1. Introduction and Historical

Evaluation of MFS -business has been continuously growing as a new industry during the last decade (Van Hoeck, 2001). The banking industry has been leading this trend in recent years, and now all banking transactions completing through internet applications is sometimes called e-banking (Boss et al., 2000;Smith, 2006;Hwang et al., 2007;Shin, 2008). E-banking relies heavily on information and communication technologies (ICT) to achieve its promise of 24 hours availability, low error rates, and quicker delivery of financial services. When considering e-banking, bank websites usually come to mind first, but e-banking requires much more than just a good website. It needs back end applications such as account systems, support applications such as Customer Relationship Management (CRM systems), communication technologies to link e-banking to the payment systems such as LINK, and middleware to integrate all these often different type of systems. (Shah & Clarke,2009). Consumers are attracted to these technologies because of convenience, increasing ease of use, and in some instances cost savings (Anguelov et al., 2004). E-banking has been viewed as an upgrading from previous electronic delivery systems to open new business opportunities for the banking industry (Ebling, 2001).

In modern age Mobile Banking or M-Payment is the appreciable technological services of the commercial banks through which customers can get different banking services like checking account balances, fund transferring, receiving alert, pay bills, deposits and withdraw money and so on with the support of telecommunication devices and personal digital assistance. The Cellular telephone (commonly "mobile phone" or "cell phone" or "hand phone") is a long-range, portable electronic device used for mobile communication. (www.wikipedia.com).The telecommunications industry worldwide has scrambled to bring what is available to networked computers to mobile devices (Schofield & Kubin 2002).

In broad sense different types of hand held devices and movable objects that provide mobile banking services can be considered as mobile financial services. In this respect Automated Taller Machine (ATM), Online Banking, Debit or Credit card can also be considered as mobile banking services. But mobile banking services generally refers to the financial services delivered via Mobile networks and performed on a mobile phone or personal digital assistance that allows customers of a financial institutions to conduct a number of financial transactions.

The introduction of mobile banking (m-banking) services in both high and low-income countries has revolutionized traditional notions of 'banking' in lowincome countries in particular m-banking is regarded as an opportunity to bring financial services to the unbanked poor who are not a profitable target for commercial banks. The promise of m-banking lies in the fact that access to these services requires no more than access to a widely available and inexpensive technology such as mobile telephony, even for poor uneducated individuals who are typically marginalized by traditional banking providers. This promise has been materialized most successfully in Kenya, where Safaricom's M-PESA started in March 2007 and, by September of 2009, over 8.5 million Kenyans had registered to use the service and US$3.7 billion (10 percent of Kenya's GDP) had been transferred over the system. This policy brief describes the current international experience regulating the provision of m-banking services. (www.theigc.org)

The spread of mobile phones across the developing world is one of the most remarkable technology stories of the past decade. Buoyed by prepaid cards and inexpensive handsets, hundreds of millions of first-time telephone owners have made voice calls and text messages part of their daily lives. However, many of these same new mobile users live in informal and/or cash economies, without access to financial services that others take for granted. Indeed, across the developing world, there are probably more people with mobile handsets than with bank accounts (Porteous, 2006). Various initiatives use mobile phones to provide financial services to "the unbanked." These services take a variety of forms-including long-distance remittances, micropayments, and informal airtime bartering schemes-and go by various names, including mobile banking, mobile transfers, and mobile payments. Taken together, they are no longer merely pilots; in the Philippines, South Africa, Kenya, and elsewhere, these services are broadly available and increasingly popular.

Across the developing countries, millions of people rely on informal economic activity and local level networks to earn their living. Most of these populations are from bottom of pyramid and they don't have access to basic financial services/banks as access to them is costly and very limited. However, the outstanding growth of mobile sector worldwide has created a unique opportunity to provide social and financial services over the mobile network. With over 4 billion mobile cellular subscriptions worldwide, mobile network has the ability to immediately offer mobile banking to 61% of the world population (Sultana, 2009).

