1. Introduction

ne of the items in the financial statements which is regarded as the performance evaluation scale and for-profit unit profitability competency is the "profit reporting". But, the net profit calculation of a forprofit unit is influenced by the accounting methods and estimations. The managers authorization in the usage of actualization and adaptation, estimation and prediction and also the implementation of methods such as the change in the method of the inventory evaluation, goodwill depreciation, current costs or considering the research and development costs as capital and the determination of the costs of doubtful debts are among the subjects through the exertion of which managers can change the profit. From one hand, due to the most of the managers' awareness of the firm status, it is expected that the data be procured and offered in a manner which is most reflective of the company status. From the other hand, because of some reasons such as retention in the company, receiving reward etc. The forprofit manager may intentionally or unintentionally manifest the company's status as optimum through the manipulation of the data.Under such circumstances, there would be a discrepancy between the real profit and the reported one in the financial statements and there would be expected an incident under the title of profit management.

Also, quality which is the determinant of the auditing performance is a function of numerous factors such as auditor's capabilities (including knowledge, experience, adaptation power and technical efficiency) and professional implementation (including independency, objectivity, professional caring, interest conflict and judgment). (Mojtahedzadeh, Vida and Parvin Aqaee, 2004)

2. II. A Review of the Study Theoretical Foundation

Generally speaking, auditing has long meant scrutinizing the accounts in order to discover the frauds and misuse and during the course of history therehas always been some sort of auditing in the governmental and private organizations, but auditing in its new and modern meaning is the examination and commenting on the financial statements and the reason behind this novel meaning is the growth and the emergence of the enterprises in which the shareholders responsibility is confined to the amount of the capital they have put in the company. The origin of this modern usage of auditing is England. But, the wonderful change that is now on the way, is the auditing evolution from financial auditing to comprehensive and inclusive auditing in which besides the examination of the entities financial statements reports from the point of view of observing the due policies, its operations and transactions are also examined by the decision making authorities (such as general meeting) and the observance of the rules and regulations governing the economical entities and the entities mangers efficiency is also evaluated from the perspective of the quality of using the extant resources and the method of implementing the plans and operations and the obtained results will be reported. This type of auditing which its recent aspect is termed as management audit generally regarding the big firms possessing macro-resources and their area of activity is vast and its management is different from capital possession is being implemented in response to the management performance evaluation necessity of such organizations by the qualified experts (accountants and experts from the other disciplines) and it is the professional accounting evolution future trend.

In other words, auditing is the inspection seeking for accounting evidences and other documents at the foundation of financial statements.

3. Types of auditing from various perspectives:

From the point of view of refering the task: 1.obligatory 2.optional From the nature of examination and auditing: 1.systematic examiantion 2.verificational examination 3.case examination (special) From the task fulfilment point of view: 1.implied audit 2.final audit 3.continuous (ongoing) auditing Auditing objective:

Validating the financial statements in order to create confidence in their presentation favorableness and their reliability. Validation is consisted of two separate stages: 1. Collecting auditing documents 2. Reporting the findings or the socalled audit reports Which communicates the auditors notions and comments regarding the presentation favorableness and reliabilty of the financial statements to the financial statements users. (Abbas Arbabsoleymani and Mahmood Nafari, 2009) III.

4. Auditor and Audit Quality

Auditor quality: is defined as the overall quality of the auditing services in generally all of the organization auditing processes.

Audit quality: the word audit quality conveys different meanings to different people. With this explanation that the auditing process should bedefined seperatedly for every auditing task since it is likely that all of the auditing taskes performed by the same auditing institution are not with the identical quality level.

From one hand, the auditing quality can have various meanings for the auditors. Moreover, in its examinations auditing can evaluate business risk as well in the preservation of the generally accepted auditing standards in order to prevent lawsuits and the dissatisfaction of the employer and also limiting the damage to the professional reputation which is an outcome to malauditing. Deangelo (1981) defines the auditing quality as the likelihood of the discovery and the report of the important extant distortions in the financial statements by a certain auditor.

