. Global Journal of Management and Business Research

Volume XV Issue III Version I Year ( ) C the rationality of the driving influence. However, the advanced explanations given by such a mathematical model seem too simplistic to convey the process of influence, the complexity of the players and multiplicity and simultaneity of rationalities implemented.

8. c) Managerial theories

Contemporary models of strategic management perceive the influence as a key instrument for the sustainability of business. In the competitive analysis of Porter, for example, activities of influence appear to be a key factor of success. From another point of view, the theories of the firm including the property rights and information asymmetry emphasis more on analyzing the relationship of the firm with its environment. Thus, the introduction of the concept of "stakeholder" or "shareholder" has led to the emergence of a different kind of relationship between companies and environmental stakeholders namely: the relationship of influence.

IV.

9. The Challenges of Corporate Lobbying

This is to evoke in turn the financial issues, strategic and marketing actions of influence.

10. a) Financial issues

From a strictly financial point, the major issue of the action of influence is to reduce the asymmetric information that resides between the leaders and all stakeholders, including investors, financial intermediaries and prescribers. The influence process involves the dissemination of relevant, reliable, instant, financial as well as non-financial, that would contribute to the efficiency of financial markets 2 . The practice of influence wouldreduce the priceof volatility and increase liquidity. So it decreases the prime risk demanded by capital providers, and therefore lowers the cost of capital and further develops the expected cash flows further.

11. b) The strategic challenges

The share of influence goes beyond the financial logic and participates in the strategic development of the company, in the sense that it integrates, distributes and reveals the principles, rules, norms and values which constantly guide the company and define its image with various stakeholders .Integrated in the overall strategy of the company, this practice has the main function of legitimizing the action of the leaders of the firm by informing, educating or persuading the various external actors. This creates a sense of strategic credibility outside the company through the dissemination of reliable information, accurate and precise. The companies' leaders must also use messages reflecting on the one hand, their ability to control or change the environment and secondly, control over the organization.

12. c) Marketing issues

Through a good approach of influence, leaders seek to develop and retain their shareholdings by deploying ways to change in their direction, the conditions of the exchange between their trading companies and shareholders .The process akin well for marketing actions.

The shareholder marketing is a set of actions planned in the form of requests for a permanent savings available to convert demand for securities in favor of the company in order to realize a capital gain and / or return for its investors. This new dimension seeks to develop a long-term relationship with its shareholders for their loyalty.

13. V. The Legitimacy of the Evaluation of Actions of Influence

Like any strategic action, the practice of influence is conducted according to objective. Therefore, it must be evaluated to an end. But this postulate of performance measurement remains difficult to apply in reality. Indeed, apart from some quantitative studies (De Figueiredo and Tiller, 2001 and Madina Rival, 2002), the action of lobbying has been the subject of several descriptive studies and that are rather focused on certain aspects (political, collective action ...). In addition, there is little research on the assessment of economic, financial and policy of such a practice.

Despite this complexity, the evaluation of the strategies of influence is considered essential for two interests: the action of influence is an expensive activity in terms of resources, in addition, its losses are uncertain and therefore it is too risky.

a) The influence seen as a cost center An overview of the relative literature on the action of influence of corperations, allows us to identify three types of lobbying costs which are: i. Operating expenses They are usually related to the costs of the factors used by the company for the conduct of lobbying. They result from the aggregation of various expenses borne by the company include: cost of the day before, consultant fees, costs of lobbying media.

ii. Transaction costs They cover dealing costs, acquisition and transmission of information found in the activities of influence in companies.

14. c. Costs against influences

These are responses that can be exercised by competitors of the company or any other markets, reduce neutralizing the effect desired by the action of influence.

a) The influence as a performance vector From the above we can see that lobbying profits are not clear and have otherwise been very volatile. However, the important contribution of lobbying practitionershas allowed rare research on the subject which has highlighted the strategic nature of the action of influence. From this, if done well, could provide lobbying companies with a competitive advantage as a source of value creation3 4.

This original analysis lays the foundation of the debate of the profitability of lobbying that is evaluated by its ability to deliver value to the lobbying companies. Thus, it is possible to estimate the efficiency of the action of influence through the following formula: This reasoning leads us to question themethods of earnings valuation that are generated by the action of influence and therefore on how to approach its ability to create value for the lobbying firms.