It is now a burning issue in banking services. It is a systematic set of process that enable bank customers to have bank services through mobile phone starting from a simple mobile handset to personal digital assistance. Now a day mobile banking services has increasingly becomes necessary components of doing business and implementing business strategy for economic development.

Some banks are making significant investments in mobile systems to deliver a range of types of business value, from increased efficiency and cost reduction, to improved operational effectiveness and customer service to provide a competitive advantage. A factor that has contributed to this development has been the extended availability and capacity of mobile communications infrastructure around the world. The number of types of mobile devices has been increasing rapidly and the functionality available has also improved. The shrinking costs of data transmission and, due to the intense competition from suppliers, the reduced costs of devices have catalyzed the distribution of mobile technologies and amplified the growth of the worldwide mobile market. In those countries where traditional telecommunication infrastructure is not well developed, mobile technologies is transforming accessibility to the Internet based services. Mobile banking may be described as the newest channel in electronic banking to provide a convenient way of performing banking transaction using mobile phones or other mobile devices. The potential for mobile banking may be far greater than typical desk-top access, as there are several times more mobile phone users than online PC users. Increasingly "mobile life styles" may also fuel the growth of anywhere, anytime applications. (Shah & Clarke, 2009) Low fees, less time consumption, privacy, freedom from time and place and easy communication are the variables that determinants tend of the using technology. Mobile phone has faced some greater influence of inhibitors in using mobile for banking purpose, perceived credibility and security issues (Luarn and Lin, 2005). Mobile banking isn't as fully functional as online banking. We offer things you can do every day, such as looking at account activity and paying bills. (Thomas Trebilcock, vice president of e-business and payments at PNC Bank.) Mobile wallet usage has struggled in the mainstream primarily due to concerns around security, technologies and confusion over what is a mobile wallet exactly. The key to mobile wallet growth will be adding value to both consumers and merchants while addressing concerns around fraud and security. Convenience features such as making it easier to organize consumer loyalty programs, location based offers, the ability to skip long checkout lines and rewards for using mobile will begin to spur user adoption. (Bob Graham, 2014) Mobile banking is gaining ground among the people in Bangladesh within a short span of time for facilitating its easy transaction services. Some 3.0 million people make now the use of different services under mobile banking. There are about 70,000 outlets of mobile banking service-providers, making the services available to the users. The government, in tandem with the country's central bank, is giving a greater focus now than ever before on supportive efforts to bring a large number of people under the banking channel by using mobile banking service as only a quarter of the country's population has now access to the formal banking sector. (http://www.thefinancialexpress-bd.com/old/index) Santus et.al (2011) in their study "The Dimensions Affecting the Adoption of Mobile Banking in Bangladesh" have shown that some factors make the adoption of mobile banking service easy for the customers and those are convenience, cost, security, confidentiality, handset operability, procedure and knowledge, network.

The central bank issued guidelines on "Mobile Financial Services for Banks" in September 2011 clearly stating a choice to make the market bank-led. It has provided 10 licenses to banks to offer the full range of mobile financial services. (http://www.cgap.org/blog/gr owth-mobile-financial-services-bangladesers.) The guidelines on mobile financial services for the banks were amended by the Bangladesh Bank with the directive issued in December, 2011 to all banks to follow the same. (http://www.thefinancialexpress-bd.com/old/inde x) Bangladesh Bank has fixed the transaction limit for the account holders of mobile financial services at maximum Tk. 10,000 daily and a total of Tk. 25,000 on monthly basis vide DCMPS Circular No. -10/2011 December 14, 2011. (http://www.bb.org.bd) .The limit is applicable for any number of transactions The Bangladesh Telecommunication Regulatory Commission (BTRC) has set the charge at 2.0 per cent for each transaction for 'cash-in' and 'cash-out' purposes and Tk 5.0 for the lowest amount of transactions for mobile banking. Among the mobile banking service-providers, 'bKash' has set its charge at 1.85 per cent for remitting money, Dutch-Bangla Bank, at 2.0 per cent and Islami Bank, at 1.5 per cent, under mobile banking services. The transaction limit is Tk 25,000 per day by one person.

