1. I. Introduction

tock market is considered to be a barometer of the Economy. The economic development of a country depends largely on the effective performance of stock market. The stock market augment the process of economic development though a number of ways: a) bringing together holders of surplus funds and users of such funds; b) offering a broad spectrum for investment and financing choices to both investors and issuers, c) drawing more institutions into investment, and e) reducing the dependence of industrial enterprises on non-security market for capital. Stock market can perform well to meet the continuous financial needs of business enterprises if exist a congenial environment for boosting confidence of both stock market operations and investors. The growth and development of stock market in a market economy largely depend upon the creation of enabling environment for boosting up investors' confidence. Bangladesh capital market has achieved some major milestone events in the recent past. The capital market operations in this part of the country started in mid-fifties with the establishment of East Pakistan Stock Exchange Association in 1954, which started trading in 1956. Initially it was a mutual organization (cooperative body) which was corporatized in recent activity of the Dhaka Stock Exchange (DSE) in term of turnover in the name of Dacca Stock Exchange Ltd. During those early periods until 1971, all trades in the exchange were conducted using trading data collected over telephone from Karachi Stock Exchange. After independence of Bangladesh, the operations of the stock exchange remained suspended until August 1976. At that time market trading started with only 14 listed companies having market value of only taka 90 million. The trade volume was very thin and could not attract investors. Over time some reform in-initiatives were taken to strengthen the market. First time Tk.1crore daily trades were recorded in April 1992. Government adopted the Securities and Exchange Commission Act 1993 and established the SEC as the regulatory authority for the market and the Securities and Exchange Commission (SEC), established in 1993 under this Act, as the central regulatory agency oversees the activities of the entire capital market including issue of capital, monitoring the issue of stocks and operation of the stocks market including regulating of portfolio market.

Bangladesh capital market is one of the smallest in Asia but within the south Asian region, it is the third largest one. It has only two full-fledge automated stock exchange Namely Dhaka Stock Exchange (DSE), Chittagong stock exchange (CSE) and OTC stock exchange operated by CSE. It also consists of a dedicator regulator, the Securities and Exchange Commission (SEC), since, it implements rules and regulations, monitor their implication to operate and develop the capital. It consists of Central Depository in Bangladesh that provides factices for settlement of transaction of dematerialized securities in CSE market and DSE.

2. II. Rationale of the Study

The Stock market is the market for long-term loans and equity capital. Developing countries in fact, view capital market as the engine for future growth through mobilizing of surplus fund to the deficit group. An efficient capital market may perform as an alternative to many other financing sources as being the least cost capital source. Especially in a country like ours, where savings is minimal, and capital market can no wonder be a lucrative source of finance.

At times when the banking sector of the country is facing the challenge of bringing down the advancedeposit ratio to sustainable level, the economy of the country is unfolding newer horizon of opportunities. Due to over-exposure level of the financial system the securities market could play a very positive role, had there been no market debacle.

The capital market also helps increase savings and investment, which are essential for economic development. A Stock market, by allowing diversification across a variety of assets, helps to reduce the risk of the investors must bear, thus reducing the cost of capital, which in turn spurs investment and economic growth.

From the above points it is easily realize that Stock Market is the most important sector to accumulate capital for the industrialization of the country, but it is most vulnerable. For that, I have motivated to dig deep into these issues and accordingly I have under taken the study to evaluate the performance of the Stock Market. The study is an endeavor that will be helpful to the listed companies, stock brokers, Management of CSE, SEC, and Bangladesh Government.

3. III. Objectives of the Study

The main objective of the paper is to ascertain the impact of stock market on the economic development of Bangladesh. Morespecifically the main aim of this study is to evaluate stock market performance of the Chittagong Stock Exchange, highlight its growth and development, analyze the performance of securities listed and examine the market capitalization as well as the contribution to GDP of the country.

4. IV. Methodology

The CSE made the government to launch the central depository system on wide area network connecting Dhaka, Shylet,Rajshai,Coxesbazar, based brokers to Chittagong enabling hinders of thousands of people to invest in the securities market.CSE made the government to launch the central Depository System and ails after proactive initiative of CSE,SEC is now in the process of implementing the idea of establishing a securities trading institute in the country alongside CSE has always been very active in the promoting stock investment by creating awareness among the general public since its inception.