Davidon and Neo (1993) in a more comprehensive definition, define the auditing qulaity as the auditor competency in the discovey and resolution of the important distortions and manipulations performed on the reported profit. Therefore, the auditor's capability is a crucial subject in the auditing quality which hs been interpreted from various aspects and it has an extensive relationship with the internal and external factors, auditors' characteristics (such as experience, competency, ethics etc.), auditors' independency (independency from employer, market competition etc.) And legislative environment (obligatory substitution, auditing and nonauditing services etc.). According to the fact that the auditing quality is multifaceted, it it is not evident that which of the aforementioned factors is influential in determining the auditors' qualities and therefore the auditing quality cannot be directly observed and measured.

And also the process of completing the servicing activities is not tangible in the process of progress and contrary to the merchandise under construction. (Morteza Asadi and Majid Darabi, 1391)

5. a) Factors affecting the auditing quality

Conceptually, the auditing quality can be measured through the three basic aspects of inputs, outputs and environmental factors. Except auditing standards, there are other inputs for the auditing quality. One such an input is the unique and prominent features of the auditor such as his or her experience, moral values and his propensities. One of the other important factors, is the auditing process. This process includes auditing methodology, the amount of the effects of the applied auditing methods and the amount of acccess to the required auditing documents and evidences.

Auditing outputs also bring about important outcomes for the auditing quality, since the outputs are taken to consideration by the users for the auditing quality evaluation. For instance, when the auditor's report clearly expresses the result subsequent to the auditing act can exert a positive impact on the auditing quality. Also, the relationship between the auditors and the leadershipfoundations in such subjects as financial reports quality aspects and the internal control weaknesses can have a positive effect on the auditing quality.

6. b) The relationship between auditing quality and profitability

More qualified auditing firm with better quality can affect the management discretions in the selection of the accounting procedures and its motivation for manipulating the profit. Also, the more there are accounts such as accounts recievable, accounts payable, and inventory (of the optional accrual items), the more there would be observed demands for better supervision and more qualified auditing.

The bigger the size of the auditing and the longer the tenure period of auditor, the higher the quality of the auditing will be and the higher the quality of auditing the extent of its influence will be greater on the management discretions in the choice of the accounting procedures and his or her motivation for manipulating profit to reach personal interests and the higher would be the reliability of financial statements. (Asghar Azizi, 2010)

7. c) Auditor size

The quality of the auditing institutions differ from one another and the researchers use alternatives for the differrentiation between the auditing firms with high qualities and those with low qualities. The size of the auditing firms, their history and the trade mark are but some of the discriminating factors. That is to say that bigger institutions and those with more respectful and famouse trade mark in relation to the others exhibit higher quality auditing job.

8. d) The relationship between the auditing quality and the auditor's size

The auditing size is one of the features which influences the auditing quality. Deangelo believes that the bigger auditing companies offer auditing services with higher qualities, since they are intending to acquire better fame in the work market and because the number of their clients is great they are not concerned with and worried about losing them. It is stipulated that such institutions due to having access to more interests and facilities for training their own auditors and performing various tests offer auditing services with higher qualities. (Mojtahedizadeh and Aghaee, 2004) Firms with bigger auditing size besides their fame and credit perform more successfully in issues such as training the staff and maintaining independence (seeming and real) in the face of the employees and other important issues influencing the increase in their uality of auditing. Therefore, the audited companies by the auditing organization are rated among the companies that their finacnial statement items are of a great value and in the end they will enjoy from a higher auditing quality. And on the contrary, the companies audited by the other auditing institutions (auditing firms which are members of the formal accountant society) are regarded as having smaller size in relation with the auditing organization. These auditing firms have lower validating and valuational power in comparison with the auditing organization and subsequently they will have lower quality auditing from the independency, staff training etc (Yahya Hassas, Yeganeh and Kaveh Azinfar, 2010) e) Auditor's tenure period Auditor's tenure period is one of the measures for measuring the auditing quality which is expressed as the number of consecutive years that an auditor examines and audits the auditing firms.

f) The relationship between auditing quality and the auditor's tenure period Regarding the effect of the continuous appointment of the auditor on the audit quality there exists two perspectives: 1. It is believed that the long-term relationship between the employer and the auditor causes their extreme closeness and this in its turn hurts the auditors independence and the auditing quality mitigation. 2. Refers to the auditing problems of the relationship between the auditor and the employer in the early years. In this perspective, having no exact familiarity with subjects such as operation type, accounting system and the internal control structure of the auditted company plus increasing the auditing costs may add to the possibility of the auditor not getting to the errors and basic violations. Therefore, in case of the continuation of the auditor's appointment the possible mistakes in the accounting information will be easily discovered and this per se brings about the increase in the accounting information quality and therefore increase in the predictive potential of the information. (Mohammadramazan Ahmadi and Kamran Jamali, 2013) Output is the reward that an investor expects from his or her investment in a project.