The Brac Bank-initiated mobile banking service, 'bKash', is at present the country's leading serviceprovider in mobile banking. Dutch-Bangla Bank and Islami Bank Cash are next in line, after 'bKash', as the service-providers in mobile banking, in terms of volume of transactions, clientele coverage and number of personnel, directly or indirectly, involved in the process of making such services available to the people. (http://www.thefinancialexpress-bd.com/old/index)

The mobile financial services market is at an early stage of development as providers are working to stabilize their technology build agent networks and acquire new customers. This involves finding and training agents, marketing, helping customers transact and acquiring customers by using know-your-customer (KYC) and account opening processes. A survey conducted by Bangladesh's central bank found that the new services are reaching multiple parts of Bangladesh and that most clients and agents express cautious optimism about mobile financial services being valuable to them. These developments offer promising signs that mobile financial services could develop in time. Bangladesh has a large population in a small geography. It is also home to one of the most deeply penetrated microfinance markets. Indeed, Bangladesh's overall access to accounts for adults of nearly 40% is higher than South Asia's average of 33% and the global low-income country average of 27% (source). Nevertheless, most banks, mobile operators and microfinance institutions agree that mobile financial services are likely to focus initially on domestic personto-person transfers that are very scarce among formal provide. Bangladesh Bank's aim is to ensure that the market develops with several providers, and diverse technologies are tested and used, different kinds of agent networks deployed, and a range of products available so that the consumer is empowered with a full range of choices. It is an exciting time in Bangladesh for mobile financial services and much will be learned in the coming months.

2. Objectives of the Study

The basic objective of this study is to specifically focus on the exponential trend for the uses of Mobile Financial Services (MFS) in Bangladesh and also to evaluate the competitive market position of Mobile banking services provider commercial banks with the customer demand. Finally the objectives include findings out some scopes for further research in this field.

3. III.

4. Methodology

This research includes both qualitative and quantitative techniques and collected data were classified in primary and secondary sources. Primary data were collected through field level study and a questionnaire with pertinent questions to analyze the upward trend of the uses of mobile banking at different regions in Bangladesh as a newly established service of some commercial banks and to assume its potentiality.

The sample size is 300. By using suitable sampling method, 300 respondents who are mobile financial services customers and the agents are interviewed with direct conversations and for analysis purpose those data were segmented on the basis of various dimensions like-income groups, professions, age limit, relevant products, safety, demanding groups, etc. Data have been collected from the five different regions across the country. Among the banks that provide mobile financial services, 5 banks have been taken as sample of the research. Of those 5 banks, 2 pioneer bank's information regarding mobile financial services is used to show the competitive growth. And for secondary data firstly, the maximum exploratory part of the article obtained through secondary sources likedifferent search engine, books and related journals, different publications, Bangladesh Bank guideline, etc. Secondly, survey questionnaire was overseen to empirically evaluate the level of acceptance and customer demand of m-banking in Bangladesh.

