1. Introduction

wing to liberalization and globalization measures initiated since 1991, the banking industry in India has undergone a radical change. This measure, along with the rapid growth in the Indian economy followed by strong contribution from government, private and foreign banks transformed the banking sector in India. Further, deregulation, increasing market size, increased competition, technological blend and attitudinal transformation lead bankers to be more sensitive towards customers' needs and their ultimate satisfaction.

As the generation of income for banks revolves around the customer; rendering quality service, satisfaction and keeping them intact with the service provider in a longer run, is a key for subsistence and success. Numerous organizations have started embarking into multifaceted approaches to improve the quality of their services as they begin to grasp the verities behind what manufacturing sector learned in the past few decades that-'quality does not improve unless it is measured'. Therefore, the topic of service quality has increasingly been recognized as one of the key strategic values of organizations in both the manufacturing and service sectors alike (Berry, Zeithaml and Parasuraman 1985;Bitner, Booms and Tetreault, 1990;LeBlanc and Nguyen, 1988). a) Indian Banking Industry and Financial Services During the last decade the commercial-banks in India underwent through significant qualitative and quantitative changes and manifold growth. On one hand, bank had to shoulder the social responsibility to take a leading role in the balanced socio-economic development of India, while on the other hand, it was asked to be concerned about level of profitability. The dynamic process of development and diversification coupled with structural, financial and technological changes have led to an ever growing competition, not only among banks but also from non-banking institutions, it is high time that banks should create new financial services in order to improve banker-customer relationship, to anticipate, identify, reciprocate and satisfy their needs efficiently, effectively and profitably.

The crucial role that the banking system played in India to foster institutionalised savings and channel funds in desired directions was recognised in the First Five-Year Plan, which emphasised that banking system had to be fitted into the scheme of development to make the process of saving and their utilisation 'socially purposive'. After independence, the growth of banking industry has been phenomenal and has no parallel anywhere in the world. The spectrum of services offered by banks is the widest in this country, considering that, elsewhere in the world; specialisation is more of the order. The range of services offered by a commercial bank in India varies from advances to commercial and industrial sector to advances to priority sector, i.e. to identify borrowers and lend money at a subsidised rate to the economically weaker sections. Therefore, a commercial bank has to perform mass banking and at the same time class banking for overall development of the country.

Banking, being a customer-oriented services industry, the customer is the centre of attention and customer service has to be the distinguishing factor. The challenge for banks is to lower costs, increase efficiency, while improving the quality of their service, and increase customer satisfaction. Attention has now turned to improving the quality of service encounter, when customers enter the bank and come into face-toface contact with bank staff (Chakravarty, 1996).

2. b) Service Quality

Service quality is increasingly recognized as being of key strategic value by organizations. The costs and major benefits to be derived from successful service quality are highlighted by several authors (Crosby, 1991;Reichfeld and Sasser, 1990;Edvardsson and Gustavsson, 1991;Adil, 2012;Adil, 2013a, Adil, 2013b) Grönroos, 1984Grönroos, , 1988Grönroos, , 1990)); and from the UK (Johnston, Silvestro, Fitzgerald and Voss 1990; Silvestro and Johnston, 1990). A number of these contributions have been reviewed by Lewis (1989a).

3. c) Objectives

? The aim of the paper is to identify the most prominent and frequently used scales for measuring the service quality, specifically with regard to banking sector.

? Based upon the extant literature, an attempt has been made by the researchers to draw a line of comparison between both the scales related to the efficacy, robustness and parsimoniousness of the scales in measuring the quality of service both in India as well as in other countries.

? The paper also aims at highlighting the conceptual framework of SERVQUAL and SERVPERF scales along with the steps of their development.

II.