In what follows, we are particularly interested in the analysis and evaluation of lobbying strategies of public trading Moroccan companies.

15. VI. Analyses of Specifications of Actions of Influence within Moroccan Trading Companies

Based on the foregoing assumptions, the measure of the relevance of the action of lobbying proves to be of great difficulty. Therefore, our study was inspired by similar research about the evaluation of some aspects of lobbying in other countries 4 5 . It is therefore of transposed tools adopted by this work toa Moroccan context. Thus we are particularly interested in the analysis of corporate lobbying practices that the company performs towards its financial environment.

Our work then seeks to examine the response of the Moroccan stock market towards the actions of influence exercised by trading companies and, ultimately, to explain the benefits of such a practice in training over the renown lobbying firms and thus the wealth of its shareholders.

Given the purpose of this study, a qualitative or quantitative approach alone is not sufficient. For this, a choice to combine the two approaches to retain a hybrid sequential approach was taken. First, with a qualitative approach, I proceeded to highlight the different practices of influence by our example companies by 4 A renown example of the research from MADINA RIVAL in the case of political actions of the French and British companies their ranking and ultimately lead to obtain some idea of the behavior of studied lobbying companies. Secondly, we tried through assessing the impact of the event of actions of lobbying identified by corporate performance and bring out the best practices contributing to the creation of value. This step reviews a quantitative perspective. The choice of the companies studied took place in two stages:

-Firstly, the study focused only on companies introduced before 2010; the addition of the recently introduced on the stock market could bias our assessment of the creation of shareholder value, as they could still be due to underestimation or on assessment in trading. ---Also, we eliminated from our field of study values for which the actions of influence are non-existent or rare (less than 6 shares) over the period of the study.

VII.

16. The Practice of Lobbying Amoungst Moroccan Trading Companies

In Morocco, the practice of lobbying is not popular among the majority of Moroccan companies. However, large companies have, over the past decade made undeniable efforts in this area. Current practices decision to act in their favor. Although Moroccan lobbying companies always act in response to the vagaries of their environment, some break the rule of silence and prefer to play the game; that of direct confrontation with the market.

This new trend of lobbying in Moroccan trading companies in particular, has fueled our thinking to measure the efficiency of such practices to create value for lobbying firms.

a) The data selection

17. Research of actions of influence by firms in our examples over the period of this study has led us to search the archives of two major journals in Morocco:

The ECONOMIST and LIFE-ECO. The choice of a data source is motivated by two reasons. On the one hand because of the lack of pre-established database of the actions of influence of Moroccan companies, on the other hand, the subject of confidentiality of lobbying companies prevents us from applying directly to these companies through interviews and questionnaires.

Thus, our empirical study involved 31 Moroccan companies listed in Casablanca stock exchange for which we collected 760 shares of influence over the period 2010 to 2013. A thorough recount was needed to identify the relevant actions to be adopted in our analysis. Finally, 232 actions are judged to be sufficiently appropriate to our research subject.

18. Global Journal of Management and Business Research

Volume XV Issue III Version I Year ( )

C 2015 © 2015 Global Journals Inc. (US) 1indicate, in fact, a tendency to go more and more to meet investors, trying to seduce and guide their VIII. Evaluation of the Actions of Influence by the Event Studies Method

Originally intended to test the theory of efficient financial markets, the event also used to verify the immediate reaction, studies of markets following the announcement or completion of a particular event that may affect the activity and / or performance of a company. The choice of this method has its justification in the inability of current techniques mostly long term, whereas on the horizon, several other phenomena can intervene and bias our analysis of the contribution of actions of influence to the creation of value.

The technique involves the analysis of abnormal returns 5 and cumulative abnormal returns during the period surrounding the event. This analysis is important in that it allows to conclude on the relevance of the information content of the newly disclosed ads and therefore to identify the factors determining the stock investor behavior. Given the novelty of the application of event studies of the actions of influence, special focus was taken in the implementation of the method.

The application of event studies of the actions of influence requires us to determine a period of observation rather spread out to contain all the possible reactions, but at the same time it must be reduced in order to avoid the incorporation of other interfering events. Thus, and like the majority of research in this area, we selected an initial 10-day window [J-4, J + 5].However, in some cases, market data were sought on a wider window [J-6, J + 7] due to the presence of weekends and holidays.