5. IV.

6. Findings and Analysis a) Nature of the Customer

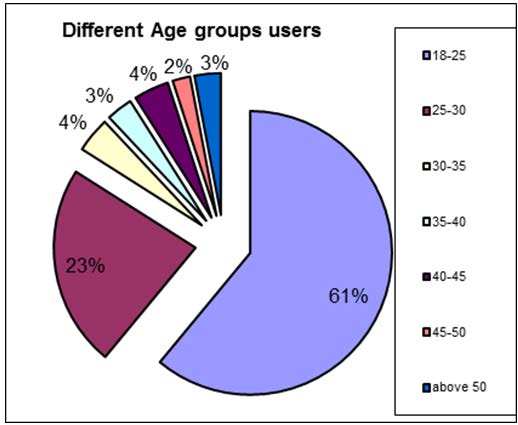

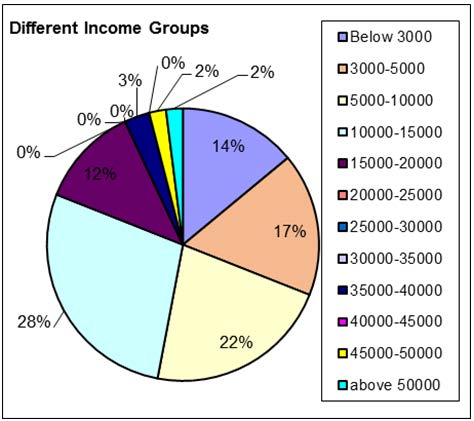

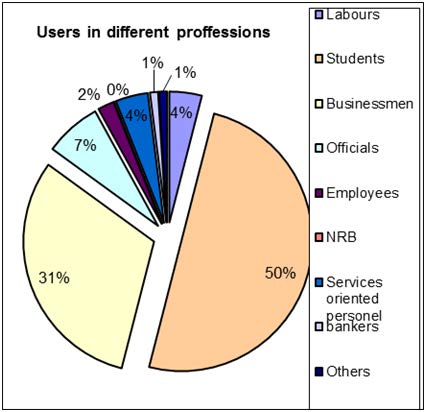

The study shows that among 300 respondents, the highest portion (97%) was regular customer of MFS while only 3% are irregular customers. (Figure -01) From the survey it was observed that among 300 respondents 28% that was the highest portion and 22% the second largest portion are belonging in the income level of 10000-15000 and 5000-10000 respectively. But the income levels of 45000-50000 and above are belonging in the lowest portion with 2 % .That means the higher income groups are detached from the MFS at present. (Figure -03) After analysis of 300 respondents collected randomly, we found that the majority portion of MFS users were students i.e. 50% and earlier it showed that the age group of 18-25 were the highest users of MFS might be the students in profession. And the second largest portion belongs to the businessmen which is 31%. But the other professionals were in so negligent stage by their uses of MFS. (Figure -

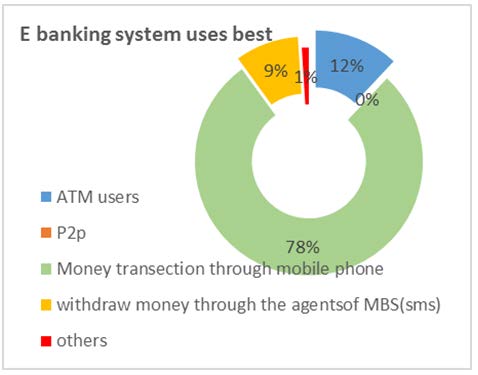

7. g) E-banking system uses best by the customers

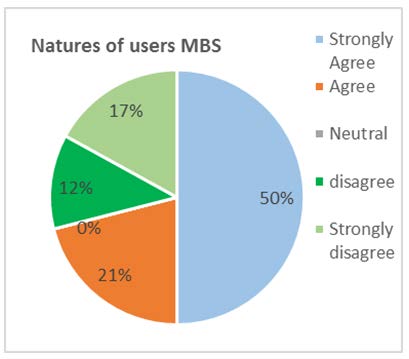

After collected of 300 respondents randomly, we found that of different E-Banking services, 78% of the respondents use mobile financial services for their money transactions. Beside these ATM stands in second choice with 12%. (Figure - It is observed that among the same 300 respondents, near about 50% were strongly agreed that transaction is very much safe through mobile phone. The second highest portion i.e. 21% was also agreed with the statement stated above. Where as among the respondents the portion of disagree and strongly disagree were 12% and 17% respectively. (Figure -08)

8. i) Available Agent and branch for M-Banking

Among 300 respondents it was measured that, the highest 58% respondents strongly agreed and 29% agreed that there are available agents and branches of DBBL mobile banking, Bkash, mCash and so on. On the other hand, in the following figure it is shown that about 11% respondents disagreed with the available agent and branches of DBBL mobile banking, Bkash, mCash. (Figure -9) [Note: Stated data has been collected from the annual reports of DBBL and Brac Bank. But the specific earnings of mobile banking has not mentioned in DBBL annual reports like specific information of bKash in the annual reports of Brac Bank. That's why the DBBL's mobile banking amounts have taken from the consolidated other operating incomes and it can be assumed that the earnings from mobile banking are included here.]