4. Literature Review

The significance of quality service in commercial retail banking is well documented in the service quality literature (Buttle, 1996) and financial services inherently being intangible, difficult to evaluate and rely heavily on experience and credence qualities of customers (Zeithaml, 1981;Zeithaml, Parasuraman and Berry, 1985). Previous researchers have proven its effect/linkages on/with satisfaction and retention of customer, positive word-of-mouth (Lewis, 1991 Lee and Hwan, 2005). Thus, there has been much interest in hypothesizing the relationship between service quality and other consumer behavioural outcomes, for which a researcher is supposed to assess service quality. Extant studies suggest that there are two broad dimensions to it i.e. outcome aspects and relational aspects (Parasuraman, Zeithaml and Berry, 1991;Morgan and Piercy, 1992;Levesque and Mc-Dougall;1996).

Outcome or operational, is the tangible component consisting of dimensions like timeliness, accuracy, convenience which is centrally related to bank's operations and delivery systems. While this component has been largely studied by the researchers, it primarily impacts current customers with whom the bank already has an ongoing customer relationship; that is, customers who have actually observed the quality of these services.

Relational component is intangible and may be described simply as customer treatment. Service quality researchers like Le Blanc and Nguyen (1988), Parasuraman, Zeithaml and Berry (1988), Cronin and Taylor (1992), Teas (1993), Avkiran, (1994), Angur, Nataraajan and Jaheera (1999), Bahia and Nantel (2000) and Wang, Lo and Hui, (2003) argued that with technical services becoming more standardized, the relational customer is made to feel when interacting with the institution and staff. This component affects both current and new or prospective customers (i.e. those who come in to see someone in the bank about a banking service).

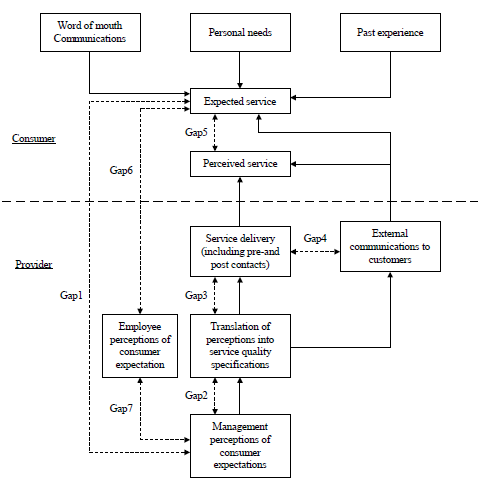

Models have been developed to assess the determinants of service quality. The works of Parasuraman, Zeithaml and Berry (1985, 1988) led to the development of a service quality model--SERVQUAL, which compares expectations and perceptions of customers regarding a particular service. Since Parasuraman, Zeithaml and Berry (1988)

5. a) SERVQUAL

Service quality is known to be an important factor in banking, and SERVQUAL provides a technique for assessing and managing service quality (Buttle, 1996). The concept was conceptualised and proposed by Parasuraman, Zeithaml and Berry (1985) and then further developed for the next eight years by the same researchers. Many other researchers have used the SERVQUAL dimensions as the basis for their research, and consequently SERVQUAL "has undoubtedly had a major impact on the business and academic communities" (Buttle, 1996), and has been said to be "insightful and [to remain] a practical framework to use in service quality management" (Christopher, Payne and Ballantyne, 2002).

East, 1997 argue that SERVQUAL measures service quality through customers' expectations i.e. what firms should provide in the industry being studied and their perceptions viz. how a given service provider performs against these criteria). Numerous research had been carried out in the banking industry using SERVQUAL model. Using structural equations model, Wang, Lo and Hui (2003) evaluated the antecedents of service quality and product quality, and their influences on bank reputation in the banking industry of China where link amongst service quality and product quality and bank reputation was observed. Angur, Nataraajan and Jaheera (1999) determined service quality in banking industry in India where they found that the SERVQUAL instrument was four dimensional structure and more helpful in addressing service deficiencies. Similarly, Sureshchandar, Rajendran and Anantharaman (2003) examined service quality in public, private and foreign banks in India. Yavas, Bilgin and Shemwel (1997) investigated the relationship between service quality, customer satisfaction, complaint behavior and commitment in the banking industry of Turkey and found that customer contact personnel played a vital role in the delivery of high quality service. In addition to the banking sector, SERVQUAL has been applied to other sectors also, in different countries such as higher education institutions, airport services, tourism sector services, accounting firms, medical services etc. (Buttle, 1996; Fick and Ritchie, 1991; Lam, Wong and Yeung 1997; Lim and Tang, 2000;Oldfield and Baron, 2000).