CSE is committed to build and maintain a transparent, accountable and modern stock exchange to cater of the needs of the capital market for the best interest of the national economy. b) Indices i. CSE30 CSE-30 index is very useful for providing a historical comparison of returns on money invested in the stock market against other forms of investments. It Year ( )

ii. CSCX (Selective category Index) CSCX (CSE Selective Categories' Index) comprised A, B & G category companies. This index includes all but not the Z category companies. This also excludes the companies/scripts which are debt securities, mutual funds, suspended for indefinite period and non-traded for preceding six months of review meeting. The index will be reviewed in the Index Committee Meeting after every six months like other two indices of CSE.

iii. CASPI (All Price Index)

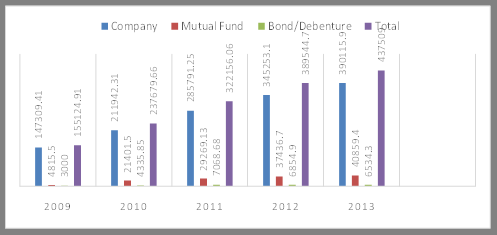

The only index the CSE has been maintaining since 10th October 1995 is an ALL SHARE PRICE INDEX using Chained Panache method.. This index was subject to unusual ups and downs and without a distinct base value. Therefore in need of a clean slate CSE finds the date 1 January 2000 is the best date to start new Indices. An All-Share Price Index with new formula and base date 30th December 1999 (the last day of the year) and new base index of thousand (to mark the millennium) will replace the existing one and A completely new Selective Index incorporating 30 scripts with base date 30th December 1999 and base index 1000. From the above graph we can easily say that, Paid up capital of listed company in CSE increase gradually year by year. This is the good sign for the development of the share market of our country. If our Share markets develop properly, industrialization of the country can achieve easily. As we know that without development of the stock market, industrialization of a country is quite impossible. At last we can say that paid up capital showing positive performance.

ii. Market Capital of the Listed Securities in CSE (Million Taka)

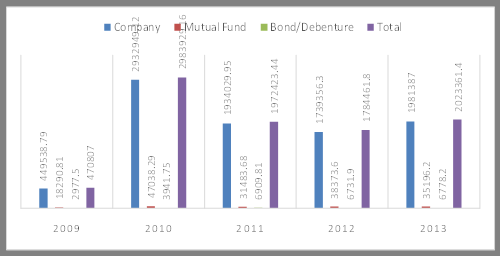

From the graph we are able to realize that, Market capital of the listed securities is not stable. In 2010 there was an excellent market capital increase happen in compare to year 2009.but it fell in 2011 in great extent. In 2012 and 2013 it increases slightly. To develop a country gradual increase in the market capital is indispensable. Although last two years it increase partially but it should be increased in proportion. e) Price Index of Listed Securities in CSE (Million Taka)

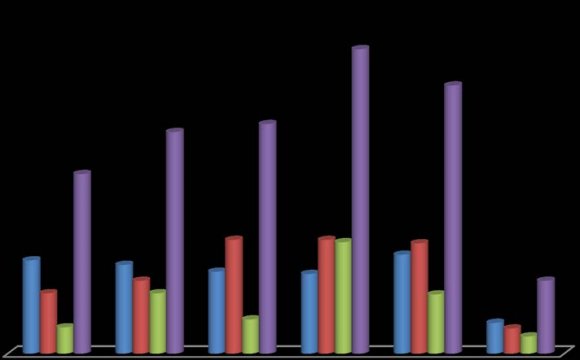

In the above table we see that, in 2010 price indices increased sharply in compare to year 2009. But it fell in 2011 dramatically. Although it again fell in 2012 slightly, but in 2013 it increased slightly. so we can say that price indices show, our capital marker is highly instable. To show excellent performance, it needs to be stable. SEC should work for making stable stock market, which will attack the small investors to come forward to invest in stock market. From the above table we see that, in the 2011 highest listed number of the companies declared dividend as calculated total 268 companies and lowest dividend declaration occurred in the 2013 recorded as total 64 companies. We also see that from 2008 to 2011 dividend declaration of the listed companies grew gradually and it fell last two years. But in the last year it fell sharply. So we say that in the last year performance of the listed securities is not expected good. From the above table, we can easily evaluate the performance of CSE. From 2002 to 2013 number of listed company increased, although initial public offerings fluctuate that means not that CSE perform weakly. It means, in every year except 2008 companies issued new shares for the public. Issued capital and market capitalization of the CSE increased every year through the era. Higher the market turnover indicates the higher performance, Market turnover of the CSE fluctuate. It should be gradually increased. Price index increased gradually this is also good.