9. Source: Annual Reports of DBBL (2011-2013) and Annual Report Brac Bank (2011-2013)

V.

10. Mobile Financial Services

Beside those two pioneers banks some of other commercial banks in Bangladesh getting interested in MFS and have launched services all over the country with the enrolment of new advancement of technology. mCash from IBBL, uCash from UCBL, EasyCash from Prime Bank Ltd and so on have already focused their figures in the MFS market in Bangladesh. Islami Bank Bangladesh Limited was inaugurated their Mobile Banking Service of on December 27, 2012 on the name of mCash with the aim of to bring all the people under its services. IBBL Mobile Banking mCash is highly secured as it uses USSD or SMS+IVR as its communication channel. In case of USSD, both the instructions and PIN are communicated using USSD while in case of SMS+IVR, instructions are sent via SMS and PIN via IVR (voice channel), both the USSD and IVR are secured for transmission of PIN. Customer's money is safe as none can withdraw his/her money without taking possession of Mobile set, PIN and Check digit together. None will be able to deposit unwanted money into a Mobile Account without knowing the check digit (although the mobile number is publicly known).account is fully registered; you will get an SMS notification. (http://bdloan.net) United Commercial Bank launched their Mobile Financial Services "UCash" on 23rd Nov'2013. UCB has more then 100 00 agents all over the country to make available their service "UCash". Mobile Account holders (savings) of "UCash" will get daily Interest on the deposit in mobile wallet from the very first day. Initially the service of UCash will be available through 'Robi' and 'Airtel' Network. It will be accessible through all the mobile network operators very soon.

11. Recommendations and Conclusion

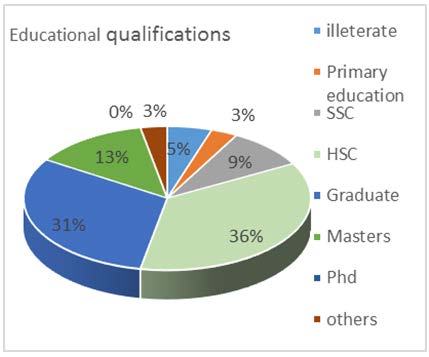

The results of this study showed that there is a positive acceptability of MFS in Bangladesh. How-ever as a new product the permitted banks should enhance several strategies those can overcome the limitations of MFS, to be an easy accessible financial services near future. The MFS providers must introduce effective and attractive strategies so that the number of customers should not be in the limit of the age group of 18-25 who are basically stand in the education level of HSC and Graduate belonging in the highest level of the respondent in the age and education group respecttively. The banks should specifically clear the idea and systems about the MFS through the buzz marketing process in order to spread the Mobile Financial Services in different age groups, income holders and professions who are not that much familiar with the money transaction system of MFS. MFS providers should increase the transaction limit in order to motivate the corporate clients in MFS and this the formal way for the banks to get higher earnings through MFS. Due to facilitate huge employment the Banks should increase the commissions of the agents. The banks and telecommunication companies should develop secured and easy understandable software with highly confidential PIN code and system so that the agents or the customers cannot send the money in other numbers by mistake or intentionally and if happen so, can recover the money back. At the same time telecommunication companies and cellular service providers should be more conscious about their network coverage in order to facilitate the transaction and communication of mbanking more faster. Finally the government should provide appropriate law and conditional financial support to cellular service providers and the banks to extend the MFS more regular to the people of Bangladesh.

