1. I. INTRODUCTION

anks are the financial intermediaries and it appears in several forms. The main services provided by banks includes acceptance of deposits and facilitating loan facilities. In old day's bank provided the services of even the customer can pay their bill through bank. Bank is providing the services of investment to the customer one important service which we cannot ignore that is the service of plastic money which make the customer able to carry any amount from one place to another without putting it into his pocket and use the money anywhere in the world the plastic money refer to the Debit and Credit card. Most banks have chip and Pin card. To use these cards the customer must have PIN and each card has different PIN assigned for use of the card. Today's world the plastic money is very popular in customer due to its benefit of safety security, convenience in carrying and of its liquidity. One of the main benefits of credit cards, for both buyer and seller, is that the transaction is instantaneous. The customers do not need to complete any additional steps to finalize their purchases, and they can make spur-of-the-moment decisions. Basically banks have to type of cards as follows:

Author : Assistant Professor, Dept. of Management, Lovely Professional University, Punjab, E-mail :[email protected] Author : Associate Professor Department of Economics D.A.V. College, Malout, Punjab. E-mail : [email protected] Debit Card Debit card is a card which allowed a customer to access immediate to his fund electronically. Plastic card giving consumers access to their funds electronically. Debit cards act like checks when paying for goods and services or withdrawing cash at automated teller machines. Debit cards with MasterCard or Visa logos are more readily accepted than checks in many retail establishments. Consumer purchases with a debit card, unlike a credit card, do not offer the convenience of paying over time, because funds are withdrawn immediately (date of purchase with online transactions, or in the next two to three days with Off-Line transactions). Debit card purchases are free of finance charges, making them advantageous for lowdollar purchases.

Common Features Of Debit Card 1. No fuel surcharge many debit card holder need not to pay fuel surcharge while using their debit card for payment transaction 2. Availability of the ATM location all over the world the ATM locations is available in all over the world so immediate requirement of liquidity can fulfill 3. Banking cum shopping facility Debit card has the feature of banking cum shopping facility the debit card holder can shop any outlet where debit card is acceptable. 4. More withdrawal limit for every platinum card holder for Platinum card holder the withdrawn limit is more than any other debit card the maximum withdrawal limit provided by the bank is Rs.2,00,000 5. More amounts required as deposits for platinum card holder the requirement of the deposit amount is more than any other debit card. 6. Cash back offer -The banks are giving some percentage of cash back on debit card while using it in any restaurant suggested by the bank for dining.

2. Credit Card

A credit card allows consumers to purchase products or services without cash and to pay for them at a later date. To qualify for this type of credit, the consumer must open an account with a bank or company, which sponsors a card. They then receive a line of credit with a specified dollar amount. They can use the card to make purchases from participating merchants until they reach this credit limit. Every month the sponsor provides a bill, which tallies the card activity during the previous 30 days. Depending on the terms of the card, the customer may pay interest charges on the amount that they do not pay for on a monthly basis. Also, credit cards may be sponsored by large retailers (such as major clothing or department stores) or by banks or corporations. The bank who issued credit card make there profit in three ways: Firstly, they charged interest on unpaid amount. Secondly, they charged an annual fee from the customer. Thirdly, from the merchants the sponsors make money by charging merchants a small percentage of income for the service of the card. This arrangement is acceptable to the merchants because they can let their customers pay by credit card instead of requiring cash.

Common Features Of Credit Card 1. Global acceptance in this study this is found that mostly every card has the feature of global acceptance. The credit cards are world-wide acceptable 2. Fuel Surcharge waiver every fuel credit card has fuel surcharge waiver there can be difference between the reward points. But as per the waiver there are 0%-2.5% fuel surcharge waiver on fuel 3. Cash advance facility the holder can get the cash advance on its credit card. 4. Loan facility on credit card the holder has the facility to get the loan on that 5. EMI Facility the credit card holder can purchase any good on EMI basis through the credit card 6. Insurance benefit: the credit card holder got the insurance benefit on the credit card. 7. Loss Liability: the credit card holder have the facility of blocking the card at the time of its lost and he need not to pay the amount up to certain limit if he registered the complaint within the timeframe. 8. Billing Statement: every credit card holder has billing statement facility which they can get easily by online.

9. Reward program: every credit card has the feature of reward points which the holder can redeem any outlet suggested by the particular bank. 10. Low interest credit card most of the bank having lower interest rate option. These types of card segmented as the name of low interest credit card. 11. Dining credit card:-in this credit card there are benefits or waiver related to having dinner at any hotel suggested by the bank. 12. Railway card: mostly bank that issued railway credit card has the facility to get the waiver in the railway fare up to a certain limit. 13. Joining fee and annual fee: almost every credit card has some joining fee and annual fees range is between 200-500 Above mentioned are the common features of various debit and credit cards offered by selected banks that are Citibank, Standard Chartered Bank, HSBC and State Bank of India (SBI) and Bank of Baroda.

ii.