9. IV. The Effect of the Aiditing Quality on the Output

Shareholders and investors are continuously searching for information which assists them in the selection of the best investment and appropriate portfolio. One of the important discussions which influences the investors decisions is the accounting information quality. Financial researchers are constantly looking for variables to be able to predict the stock return for the future terms with a higher percentage of confidence in relation to the prior variables and models. The recognition of the way that the stock market responds to the accounting information is of a great value for the recognition of the capital market efficiency and also the evaluation of the utility of the financial statement information . Experimental researches show that the accounting figures have predictive power and the accounting information predictive value can be accepted as one of the qualitative features of accounting information. Therefore, the financial statement auditing is counted as one of the most crucial tools for confiding in the companies' financial data clarity and it makes the accounting information, for example financial ratios of each of the shares, predictive

10. The Relationship Between Auditing

Quality with Predictive Profit

Prediction is the key element in the economical decisions. Investors, creditors and other entities rely on the predictions and expectations in their decisionmaking. For instance, an investor in making decisions regarding purchase, sale or the retention of shares is willing to become aware of the time and the amount of the partitioned profits and their risks. To become aware of such future partitioned profits characteristics which is not readily available apriori and with absolute precision therefore prediction should be perforce resorted to. Crediors are interested in the prospective profit of the company as well.

Audit high quality increases the reliability of the reports via decreasing the intentional and unintentional errors in the historical profit. The historical profit information is not a proper index for the evaluation of the prospective performance evaluation. Therefore, the prediction of the future profit is of a particular position. The profit predictability power increases with the existence of reliable financial information. Previous researches show that the business entity makes use of the historical profits information to predict the future profits. Financial analysts process the available information such as prior profits and prices in order to be able to estimate the future profit and because one of the sources for the companies to procure budget is the profit prediction, financial statements are historical, therefore, the validity and the financial statements reliability is of great importance for them. (Dr.Seyyed Hossein Alavi Tabari, 2009)

11. a) Study background

There are few researches performed on the subject in Iran and most of the performed researches regard the audit quality which is explained below.

Mashayekhi et al dealt with the survey of the optional accrual items role in the profit management of the companies accepted in Tehran's securities exchange market. The results of their study suggests that in the studied companies profit management has been exerted through the increase in optional accrual items.

Karami and his colleagues (2011) in a study came to this conclusion that there is a direct relationship between audit selection continuation and profit management (in the orientation of showing lesser profit). Bozorgasl and Shayestehmand (2011) found that with the increase in the audit continuous appointment, the probability of profit management becomes more likely, whether in an ascending or descending manner.

Hassasyeganeh and colleagues (2005) in a study entitled as "influencing factors on independence and competence of members of Iran's formal accountant society in offering deposition services", dealt with the audit quality the result of which was the determination of the 7 affective factors for enhancing the audit quality as stated below:

1.specialism, 2.audit efficiency, 3.discovery of the important distortions, 4.interest conflicts, 5. The existence of the rules and regulations, 6.market mechanism, 7. the size of the audit firms Nourvash et al ( 2006) dealt with the survey of the accrual items quality and profit with an emphasis on the accrual items estimation error. The results obtained shows that the quality of accrual items has a positive and significant relationship with profit sustainability and the accrual items are more interpreted as lower quality and lower sustainability of the profit.

Ebrahimi Kordlor and Seyyedi in their study surveyed the relationship between the independent auditors and the type of auditor's comment and profit management and they came to this conclusion that only auditing firm type is in relationship with the optional accrual items.

Azizkhani et al performed a study under the title of "auditing tenure period, auditing partners and financial reporting validity. The results of their study shows that auditing tenure period and audit partners have a relationship with the forecasted costs of the equity holders' rights. Also, the researchers found that the increase in the auditor's tenure period leads to the high quality financial reporting.