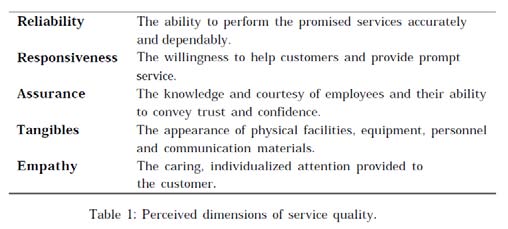

i. SERVQUAL Instrument SERVQUAL comprises 22 items (Likert-type) with five dimensions namely-tangibles, reliability, responsiveness, assurance and empathy. Each item in SERVQUAL instrument is of two types. One to measure expectations about firms in general within an industry and the other measures perceptions regarding the particular company whose service is being assessed.

The quality gap (Q) is calculated by subtracting the expectation (E) from the perception (P) value i.e. P-E = Q. Summation of all the Q values provides an overall quality rating which is an indicator of relative importance of the service quality dimensions that influence customers' overall quality perceptions. Parasuraman, Zeithaml and Berry (1988) suggested that SERVQUAL may be used to: ? track service quality trends over time; ? compare branches within a bank or building society; ? compare an organization with its competitors; and ? categorize customers into perceived quality segments based on their individual SERVQUAL scores. The original SERVQUAL instrument, proposed by Parasuraman, Zeithaml and Berry (1985), identified ten components of service quality. Later, in a further study, those ten components were merged into five dissimilar dimensions viz. reliability (5 items) which is the ability to perform the service in an accurate and in dependable manner; tangibles (4 items) which refers to the appearance of physical factors such as equipment, facilities and personnel; empathy (5 items) which involves providing individual attention and care to customers; responsiveness (4 items) is the willingness to provide help and prompt service to customers; and finally assurance (4 items) refers to the knowledge and courtesy of employees and their ability to convey trust and confidence.

6. iii. SERVQUAL Applications and Criticisms

Although many studies have used the SERVQUAL model as a framework in measuring service quality, there has also been theoretical and operational criticisms directed towards this model exist in the literature of services marketing. These criticisms have mainly revolved around right from its dimensional Gap 4: Gap 5: structure to the interpretation and implementation of the instrument (Buttle, 1996;Babakus and Boller, 1992;Lam Wong and Yeung, 1997;Smith, 1995;Newman, 2001).

A number of researchers have reported different dimensions for expectations, perceptions and gap scores. Thus, the universality of SERVQUAL's five dimensions has been questioned (Buttle, 1996;Carman, 1990;Cronin and Taylor, 1994). Shortcomings concerning convergent and discriminant validity have also been noted (Buttle, 1996). Nevertheless, despite the criticism, SERVQUAL has been widely used in various contexts throughout other studies. The SERVQUAL instrument has been widely used because it "provides a basic skeleton... which can be adapted or supplemented to fit the characteristics or specific research needs of a particular organization. . ." (Parasuraman, Zeithaml and Berry, 1988). (1985,1988) with respect to conceptualization and measurement of service quality, and propounded a performance-based measure of service quality called 'SERVPERF' illustrating that service quality is a form of consumer attitude. They argued that SERVPERF was an enhanced means of measuring the service quality construct. Their study was later replicated and findings suggest that little if any theoretical or empirical evidence supports the relevance of the E-P= quality gap as the basis for measuring service quality.