3. REVIEW OF LITERATURE

Jonas ( 2008) discussed that the credit card holder can take the help of solicitor to write off the credit card unpaid loan. If the loan is too old or before 2007 then it will automatically written off otherwise solicitors can arrange written of loan by taking some fees on that this scheme help the credit card holder to save him in poor credit rating. Jessy ( 2010) study was based on written of the credit card debt in full. If the debt is old or the customer can be able to prove that any debt is unauthorized then the debt can be written off in full. The author has mainly discussed that if the credit card holder did not informed by the credit card company about the changing interest rate and the charges then the debt will be written off in full. Lamaute (2011) expressed that credit card is the best option when other source of credit is hard to available. Some people are tapping their retirement accounts to pay off their high credit card debt. Tapping one's nest egg should be used only as a last measure, but for those who decide to go that route getting a 401(k) loan may be a smarter move than taking a distribution from an Internal Revenue Service (IRA) or 401K and being hit with taxes and a 10% early withdrawal penalty. That's because with a 401K loan. There are no taxes and penalty on early withdrawal as long as the loan is repaid on time according to the loan terms and less rate of interest. Strauss (2011) expressed the effect of debt written off against the credit card if there is a default in the payment of the credit card instead of giving the debt account in the hand of collection agency hired by the credit card company it is much better to take the help of the lawyer who must be expert in his field and able to arrange benefit of negotiation from creditor for the credit card holder. Maheshwari (2011) expressed that the number of debit card and credit card are going to increase vary rapidly in India. The study was based on rational statistics and it was proved that the debit and credit card has increased usage in India. This study also provides extensive information on the traditional markets along with the emerging markets.

4. iii. NEED OF STUDY

There were so many studies which are based on the plastic many services but no one has discussed about the usage of all the available features of the cards by customers. This study includes that how many customers are using the complete features of the debit and credit cards. In case of non-usage of some features then what are the reasons behind. And what are those features which are not commonly used by the customers. If there lack of awareness about the usage of available features than who is responsible either government, bank or customer itself to make them aware for the same.

IV.

5. OBJECTIVES

To study the existing features of the debit and credit cards issued by selected banks.

To find the reasons behind the usage and non usage of some features of the cards by the customers.

In case of non-usage of some features than who is responsible to make the customers aware about the same.

To find the extra features required to be added with existing features.

V.