12. b) Foreign study backgrounds

De Angelo, Palmerose, Tendello and Vastraelen and Chen et al, consider the auditing firms which are members of the top 4 big auditing organizations (previously they were famous as 6 big auditing organizations and 8 big aditing organizations) as the great auditing organizations with credibility and fame and proposed the auditing performed by these organizations as the high quality auditing and presented it as the scale and the measure of the auditing quality in their studies, since the firm members of the 4 top big auditing organizations besides their reputation and credibility, perform successfully in the field of personnel training and education and preserving independency before the employers and the other items influencing the quality enhancement. and profit management in the stages before and after the IPO and they came to this conclusion that, firstly, in such companies profit management takes place and secondly, there is a significant relationship between profit management and audit quality, and it is in a way that the higher the quality of auditing the lower the profit management of such firms. Also, Bal and Shiva Kumar (2005) stated that the private companies in comparison with the governmental companies are in short for the timely announcement of their losses. Tendello and Vanstraelen (2008) also in a study under the title of "profit management and auditing quality in Europe: private distribution firms", by considering the top 4 big auditing firms as the high qualtiy auditors and the survey of the profit management in the audited firms by these four firms and the profit management came to this conclusion that there is a significant relationship between profit management and audit quality and the high quality of auditing in the companies having similar taxation regulations causes the profit management to go down.

13. Global Journal of Management and Business Research

Ken Chen et al (2005) in the article auditing quality and profit management for the companies involved in the initial public offering (IPO) of Taiwan stock market by selecting top 4 big auditing firms as the quality auditors and the comparison of the profit in the audited firms by these four firms and the profit in the audited firms by auditors other than these four big firms studied the auditing quality relationship and profit management in the stages before and after the IPO in Taiwan came to this conclusion that, firstly, in such companies profit is managed and secondly, there is a significant relationship between profit management and audit quality, and it is in a way that the higher the quality of auditing the lower the profit management of such firms. (Chen, K; Lin L.K.&Zhou, J.2005)

In the study performed by Louis Hencock (2005) it became evident that the bigger auditing firms usually offer better services than the smaller organizations. But there was also found that the smaller auditing firms provide their employers with better consult. (Louis Hencock, 2005) Kim et al (2003) showed that the discrepancy between the big auditing firms effectiveness and the small auditing firms originates from the companies' managers conflict with the auditors regarding the auditing reports. When the managers are sufficiently motivated to increase the amount of the profit via the use of profit generating accounting procedures, the auditors impartiality results in the conflict between the managers and auditors. They found out that the big auditing companies are more effective in preventing the profit manipulation than the small firms (supposing the existence of the contradiction between the managers and the auditors).

Lahm and Chang (1994) found out that generally the big auditing companies do not necessarily offer better auditing quality than the smaller firms. (Hay David, Davis David, 2002). Fuerman (2006) in his study came to this conclusion that the bigger auditing firms have lesser auditing negligence. (Fuerman R. Comparing 2006) Deltas and Doogar (2004) in their studies came to this conclusion that the lower the diversity of auditing products the higher the quality of the financial statements will be (Deltas G, Doogar R.2004) Chuntao and colleagues (2007) in their study dealt with the analysis of the cognition (perceotion) of the stock exchange market through the auditing quality among some of the small auditing institutions in China's auditing market. These researchers found that there is positive relationship between the size of the auditing firms and the investor's perception of the profitability quality. The results of the studies performed by Chuntao et al showed that different sizes of the auditing firms affects the auditing quality. (Chuntao Li., Frank M.song,2007) Chi and Doogar (2005) showed that with the increase in the tenure period, the auditors' tendencies for publishing reports containing the cooperation continuation condition decreases. Kapli and Dose (1993) also found that low quality audits increase with the tenure period. The results of the studies by Vanstraelen (2000) signifies that the long-term cooperation between the auditor and the employer increases the likelihood of issuing accceptable reports by the auditors. The results of the studies performed by Batz e al (1982) shows that the auditors' judgment is influenced by the employer-auditor long-term relationships.