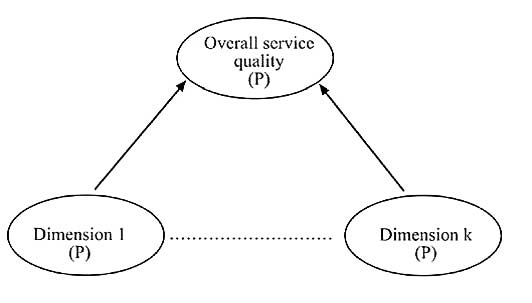

Source : Martinez and Martinez (2010).

Figure 2 : Performance Only Model (SERVPERF)

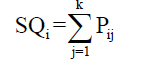

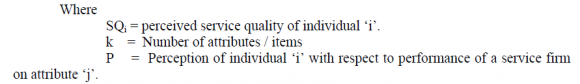

Levelling maximum criticism against SER-VQUAL scale, Cronin and Taylor (1992) provided empirical evidences across four industries viz. fast food, pest control, dry cleaning and banking to support the superiority of their 'performance only' scale over SERVQUAL scale retaining the same items as had been proposed by the Parasuraman, Zeithaml and Berry (1988). In equation form, SERVPERF service quality can be expressed as:

c) Studies SearchThe following procedure was used to obtain an ample collection of studies reporting the use of both SERVQUAL and SERVPERF scales. First, an electronic search of the following databases was conducted: Direct Science, Inderscience, Emerald, ProQuest (ABI/-INFORM Global and dissertation abstracts). Secondly, a manual examination of the articles identified from the computer-based searches was carried out. Thirdly, manual searches of leading marketing and services journals were conducted. The search process yielded the following studies using either the original scale in its totality or a modified version of the same (see Table 2 and Table 3).

7. Conclusions & Discussion

Overall, a number of measures have been proposed in the past to determine customer expectations, customer perceptions and overall satisfactions in service industries but prominent among them are SERVQUAL and SERVPERF. Although, a number of measurement problems have been highlighted by researchers (e.g. Babakus and Boller, 1991;Carmen, 1990;Lewis and Mitchell, 1990;Lewis, 1993) Original researchers of SERVPERF argued that owing to the limitations of operationalization, conceptualization, measurement and applications of SER-VQUAL's scale, the performance-based measure was an enhanced means of measuring the service quality construct, triggering an interesting controversy in service quality research. However, later Parasuraman, Zeithaml and Berry (1994a) responded to the concerns of Cronin and Taylor (1992) and Teas (1993) by empirically proving that the validity and alleged severity of many of those concerns raised by them were questionable, and in fact elaborated that though their approach for conceptualizing service quality could be revised, relinquishing it altogether in preference of the alternate approaches as proclaimed by the critics did not seem justified. In another empirical work, Parasuraman, Zeithaml and Berry (1994b) refined SERVQUAL's structure to embody not only the discordance between perceived service and desired service, but also the discrepancy between perceived service and adequate service.

The complexity of service quality evaluations is evident in the many failed attempts to replicate the dimensional structure of service quality perceptions. The widely applied SERVQUAL scale (Parasuraman, Zeithaml and , for example, has been criticized, as its five dimensions, namely, reliability, empathy, tangibles, responsiveness, and assurance, were difficult to replicate across diverse service contexts (Buttle 1996) Role of expectations and its inclusion in the SERVQUAL measuring instrument is a cause of major concern. To a certain extent, in SERVQUAL there is an overlap between the technical and functional dimensions. Furthermore, the use of a perception scale is justified by the dynamic character of the Indian client's expectations and by the greater effort required by the respondents to complete two questionnaires, one prior using the services (i.e. expectations) and another post reduce the number of respondents willing to respond their genuine feedback in the study. The SERVPERF scale is found to be superior not only as the scale is efficient in capturing the true customer's perceived service quality as also more effective in reducing the number of items to be measured by half viz. 22 items in contrast to SERVQUAL's 44 items (Hartline and Ferrell, 1996;Babakus and Boller, 1992;Bolton and Drew, 1991).

8. Global Journal of Management and Business Research

| III. |