6. RESEARCH METHODOLOGY

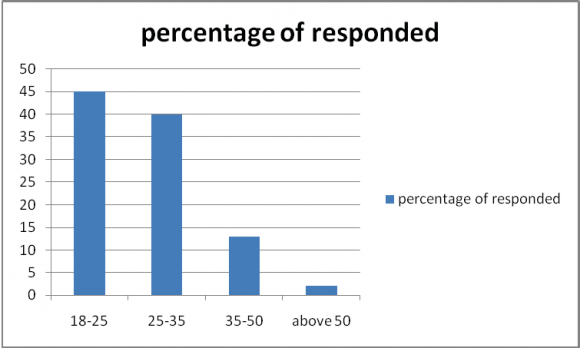

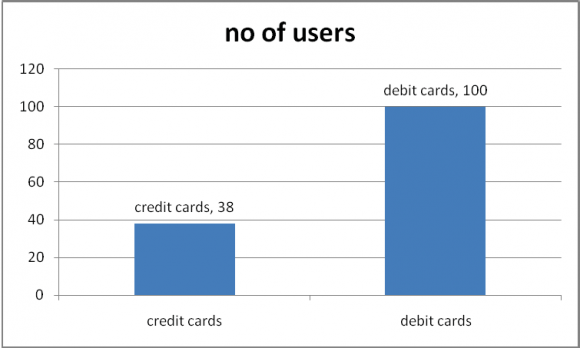

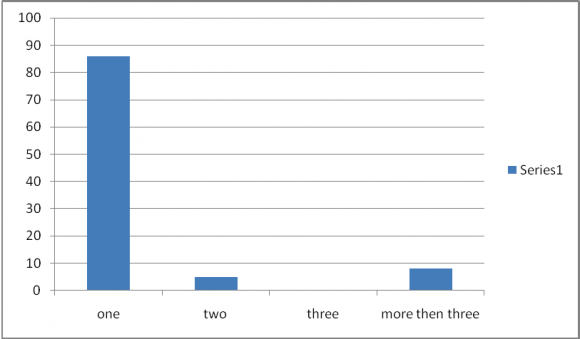

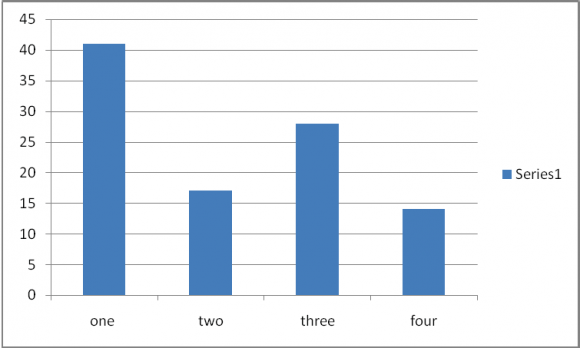

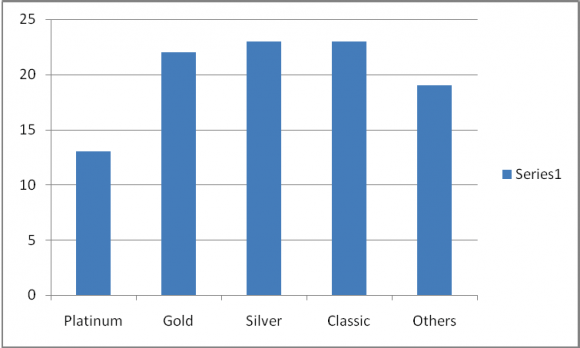

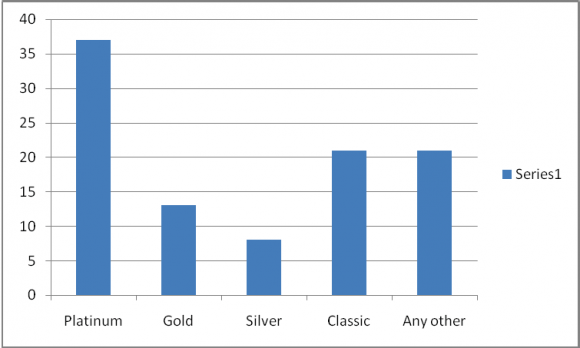

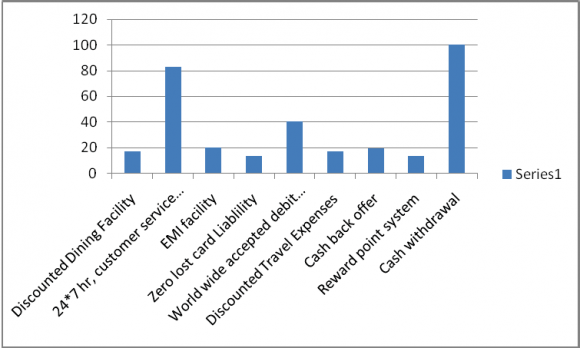

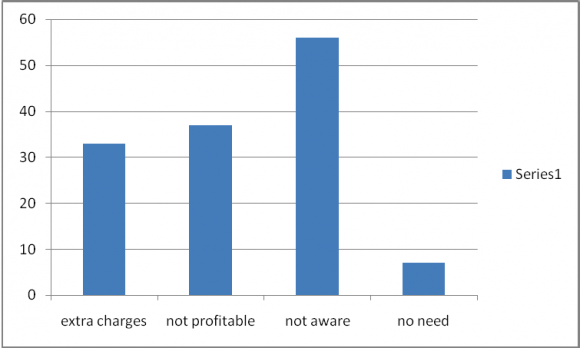

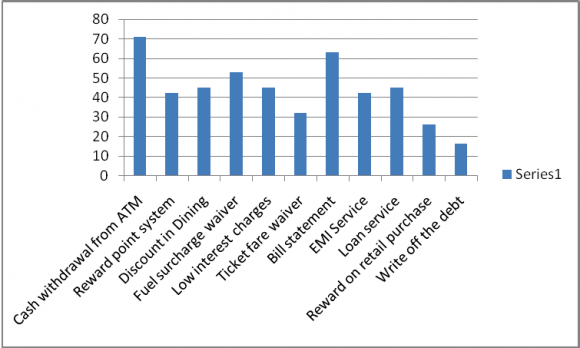

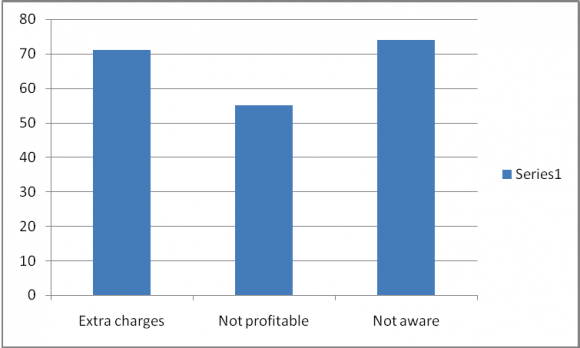

As this study is empirical in nature so that primary data was collected with the help of a structured questionnaire. To study the usage of available features of debit and credit cards, primary data was collected from 200 customers, 40 customers from each selected bank in the sample named Citibank, Standard Chartered Bank, HSBC, State Bank of India (SBI) and Bank of Baroda from Punjab state in northern India with the help of convenient sampling method. . And secondary data has been collected from internet, journals, articles and other publications. Statistical comparisons are made with the tables, graphs and ratio analysis. Fig 8 shows that 56 % of the customers having debit cards are not using all other features than money withdrawn because they are not aware for other features offered with their cards. It shows that non-usage of all features of cards has one reason that was due to lack of awareness about all the features of the cards. 37 % people responded that the reason behind the nonusage of some features was that those features are not profitable for them. And 33% of total respondents were not used the features of debit cards because banks has extra charges for the same and 7% people thought that they have no need of these features only money withdrawn was enough feature for them. But the basic condition behind that was customers has to pay some charges for the same. 53% customers have used credit cards for fuel surcharge waiver. 42% of the total credit card holder used the reward point system.

7. VI. FINDINGS AND INTERPRETATION

Here it was also felt that percentage customer was more who used credit card features in comparison to debit card features. that bank was taking extra charges for that so they are not interested in these features. 55% respondents said that the services are not profitable. Fig11 : Responsibility to make the respondents aware

It is found in table 8 and table 10 maximum no. of respondents reply that they are not aware about all the features available in their debit and credit cards.

Then it has been asked to the all the respondents that whose responsibility was that to make them aware about the usage of the features of cards with them. 71% respondents answered that bank should remind the customer for the features available in their cards, 3% said government (Monetary regulatory authority) should make them aware through advertisements, and 26% answered that it was there own duty to get the information from the bank regarding the features of the cards and to read the available leaflet given with the cards as shown in fig 11 . VII. RECOMMENDATIONS 1. Renewal fees should not be there at the time of card renewal. 2. World-wide accepted credit cards should be offered. 3. Password is required at the time of swapping of cards. 4. Annual fee should not be charged on credit cards. 5. Extra charges should not be there for any add on features.