Steak (1991) in a study stated that in the sampling performed, 30% of the companies claiming a lawsuit, their auditor's tenure period has been 3 years or shorter. (Ghplamreza Karami et al, 1390) Kamran et al (2001) in some studies surveyed the profit management and auditor substitution relationship by posing this question that whether changing the auditor will increase the audit quality? The results indicate that in case that the auditor substitution is voluntary, this change (shorter commission periods) will increase the auditing quality.

Gaiger and Raganandan (2002) with the survey of the companies filing a bankruptcy during the years from 1996 to 1998 came to this conclusion that there is a positive relationship between the auditor's tenure period and the possibility of the bankrupted company receiving a conditional report demanding the cooperation continuation in the year before bankruptcy.

Fundano et al (2010) studied the relationship between the audit quality and the company size and the cost of equity. In this research, the tenure period, auditing firm size, and the auitor's expertise are considered as the scales of the auditing quality. The rsults of the study shows that there is a negative and significant relationship between the auditing firm size, the auditor's commisssioning period and the auditor's expertise in the industry with the cost of equity.

Jule, Job and Hugton (2005) in their study for the measurement of the audit quality besides the auditing firm size made use of the audit firm expertise in the employer's industry. They believed that the audit companies who are expert in the employer's industry would do the auditing with higher qualities. Amongst these, the results of the study performed by Davis et al (2009) comes striking. They found evidences which indicates that the predicted profit, for the companies with short appointment continuation (of less than three years) and the long appointment continuation (of 15 years or more) normaly are accompanied with lower error rates and these companies usually by making use of the optional accrual items achieve the expected profit or more than what is forecasted. These results show that as it is possible that the auditing quality decrease with the enlarging the auditor's appointment period, there is the possibility that the auditing quality suffers in the early years of the employer-auditor relationship. (Davis, L.R., Soo,B.,&Trompeter, G.2009) Davis and Soo (2002) noted the positive relationship between the auditor's continuous appointment and the amount of the optional accrual items and the negative relationship between the auditor's continuous appointment and the error in the forecasted profit by the analysts. These results show that due to the auditor's continuous appointment the auditing quality succumbs and the management will bear witness to more flexibility from the auditors side in the reports and would be able to acquire the forecasted profit. (Davis, L.R., & Soo,B., 2002).

14. c) Study Hypotheses

In the current study the hypotheses have been compiled based on the objectives and the importance of the theoretical foundation as follows: 1. There is a significant relatioship between auditor tenure period and the profitability ratios. 2. There is a significant relationship between the auditing size and the profitability ratios.

15. VI. Study Population and Statistical Sample

The study population is all of the companies accepted in Tehran's securities exchange market and the sample is determined based on demography taking the following conditions into consideration:

1. The fiscal year ends in Esfand (March) every year. 2. The companies had not changed their fiscal yer during the study period. 3. Companies had provided the stock market with their finacnial statements during the study years. 4. The companies had been audited during the study years.

According to the bove mentioned conditions the number of the statistical sample has been determined as 52 companies. It is worth mentioning that the outlier observations were not taken into consideration.\

16. a) Study methodology

The current study deals with the relationship between the audit quality and profitability of the companies accepted in Tehran's securities exchange market. Therefore, this is an applied research. In the present study the library method was taken advantage of for collecting data and information. In the library part, the basic theories of the study were compiled from the persian and english books and journals. The methodology of the study is exploratory-surveying of correlation type. The temporal scope of the study is the years from 2008 to 2013. The present study data have been extracted from the financial statements and the explicatory notes by making use of the Rah-Avard-e-Nowin and Tadbir-Pardaz softwares. And for data analysis the SPSS and Excel softwares were used.

17. b) Study variables

i. Independent variable 1. Auditing size: to survey the auditing size it was taken advantage of the reliable auditing firms in the stock market. 2. The auditor's tenure period: the auditor's tenure period is one of the meaures of audit quality measurment which refers to the consecutive years that the auditing firms are appointed for the examination and auditing the accounts of other companies.

ii. Dependent variables 1. Profit margin: it is obtained by dividing net profit by the net sale. 2. The investment return rate: it is obtained by dividing the net profit by the total assets. 3. The equity return rate: it is obtained by dividing the net profit by the equity.