At present the modern financial transactional facilities through mobile phone are much more attractive than those of traditional banking system. Mobile Financial Services provides customers available access to their banks. For low income people MFS is a newest approach may make possible to use such kind of banking where banking facilities cannot reach till now. The cost of using MFS is comparatively low. So the Mpayment will be very much effective for the customers of rural area in Bangladesh who are relatively attached with the different family and business activities with the different corner of Bangladesh. M-payment is almost new approach in Bangladesh with high response from the MFS agents and customers, but Bangladesh Bank permitted 17 commercial banks to do such kind of mobile banking business in Bangladesh. -------------------------

| Nature of the Customers | No. of Respondents | Percentage | |||

| Yes | 97 | 97% | |||

| No | 3 | 3% | |||

| No. of customers | 3% | ||||

| Income groups | No. of | Percentage | |||

| Respondents | |||||

| Below 3000 | 14 | 14% | |||

| 3000-5000 | 17 | 17% | |||

| 10000-15000 | 22 | 22% | |||

| 97% | 15000-20000 | 28 | 28% | ||

| 20000-25000 | 0 | 0% | |||

| 25000-30000 | 0 | 0% | |||

| 30000-35000 | 0 | 0% | |||

| 35000-40000 | 3 | 3% | |||

| 40000-45000 | 0 | 0% | |||

| 45000-50000 | 2 | 2% | |||

| Above 50000 | 2 | 2% | |||

| Age | No.of Respondents Percentage | ||||

| 18-25 | 61 | 61% | |||

| 25-30 | 23 | 23% | |||

| 30-35 | 4 | 4% | |||

| 35-40 | 3 | 3% | |||

| 40-45 | 4 | 4% | |||

| 45-50 | 2 | 2% | |||

| Above 50 | 3 | 3% | |||

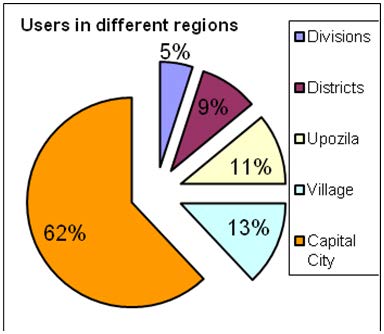

| Regions | No. of Respondents Percentage | |||

| Divisions | 5 | 5% | ||

| Districts | 9 | 9% | ||

| Upozilas | 11 | 11% | ||

| Villages | 13 | 13% | ||

| Capital City | 62 | 62% | ||

| Year 2014 | ||||

| Professions | No. of | Percentage | ||

| Respondents | ||||

| Labors | 4 | 4% | ||

| Students | 50 | 50% | ||

| Businessmen | 31 | 31% | ||

| Officials | 7 | 7% | ||

| Employees | 2 | 2% | ||

| NRB | 0 | 0% | ||

| Services oriented | 4 | 4% | ||

| personnel | ||||

| Bankers | 1 | 1% | ||

| others | 1 | 1% | ||

| ( ) C | ||||

| Education | No. of Respondents Percentage | |||

| Illiterate | 5 | 5% | ||

| Primary education | 3 | 3% | ||

| SSC | 9 | 9% | ||

| HSC | 36 | 36% | ||

| Graduate | 31 | 31% | ||

| Masters | 13 | 13% | ||

| Phd | 0 | 0% | ||

| Others | 3 | 3% |

| E-banking system | No. of | Percentage | |||||

| uses best | respondent | ||||||

| ATM users | 12 | 12% | |||||

| P2P | 0 | 0% | |||||

| Money | transections | 78 | 78% | ||||

| through Mobile Phone | |||||||

| Withdraw | money | 9 | 9% | ||||

| Natures of users Strongly Agree | No. of Respondents 58 | Percentage 58% | through Agents of MBS (SMS) others | 1 | 1% | ||

| Agree Neutral Disagree | 29 2 11 | 29% 2% 11% | Available Stongly | ||||

| Strongly Disagree | 0 | 0% | 2% | 11% | 0% | Agree agree | |

| Neutral | |||||||

| 29% | 58% | Disagree | |||||

| Stongly | |||||||

| agree | |||||||

| Natures of | No. of | Percentage | |||||

| users | Respondents | ||||||

| Strongly Agree | 50 | 50% | |||||

| Agree | 21 | 21% | |||||

| Neutral | 0 | 0% | |||||

| Disagree | 12 | 12% | |||||

| Strongly Disagree | 17 | 17% | |||||