6. No marketing call should be there. 7. Information should be given by notice. 8. Customer relationship should be strong in public banks. 9. One of the respondent told SBI debit card with world wide acceptance features hasn't worked in Nepal. That type of complaints should be taken care very seriously.

VIII.

8. STRATEGIES TO ENHANCE E-CUSTOMER BASE IN BANKS

1. The bank can convert the non users into users by providing some features free of cost to the customers. 2. Customer Relationship Management should be stronger in all the banks.

3. Credit cards features should be available at lesser charges and if possible some features should be free of cost to make their usage popular as the main reason behind the popularity of debit cards then credit cards is that the debit cards having no annual fee which can generate customer interest. 4. Send features update along with the monthly statement. 5. Arrange customer meeting periodically to get the service feedback from the customers. 6. There should be strong awareness program like advertisements about banking services for the customers. 7. There should a security key or password requirement available for the card holder at the time of swapping.

Because at the time of swapping swap machine never ask for password which can be a cause of bad transaction and customer face the problem due to security reasons. 8. No extra charges should be deducting without prior information to the customers about the features available with some charges. Some message alerts can be used for the same. 9. Banking regulatory authority should work for the popularity of usage of swapping machines. 10. Interest rate should be less in credit cards. 11. There should be proper assessing late fees and no charges to the customers for the services which they never ordered like credit insurance.

IX.

9. CONCLUSION

Finally it can be concluded that plastic card facility is good for all but credit cards are very costly in term of more interest charges, annual fees, renewal fees etc. There should be fewer charges for the same and customer should be made aware about the features given by the bank to the customer along with the cards. So that customer is able to use these facilities. And banks should take the responsibility of making their customers aware for the features in cards at proper time and also inform to the customers for all extra charges for their services.

10. Annexure

11. QUESTIONNAIRE

I am conducting a survey on "E-Banking Based Facilities to the Modern Living" for my research paper. Kindly devote some time to answer the questions. This information should be used only for research paper and kept confidential.

12. Personal profile

| Responsible Percentage respondents | |

| Bank | 71 |

| Government | 3 |

| Self | 26 |