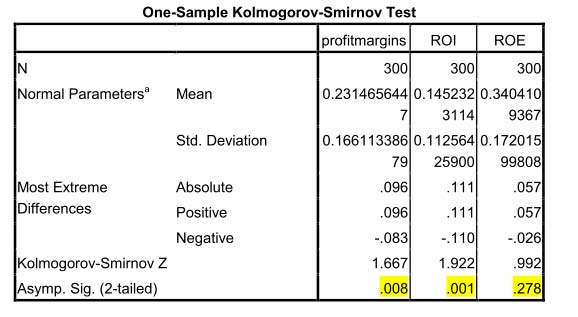

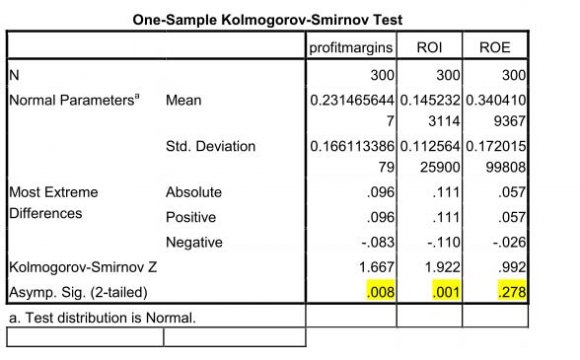

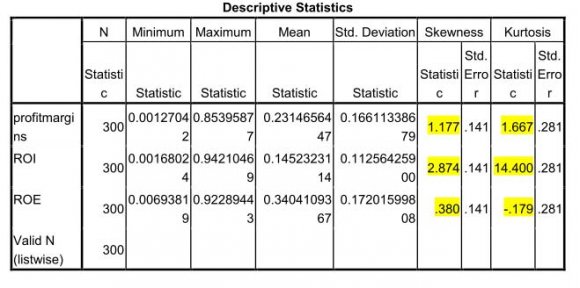

c) Data analysis i. Inferential statistics One of the linear regression presupposition is that the dependent variable data distribution should be normal or near normal. To figure out the data normality or otherwise the data abnormality, the one-sample Smirnov-Kolmogorov test and the descriptive tests were used.

In the interpretation of the Smirnov-Kolmogorov test, if the test significance level is more than 0.05 then it can be said that the observatory and the theoretical distribution are identical and there is no difference between the two that is to say that the obtained distribution is closer to the normal. As it can be seen the investment return rate is not normally distributed.

18. Year ( )

19. D

In the interpretation of the descriptives if the amount of this error is in the range of 2,-2, then the data distribution is normal. As it can be seen the investment return rate is not present in this range, so it is not normal.

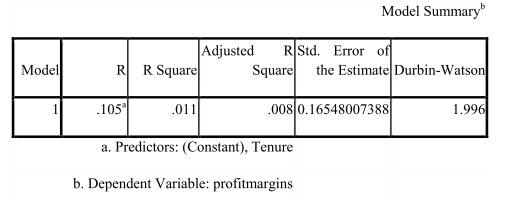

If the results of the test showed that the data distribution is not normal, for the implementation of regression the normal data log should be applied. First Hypothesis: there is a significant relationship between the auditing tenure period and the profit margin: R: it is known as the multiple correlation coefficient and it is indicative of the amount of the multiple correlation between the entire collecion of the dependent and independent variables. It takes a number from 1 to -1. The closer it is to 1 it is more indicative of the strong correlation between dependent and independent variables.