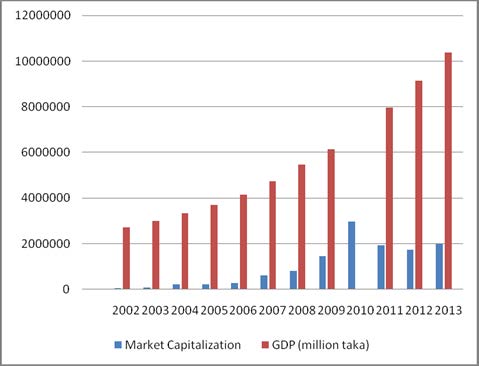

5. i) Market Capitalization of CSE and Contribution to the GDP

From the above table we can easily say that, from 2002 to 2004 market capitalization and its contribution in the GDP increased at 6.07% from 2.21%, but in the 2005 it decreased to the 5.61%. It again increased in the year 2006 to 6.44%. From the year 2006 to 2009 it increased moderately at 23.92% from 6.44 %.In the year 2010 it increased sharply to 43.20%, but it in the year 2011 to 24.27% and in the 2012 to 19.01%. In the last year it increased slightly to 19.08%. j) Market Capitalization and Turnover of the CSE From the above chart, we can say that highest market turnover ratio with the market capitalization in 2002 and lowest in the 2013.Average market market capitalization is TK 1031542.25 million and the average market turnover value is Tk93701.52 million. The average market turnover ratio with the market capitalization is 9.08, By considering overall calculation we can say that ,the contribution of the CSE in the market capitalization of our country is indispensable. So SEC should make necessary rules and regulations to increase performance of the CSE.As the performance of the CSE will increase our country capitalization also increase for the industrialization and development. In the above table show the financial position of the CSE from the year 2008 to 2013. In the table we see that total income and expenditure of the CSE increased in every year from 2008 to 2013. For the increased amount of the total expenditure of CSE, netprofit fluctuates in every year. Sometimes it was better than the previous year; few times it was worse than the previous year. Investment in the FDR, paid up capital increased gradually in every year. Employees of CSE increased gradually in every year up to the year 2011, last two years it was decreased by two employees.

The year 2013 ended with a net profit of Tk391.53 million which was 59.31 million lower than that 2012. The exchange achieved surplus during the year, the operating revenue declined by 27.22% as the row of falling turnover continued this year too. The listing fee also dropped by tk35.84 million. Meanwhile, as the free annual maintenance period came to end the expenses under this head increased by T57.23 million in 2013. The general expenses increased by Tk24.09 million due to increase legal and professional expenses centring demutualization.CSE has to count excess depreciation of Tk 5.88 million due to the change in fixed asset base for revaluation as per the requirement of the exchange Demutualization Act 2013.In the 2013 total reserves and funds decreased with compare to year 2012 but investment in FDR and paid-up capital increased in 2013 against the year 2012. After all, although net profit decreased in the year 2013 than the year 2012,but performance through the year was good. The average contribution of the CSE to the GDP is 18.29%, this is mentionable contribution of the Chittagong Stock Exchange. So we can say that performance of the Chittagong stock exchange is the most important factor for the development of the country. Government should take necessary steps to develop our capital market to develop the country.

6. V. Key Findings and Recommendation

Average market capitalization of CSE is TK 1031542.25 million and the average market turnover value is Tk93701.52 million. The average market turnover ratio with the market capitalization is 9.08. By considering overall calculation the study shows that, the contribution of the CSE in the market capitalization of the country is indispensable.Since the performance of the CSE will increase capitalization, industrialization and development of the country,SEC should make necessary rules and regulations to increase performance of the CSE.

7. VI.

8. Conclusion

At the end of the study, it is understood that there is no way to improve our economy without augmenting the industrial sector from the present stalemate situation. At the beginning of the new millennium signs of improvement in the stock market are seen and it is evident that it has started contributing to the development of an alternative source of industrial financing gradually. CSE's contribution to this gradual change is immense which cannot be ignored. CSE's relentless endeavour since its establishment to develop an active and vibrant capital market in the country has become a landmark of success.. CSE's continuous efforts in the pursuit of developing a mature, stable and an expanded stock market will always be there in its mission and vision.CSE has been performing different investment related jobs, and undertaking and implementing different programs in order to accomplish its objectives.

The study shows that CSE develop capital market of Bangladesh by developing many tools in the capital market which are previously discussed, the contribution of the CSE is indispensable in the industrialization of the country, CSEcreate employment opportunity in the country.Since the establishment to the present situation CSE's gradual development indicates a bright future of the capital market as well as the economic growth of Bangladesh..

| efficient and transparent market atmosphere of |

| international standard to save and invest in Bangladesh |

| in order to raise fund and accelerate industrial growth |

| for overall benefit of the economy. Being a modern |

| stock exchange, after it's setting up in Agrabad |

| commercial area of the port city, CSE has infused many |

| new and innovative ideas for the development of share |

| market. After six months of its incorporation in 1995 floor |

| trading was started with open cry-out auction system. In |

| the backdrop of a strong need to institute a dynamic |

| automated and transparent stock exchange in the |

| country, seventy reputed business personalities under |

| the leadership of Mr. Amir Khosru Mahmud Chowdhury |

| MP, the founder president established this bourse in |

| the commercial capital Chittagong. |

| article is basically based on secondary |

| data. Annual Reports and Monthly Reviews of |

| Chittagong Stock Exchange Ltd., Annual Reports of |

| Securities and Exchange Commission, Investment |

| Corporation of Bangladesh are the main sources of |

| secondary data. In addition, capital market reports, |

| Resumes of the Activities of Financial Institutions of |

| Bangladesh, Annual Reports and other necessary |

| papers of the listed companies of CSE and other related |

| organizations are also viewed. |

| a) About CSE |

| Chittagong Stock Exchange (CSE) the second |

| stock exchange of the country was established on 12 |

| February, 1995 with the mission: To create an effective, |