In addition, to the range of methods for calculating theoretical yields 6 (Rit), we retained our case to the market model that we consider more accurate and easy in implementation.

Furthermore, to reinforce the validity of our results, our previous examples underwent further adjustments which aims to make it more suitable to our research aim, and also to achieve the implementation of event studies under the correct conditions. To this end, we excluded shares for companies who have not posted a listing of days during the period of the event. This restriction is intended to ensure some consistency in the calculation of abnormal returns.

Ultimately, in the 232 actions of lobbying identified between the years 2010 and 2013, only 117 have been retained shares, or 51% of the sample. 5 The abnormal return is the excess return relative to a level considered normal calculated using various models 6 We quote indicative model adjusted returns by the average, the model of the market index and Capital Asset Equilibrium Model Initially, we plan through the implementation of the technique of event studies to demonstrate the impact of lobbying on the creation of value. Secondly, we are interested in identifying one of the five practices observed in the cluster analysis, those having more input on the wealth created by lobbying companies.

19. a. For the sample as a whole

The table below shows that daily abnormal returns are significantly different from zero entirety (except for the date of j-2). However, this finding is not the same for the entire period of the event. Indeed, we see, value creation mainly around the event date [J-1; J + 3]. a) Implementation of the the method b) The results of the evaluation: the impact of actions of influence by the creation of stock value Graphique 1 : Evolution des rendements anormaux moyens pour l'échantillon

In general, the announcement of a action of influence generates abnormal returns of sizeable magnitude (up to 64 points on D + 1). Thus, the lobbying practice would be perceived by the market as a strategic element of great importance but the effect is very limited in time (the impact of the announcement fades in D + 5). Furthermore, the action of influence is often anticipated by investors, it helps unlock value even before its official publication.

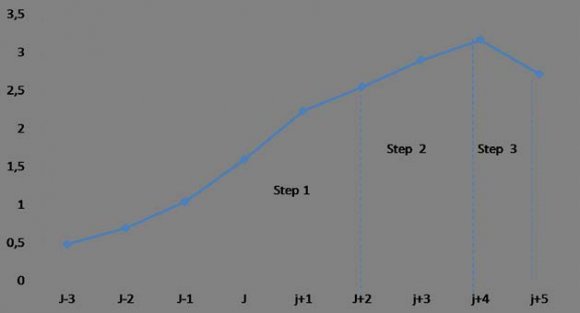

The results obtained from the calculations of average cumulative abnormal returns RAMC confirms our previous assumption. The reproduction of the data from the second part of the previous table on a curve clearly shows exceptional growth of abnormal returns following the announcement of the actions of influence. This curve traces three phases of evolution of the RAMC which are:

-A first step with accelerated upward pace starting three days before the official publication of the event and ending on the day after its announcement.

-The second phase ([D + 2; J + 4]) less agitated experiencing a slowdown in the effect of the announcement of lobbying, but it still allows to generate more returns than the market.

Graphique 2 : Evolution of the average cumulative abnormal returns of the total sample -Finally, from the 3rd day after the announcement, the effect of the action influence dissipates due to the loss of opportunity offered by the new information. Thus, the title finds its price equilibrium.

IX.

20. Conclusion

From the results of our study let us assume, first, that the action of influence of Moroccan companies could be considered in some cases to be a strategic replica to obtain a competitive advantage in the financial market, and secondly, a financial marketing campaign to retain existing and attract potential investors.

The signal theory is one of the most developed in literature to explain the interest of the lobbying action towards companies in their financial environment. Indeed, in the case of information asymmetry between shareholders and managers, they have an interest to intervene with the opinion leaders to restore investor confidence. In this context, the lobbying instrument has chosen to send a signal to the insurance market.

Behavioural finance also brings a very relevant part of the answer to the impact of lobbying on the share price. Proponents of this approach (behavioural finance) suggest that the explanation for the formation of asset prices following the advent of strategic information is based on cognitive biases. Thus, in the financial market, we can identify two groups of investors according to their degree of rationality. One group, termed 'news-watchers "are based on the fundamentals of the company for the formulation of their expectations. The second "momentum traders" refer to the recent price developments in the formation of their portfolios. The first group of investors tend to under-react to the transmitted information, while the input of the second group, the "momentum traders' exploit the initial feedback, generates an over-reaction of the price.