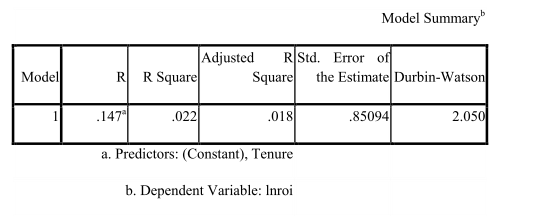

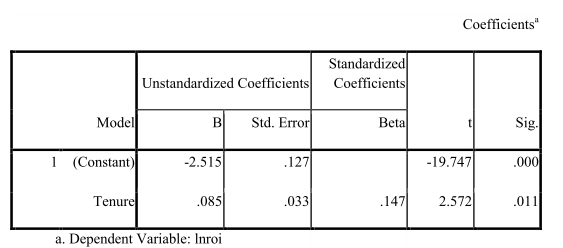

The amount of the adjusted coefficient is equal to 0.008 which suggests that the tenure period independent variable has been able to account for 0.8% of the variations of the dependent variable profit margin. Therefore, the rest of these variations (99.2%) are subjected to the effects of the variables exogenous to the model. T-value shows the relative importance of the presence of each of the independent variables in the model. To recognize which variables significantly and meaningfully influences the dependent variable we can look at t-value. Usually, when the t numerical value modulus is bigger than 2.33 the error level will be lower than 0.05 and therefore it can be said that the questioned variable has a significant statistical effect on the elaboration of the dependent variable variations. As it can be observed the standardized regression coefficient for the profit margin variables (0.071) in the error level bigger than 0.05 is not significant. Therefore, it can be said that there is no significant relationship between the tenure period and the profit margin. Second Hypothesis: there is a significant relationship between the investor's return rate and the tenure period. R: it is known as the multiple correlation coefficient and it is indicative of the amount of the multiple correlation between the entire collecion of the dependent and independent variables. It takes a number from 1 to -1. The closer it is to 1 it is more indicative of the strong correlation between dependent and independent variables.

20. Model

The amount of the adjusted coefficient is equal to 0.018 which suggests that the tenure period independent variable has been able to account for 1.8% of the variations of the dependent variable profit margin. Therefore, the rest of these variations (98.2%) are subjected to the effects of the variables exogenous to the model. T-value shows the relative importance of the presence of each of the independent variables in the model. To recognize which variables significantly and meaningfully influences the dependent variable we can look at tvalue. Usually, when the t numerical value modulus is bigger than 2.33 the error level will be lower than 0.05

21. Global Journal of Management and Business Research

Volume XV Issue IV Version I Year ( ) D and therefore it can be said that the questioned variable has a significant statistical effect on the elaboration of the dependent variable variations. As it can be observed the standardized regression coefficient for the investment return rate variables (0.11) in the error level lower than 0.05 is significant. Therefore, it can be said that there is a significant relationship between the tenure period and the profit margin.

Third Hypothesis: there is a significant relationship between the equity return rate and tenure period. R: it is known as the multiple correlation coefficient and it is indicative of the amount of the multiple correlation between the entire collecion of the dependent and independent variables. It takes a number from 1 to -1. The closer it is to 1 it is more indicative of the strong correlation between dependent and independent variables.

The amount of the adjusted coefficient is equal to 0.000 which suggests that the tenure period independent variable has not been able to account for the variations of the dependent variable of profit margin. Therefore, the rest of these variations (100%) are subjected to the effects of the variables exogenous to the model. T-value shows the relative importance of the presence of each of the independent variables in the model. To recognize which variables significantly and meaningfully influences the dependent variable we can look at t-value. Usually, when the t numerical value modulus is bigger than 2.33 the error level will be lower than 0.05 and therefore it can be said that the questioned variable has a significant statistical effect on the elaboration of the dependent variable variations. As it can be observed the standardized regression coefficient for the profit margin variables (0.323) in the error level bigger than 0.05 is not significant. Therefore, it can be said that there is no significant relationship between the auditing tenure period and the equity return rate.

Fourth Hypothesis: there is a significant relationship between the profit margin and the auditing size. R: it is known as the multiple correlation coefficient and it is indicative of the amount of the multiple correlation between the entire collecion of the dependent and independent variables. It takes a number from 1 to -1. The closer it is to 1 it is more indicative of the strong correlation between dependent and independent variables. The amount of the adjusted coefficient is equal to 0.019 which suggests that the tenure period independent variable has been able to account for 1.9% of the variations of the dependent variable of profit margin. Therefore, the rest of these variations (98.1%) are subjected to the effects of the variables exogenous to the model. T-value shows the relative importance of the presence of each of the independent variables in the model. To recognize which variables significantly and meaningfully influences the dependent variable we can look at t-value. Usually, when the t numerical value modulus is bigger than 2.33 the error level will be lower than 0.05 and therefore it can be said that the questioned variable has a significant statistical effect on the elaboration of the dependent variable variations. As it can be observed the standardized regression coefficient for the profit margin variables (0.009) in the error level smaller than 0.05 is significant. Therefore, it can be said that there is a significant relationship between the auditor size and the profit margin . T-value shows the relative importance of the presence of each of the independent variables in the model. To recognize which variables significantly and meaningfully influences the dependent variable we can look at t-value. Usually, when the t numerical value modulus is bigger than 2.33 the error level will be lower than 0.05 and therefore it can be said that the questioned variable has a significant statistical effect on the elaboration of the dependent variable variations. As it can be observed the standardized regression coefficient for the profit margin variables (0.537) in the error level smaller than 0.05 is not significant. Therefore, it can be said that there is no significant relationship between the auditor size and the investment return rate . Sixth Hypothesis: there is a significant relationship between the auditing size and the equity rate.

22. Coefficients a

23. Model

The amount of the adjusted coefficient is equal to 0.003 which suggests that the tenure period independent variable has been able to account for 0.3% of the variations of the dependent variable of profit margin. Therefore, the rest of these variations (99.7%) are subjected to the effects of the variables exogenous to the model. T-value shows the relative importance of the presence of each of the independent variables in the model. To recognize which variables significantly and meaningfully influences the dependent variable we can look at t-value. Usually, when the t numerical value modulus is bigger than 2.33 the error level will be lower than 0.05 and therefore it can be said that the questioned variable has a significant statistical effect on the elaboration of the dependent variable variations. As it can be observed the standardized regression coefficient for the profit margin variables (0.168) in the error level smaller than 0.05 is not significant. Therefore, it can be said that there is no significant relationship between the auditor size and the equity return rate.

24. Global Journal of Management and Business Research

Volume XV Issue IV Version I Year ( ) D 2015 R: it is known as the multiple correlation coefficient and it is indicative of the amount of the multiple correlation between the entire collecion of the dependent and independent variables. It takes a number from 1 to -1. The closer it is to 1 it is more indicative of the strong correlation between dependent and independent variables.

25. VII. Conclusions and the Suggestions

The objective of the current study is the survey of the auditing quality and the relationship between its variables and the profitability ratios and according to the study and the proposition of the hypotheses we came to the following results: there is no significant relationship between the tenure period and the net profit margin ratios and ROE while there is a significant relationship between the tenure period and ROI and the results of the current study conforms with the results of the studies performed by: Mayers Therefore, based on the current study there is a significant relationship between the auditing size and the net profit margin profitability ratios and ROE while this relationship with the ROI ratios is not significant. There has not been performed a study in Iran which deals with the relationship between the auditing quality and profit management. So, the comparison between this study and other internal studies regarding the subject is not possible for the time being.

26. Durbin-Watson

Test

| power grow more. Therefore, the quality of such | |||||

| information increases with the auditing quality and the | |||||

| prospective output obtained by relying on such | |||||

| information | gets | closer | to | the | reality. |

| (Mohammadramazan Ahmadi and Kamran Jamali, | |||||

| 2013) | |||||

| V. | |||||

| Year | |||||

| Volume XV Issue IV Version I | |||||

| ( ) D | |||||

| Global Journal of Management and Business Research | |||||

| Year | ||||||

| 36 | ||||||

| Volume XV Issue IV Version I | ||||||

| ( ) | ||||||

| Global Journal of Management and Business Research | 1 | (Constant) Trusteexchang e | Unstandardized Coefficients B Std. Error -2.144 .122 -.050 .081 | Standardized Coefficients Beta -.036 | T -17.551 -.618 | Sig. .000 .537 |

| A. Dependent Variable: lnroi | ||||||

| Year | No relationship exists | 1.996 | significance level 0.071 | The relationship between | Year Year |

| the tenure period and | |||||

| profit margin | |||||

| Volume XV Issue IV Version I Global Journal of Management and Business Research ( ) | Relationship exists No relationship exists Relationship exists No relationship exists No relationship exists Mohammadi, Global Journal of Management and Business Research 2.050 0.011 The relationship between the tenure period and ROI 1.859 0.323 The relationship between the tenure period and ROE 2.020 0.009 The relationship between the auditing size and profit margin 2.001 0.537 The relationship between Volume XV Issue IV Version I Volume XV Issue IV Version I the auditing size and ROI 1.848 0.168 The relationship between ROE Global Journal of Management and Business Research the auditing size and 2(4):56-82 17. Karami Gholamreza, Bazrafshan, Ameneh; ( ) D ( ) D | ||||